- A cup and handle reversal pattern drives the 7-month accumulation zone in Dogecoin price.

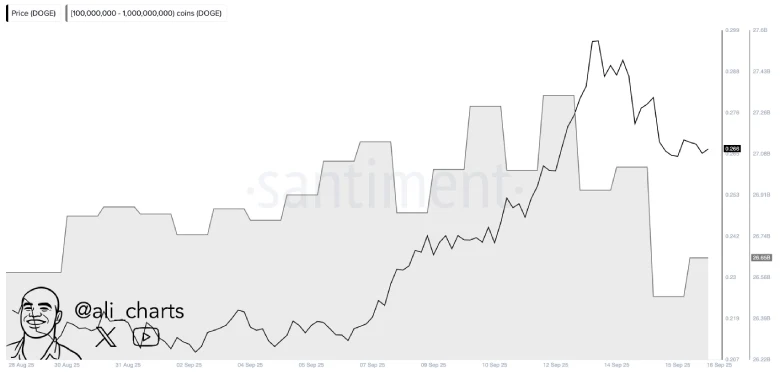

- Market analyst Ali Martinez highlights that crypto whales sold about 680 million DOGE in the past 96 hours.

- Dogecoin price is poised for a bullish reversal from $0.255 support amid the heightened trading activity in the futures market.

DOGE, the largest meme cryptocurrency by market cap, showed strong resilience to the intraday sell-off on Tuesday, September 16th. With a long-tail rejection candle, the Dogecoin price reverted from $0.27 and recorded a 0.69% gain. The buying pressure likely can be attributed to increasing trader activity in the futures market and investor optimism towards an anticipated interest rate cut from the U.S. Federal Reserve. Despite the bullish momentum, a market analyst highlights a notable selling pressure from large investors, signaling a risk for a bearish turnaround.

Whales Shed 680M DOGE in 96 Hours as Derivatives while Activity Spikes

Dogecoin price showed a steep increase since the second week of September, increasing from $0.211 to $0.30. The 44.8% climb also pushed the asset’s market cap to $40.4 billion. The rally was, however, taken away after confusion over the next interest rate move by the U.S. The Federal Reserve brought down the larger cryptocurrency ecosystem, pushing DOGE back to approximately $0.26.

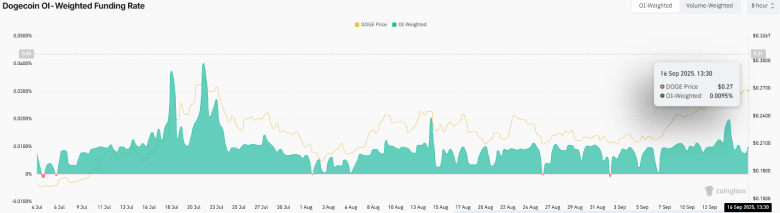

A substantial change in the derivatives activity was associated with the volatility of the prices. Statistics indicate that the future open interest of Dogecoin has nearly doubled in the same timeframe, increasing by 81% to 6.01 billion, after being 3.31 billion. An increase in the open interest in most cases is an indication of an influx of funds into the derivatives markets, which implies that there is greater speculative trading around the asset.

In the meantime, the OI-weighted financing rate in Dogecoin has stayed in positive figures, at 0.0063. A positive funding rate means that traders with long positions are paying shorts, which is usually an indication of bullish positioning on the part of the market participants.

Although derivatives interest has increased significantly, big-wallet participants have acted to mitigate the exposure. According to market analyst Ali Martinez, whales sold about 680 million DOGE in the past 96 hours. Any large holder movements can be closely monitored, since they may affect the short-term price movement and the market mood in general.

Dogecoin Price Eyes Major Breakout From Reversal Pattern

Since last weekend, the Dogecoin price has witnessed a brief correction from $0.306 to the current trading price of $0.26, accounting for a 12.1% loss. The selling pressure accelerated due to the overhead supply and market uncertainty surrounding the macroeconomic development in the US market.

However, the Dogecoin price witnessed renewed buying pressure at $0.255, supported, as evidenced by the long-tail rejection in the daily candles. As the coin price holds this support level, it also maintains a traditional reversal pattern, cup and handle, in the daily chart.

Since February 2025, the Dogecoin price has been continuing with a sideways trend as it drives a major accumulation trend in this pattern. The inclined slope of daily exponential moving averages (20, 50, 100, and 200) further reinforces the bullish trend. If the pattern holds true, the coin price should offer a sustainable breakout from the $0.287 neckline resistance with a weekly candle closing.

The post-breakout rally bolstered the Dogecoin price by over 50% and hit the $0.44 mark.

However, if the whale selling persists, this memecoin could face a breakdown below the $0.255 support and risk invalidating the bullish breakout.