DOGE, the largest meme cryptocurrency, records a 2.07% fall during Tuesday’s trading session to reach $0.155. The selling pressure followed continued trade conflict between the United States and China, which kept the broader market on edge. Thus, Dogecoin risks prolonged correction below $0.15, but a renewed accumulation of crypto whales opens an alternate opportunity.

Whale Accumulation Provides Hope for Dogecoin Reversal

In a three-day downturn, the Dogecoin price plunged from $0.169 to its current trading value of $0.155—an 8.87% fall. This downswing marks a new lower high formation in the daily chart, signaling a sell-the-bounce sentiment intact among traders.

Despite the continuing correction, the on-chain data highlights renewed accumulation from high-net-worth investors, signaling firm confidence in DOGE’s future potential.

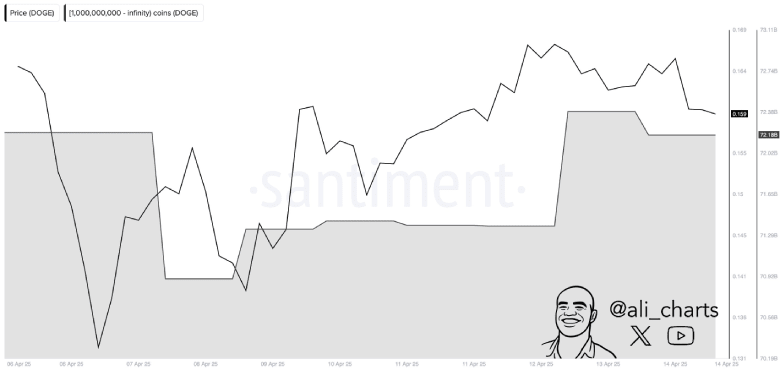

In a recent tweet, crypto analyst Ali Martinezpointed out that whales have purchased over 800 million Dogecoin within the last 48 hours. The surge in whale purchases counters the negative sentiment building out this asset, as the crypto market has often bounced amid wide market panic.

Channel Pattern Drive DOGE Price Correction

An analysis of Dogecoin’s daily chart shows a strict consolidation within the formation of a falling channel pattern, with the aforementioned price pullback.

By press time, the Dogecoin price trades at $0.5154 and holds a market cap of $23 billion. With the recent pullback, the price action shows a bearish reversal from the pattern’s resistance trend, which signals a risk of prolonged correction with accelerated selling pressure.

If the global tariff tension continues, the DOGE price will plunge another 45% to hit the channel support at the $0.085 floor.

On the contrary, if the short-term recovery recovers the bullish momentum, the buyers could breach the overhead resistance as an early signal for trend reversal. A bullish breakout from this resistance could push the asset 45% up to challenge the next key resistance at $0.23.

Also Read: Bitcoin Set to Exit 120-Day Correction as Whales Ramp Up Accumulation