Key Highlights:

- CZ urges investor-audited custody for all BNB-linked DATs (digital asset treasuries).

- YZi Labs will fund only DATs with third-party custodians.

- QMMM’s collapse exposed flaws in the DAT model.

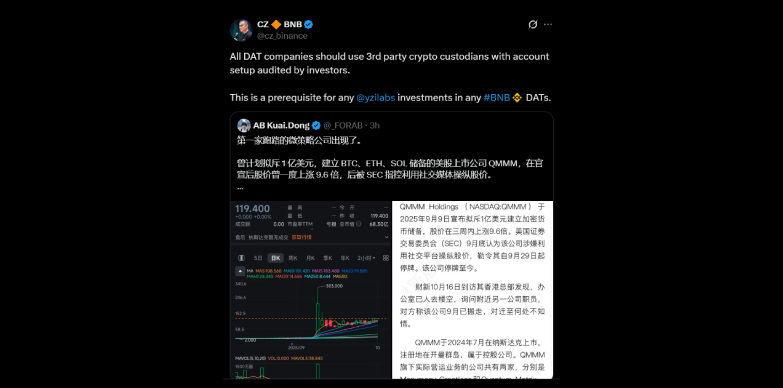

Changpeng Zhao (CZ), former CEO of Binance, is urging BNB-linked and all digital assets reserves (DAT) firms to make sure that they adopt strict rules on transparency and fund custody after controversy hit QMMM, a DAT has been accused of vanishing with investor money. On X (formerly known as Twitter), Zhao said that all DAT companies, especially those who are tied to the BNB ecosystem, must keep reserves with independent custodians through accounts that investors can audit. Moreover, he added that this setup would be a required standard for YZi Labs, a BNB project investment partner, before it agrees to back any DAT venture.

Investor-Audited Custody as a Mandatory Standard

For any large crypto reserve, it is important to build trust and to do so, Zhao emphasized that using independent custodians is key. CZ pointed out that transparency in custody must go beyond basic proof-of-reserve reports, requiring continuous investor access and external oversight.

According to CZ, the DAT model can only work if the asset is fully verifiable by the investors and is monitored by responsible third parties. His comment came right after QMMM, a widely promoted DAT startup, had suddenly gone offline. The platform’s investor channels and website have been shut down without any prior warning.

People from the crypto community have quickly labelled this incident as a setback for all the DAT firms, which have been promoted till now as a transparent alternative to unregulated yield and reserve schemes.

YZi Labs Sets Strict Investment Criteria

YZi Labs, a venture partner focused on BNB projects, confirmed that moving forward it will only fund those DAT firms that follow the third-party custodian model. By making audit-driven transparency a requirement, the lab is aiming to build a clear line of accountability which links corporate governance with investor protection.

Background on the QMMM Scandal

The controversy erupted in late September 2025 when the U.S. Securities and Exchange Commission (SEC) temporarily suspended trading of QMMM Holdings, which is a U.S. listed company that had recently pivoted into the digital asset treasury space.

QMMM’s shares had skyrocketed by more than 1,000% in just three weeks and with this data regulators suspected that the stocks were being manipulated. It was reported that the stocks were being boosted by undisclosed social media promotions asking investors to buy.

QMMM had also pledged to build a $100 million crypto treasury which was anchored to Bitcoin, Ethereum and Solana, and it was presenting itself as an early pioneer of the DAT model with claims of on-chain transparency. After the trading was suspended, QMMM suddenly shut down its website and the investor communication was stopped as well and this situation immediately raised concerns.

According to reports, the company’s Hong Kong office is also now empty, which indicates that the leaders might have taken advantage of the hype and then fled. Regulators are now looking if people inside the company were involved in the scheme.

Industry experts have linked QMMM’s collapse to QuadrigaCX and FTX, which also fell apart due to poor custody practices and unverifiable reserves. While big players such as MicroStrategy follow strict audits, smaller “micro-strategy” projects usually skip these checks. QMMM’s dependency on social media hype echoed the same manipulation that was observed during the ICO boom.

BNB’s Transparency Measures

The BNB ecosystem has already introduced safeguards to avoid such risks. Binance runs real-time Proof of Reserves (PoR), which lets users verify holdings on-chain. BNB-linked firms are also expected to use multi-signature custodial accounts, publish transparency reports and undergo third-party audits.

CZ is now insisting that new BNB-related DAT projects adopt investor-audited, third party custodians as part of their core setup. The main aim here is to reduce any conflicts of interest, cut misuse of the fund, and bring DAT operation closer to institutional best practices.

Also Read: Nansen Report Shows BNB Chain Leads in Gas Fees; CZ Spotlights Ecosystem Growth