- Dogecoin price bounded from the bottom trendline of the channel pattern.

- According to Coinglass data, DOGE futures open interest has plunged over 20% in the last two weeks, accumulating weak force from market buyers.

- A market analyst highlights that crypto whales offloaded over 3 billion DOGE tokens in the past, accelerating the bearish momentum in the market.

DOGE, the popular dog-themed memecoin, jumped 2.2% on November 9th to trade at $0.179. The upswing followed a slowdown in the correction trend in the broader crypto market as Bitcoin showcased sustainability above the $100,000 support. Similarly, the Dogecoin price managed to hold $0.16 support, signaling a reversal potential in the near term. However, renewed selling pressure from crypto whales suggests the correction trend is far from over.

Derivatives Data Shows Weakness in DOGE

In the last two weeks, the Dogecoin price witnessed a notable correction from $0.209 to a low of $0.154 before reverting to $0.179. This upswing showed multiple lower price rejection candles at $0.16 support, accentuating the intact demand pressure at this floor.

With an intraday gain of 2.22%, the DOGE price is heading to immediate resistance of $0.188, plotting a bullish breakout. Despite the uptick, there is data from the derivatives market that points to waning speculative engagement, which is suggestive of limited momentum behind the recent move.

Data from Coinglass reveals that open interest in Dogecoin futures has plummeted in the past two weeks. The total notional value of outstanding contracts fell from ca. $1.95 billion to $1.5 billion—a decline of 23%. Such a contraction is often indicative of low leverage exposures and low enthusiasm among the traders.

Meanwhile, the OI-weighted funding rate is still slightly positive at 0.032%, indicating that long positions still outweigh shorts, but it is a narrow spread.

On-chain data seems to confirm this cooling trend. Market Analyst Ali Martinez pointed out that some of the large Dogecoin holders have been steadily reducing their holdings in recent weeks. Analytics platform Santiment tracked the movement of over 3 billion DOGE from whale-controlled wallets, indicating some noteworthy offloading by high-value investors.

Analysts look back on this selling behavior as a sign that larger players are taking profits or are getting rid of their risk exposure, not accruing.

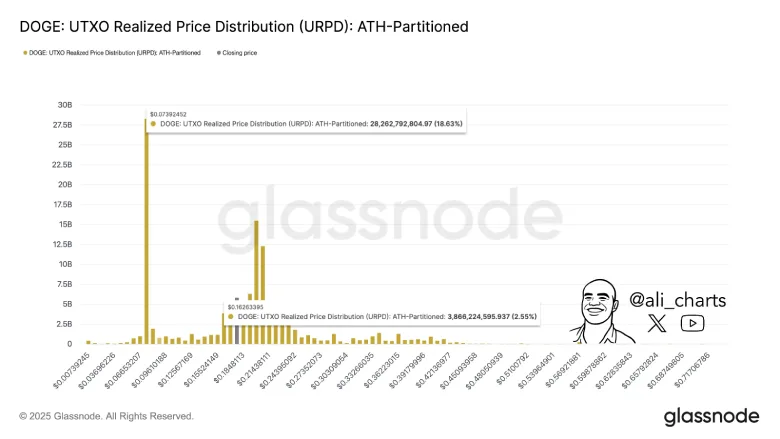

Martinez also cited weakening price support zones in his recent assessment. Based on historical wallet activity, the important support around $0.16 is showing lower buying strength. And then below that there is a lack of liquidity with the next major concentration of demand around $0.07.

The observation indicates that in the event that bearish pressure continues, Dogecoin could be met by a prolonged retracement to deeper levels.

Dogecoin Price at Make-or-Break Floor

An analysis of the data shows that the Dogecoin price upswings are positioned at the bottom trendline of a long-coming channel pattern. Since March 2010, the coin price has been actively fluctuating between the two parallel lines of the pattern, offering dynamic resolution and support for investors.

Interestingly, the bottom trendline has acted as a key accumulation floor for buyers, as a previous reversal neatly doubled the asset’s value before striking strong resistance. If history repeats, the Dogecoin price could breach the $0.20 resistance and bolster a 55% surge to challenge major resistance.

On the contrary, if the coin price breaks below the bottom trend line, the selling pressure would accelerate and drive and extend the correction trend.