- Dogecoin price rides a slow yet steady uptrend within the formation of a rising channel pattern.

- According to Coinglass data, DOGE futures open interest remains stagnant around the $1.71 billion mark, signalling a lack of speculative force.

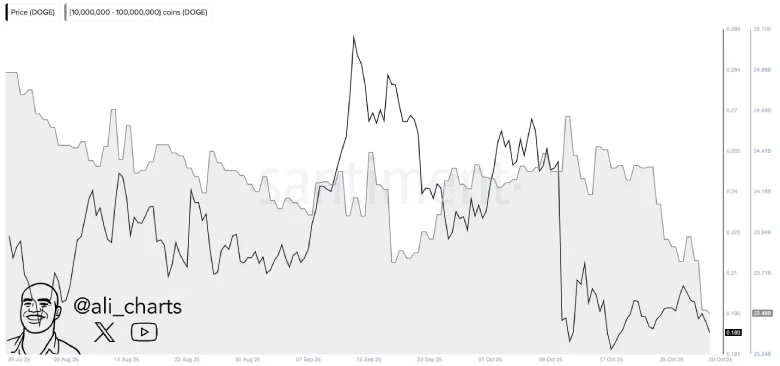

- Market analyst highlights that crypto whales offloaded over 440 million DOGE tokens in the past 72 hours, accelerating the bearish momentum in the market.

DOGE, the popular dog-themed memecoin, jumped 0.5% on Saturday to trade at $0.187. The upswing aligns with a relief rally in the broader crypto market after a notable sell-off during the weekdays. Despite the uptick, the latest on-chain data highlights strong selling pressure from large net-worth investors, steering market sentiment toward a prolonged correction ahead. Will DOGE price plunge below the $0.16 mark?

DOGE Extends Weekly Losses Amid Whales Selling and Stagnant OI

This week, the Dogecoin price witnessed a notable pullback from $0.209 to $0.189, registering a 10.5% decrease. The selling pressure gained momentum during the weekdays as Federal Reserve Chair Jerome Powell projected a hawkish stance for the December interest rate cut.

The DOGE price also faces downward pressure from the selling pressure from large investors. According to a recent tweet from market analyst Ali Martinez, crypto whales sold 440 million DOGE in the last 72 hours.

Coins moved by these entities often impact price momentum and market sentiment. Historically, whale selling has often coincided with local market tops or accelerated downtrends.

In addition, the open interest tied to DOGE futures showcased a sluggish sideways trend around $1.71 billion since mid-October. This stagnant trend indicates traders are hesitating to enter a fresh position in the futures market after the historic liquidation on October 30th. This lack of participation could further bolster downside momentum.

Therefore, a renewed uptick in this metric is crucial for Dogecoin price to drive a bullish recovery, as memecoins are strongly influenced by speculators.

Dogecoin Price to Hold $0.16 Support Amid Channel Formation

By press time, the Dogecoin price trades at $0.187, with an intraday jump of 0.5%. This uptick, backed by a 51.36% decrease in trading volume, hints at weak conviction from buyers.

The coin price is positioned below the key exponential moving averages 20, 50, 100, and 200, accentuating the broader bearish sentiment in the market. Currently, the 20-day EMA slope acts as dynamic resistance against price upswings, while a potential bearish crossover of 100- and 200-day EMAs could further accelerate selling pressure.

Thus, if the selling pressure persists, the DOGE price could plunge another 11.5% and test on the support trendline of a rising channel pattern. Since mid-April 2025, this memecoin has been resonating with the two downsloping trendlines, driving a slow yet steady recovery trend.

The recent history of the pattern indicates that the bottom support has been acting as a major accumulation zone for buyers to recoup their bullish momentum. The previous reversal from this support managed to double the DOGE value before it hit a significant resistance point of reversal.

Thus, if the support holds, the Dogecoin price could enter a short consolidation above this floor before the next rebound.

On the contrary, if the coin sellers break with support, the price may enter a deeper correction below the $0.16 mark.

Also Read: Bitcoin is Now More Resilient Than Ever: Treasury Secretary