- A rising wedge pattern drives the mid-term recovery trend in Dogecoin’s price.

- On-chain data indicates that crypto whales have purchased approximately 2 billion DOGE over the past 48 hours.

- Future contracts tied to Dogecoin price have recorded a 30% decline in open interest over the last two weeks, signaling a reduction in speculative force in the market.

DOGE, the popular dog-themed meme cryptocurrency, witnessed heightened volatility during Wednesday’s U.S. market hours. Amid the broader relief rally led by Bitcoin, the Dogecoin price jumped to an intraday high of $0.25 before reverting to $0.24. The overhead supply pressure, along with the reduction of speculative force in future markets, signals a risk of a prolonged correction. However, the latest on-chain data highlights renewed interest from large investors, hinting at an opportunity for a rebound.

DOGE Sheds 22% in Two Weeks as Futures Activity Contracts

The Dogecoin price has experienced a significant retracement in recent sessions, as its value fell from $0.36 to $0.24 over the past two weeks. The decline is around 22% downside, which brings the market cap of the token closer to $36.29 billion.

The move comes as the digital asset ecosystem has failed to gain a foothold after the U.S. Federal Reserve cut interest rates by a basis point. The expected reaction to the policy change that markets had hoped for did not materialize.

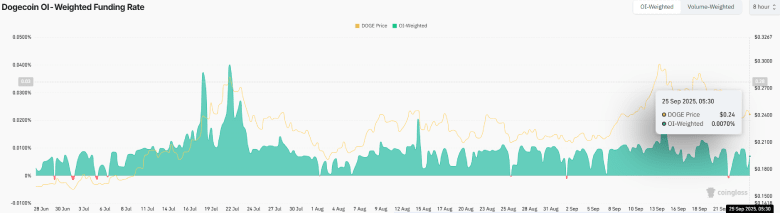

In addition to the price drop, the activity in Dogecoin’s derivatives market has reduced. Total futures open interest decreased from approximately $6.0 billion to $4.13 billion, representing a 30% decline. The data show a decrease in positions carried in the futures market, which is consistent with a decline in speculative appetite.

Funding rates remain mildly positive, with the open interest-weighted funding rate currently at approximately 0.007%. Even if the indicator is still in the green, there are no substantial spikes, which means that heavy directional betting is not happening. When combined with the falling open interest, the low levels of funding indicate a risk-off environment, where traders are not as leveraged as they may have been in the past and are taking a cautious approach.

Despite the lack of retail interest, the larger players have been active. Market analyst Ali Martinez noted that wallets associated with large holders consumed nearly 2 billion DOGE over the last 48 hours. This long position was established amid a backdrop of declining derivatives activity and soft spot prices, highlighting a disconnect between whale activity and the rest of the market activity.

Dogecoin Price Near Make-or-Break Floor

The daily chart analysis of Dogecoin price shows its recent correction as part of a rising channel pattern formation. Since June 2025, the coin price has rallied steadily, the rally resonating within the two converging trendlines, which act as the dynamic resistance and support.

The price has bounced multiple times from each trendline, underscoring the strong impact these levels have on market movement. Historical data show that a bullish reversal within the channel has bolstered buyers’ recoupment of bullish momentum and driven a price recovery ranging from 54% to 113%.

The coin price is trading above the trend-defining exponential moving averages of 100 and 200, indicating that the broader trend is bullish. If the buyers manage to defend this support, the coin price jumps 10% and challenges the immediate resistance at $0.25.

A bullish breakout from this resistance is crucial to strengthening buyers’ hold on this asset.

On the contrary, if sellers force a bearish breakdown below the support trendline, the current correction could accelerate.

Also Read: US Senate to Hold Hearing on Crypto Taxation Rules