Key Highlights:

- Crypto researcher FatMan claims that Binance might be indirectly enriching the Trump family.

- CZ denies allegations that stablecoin holdings benefit the Trump family.

- CZ and Guillén stress that holding stablecoin does not create financial ties to the issuer.

Former Binance CEO, Changpeng Zhao (CZ), has denied claims that the exchange pays tens of millions of dollars each year to the Trump family through all the profit that is made from WLFI stablecoin holdings. The rebuttal came right after a X post by FatMan was highlighted. In the post, the user suggested that Binance’s WLFI holdings could indirectly benefit people linked to the issuer of WLFI stablecoins.

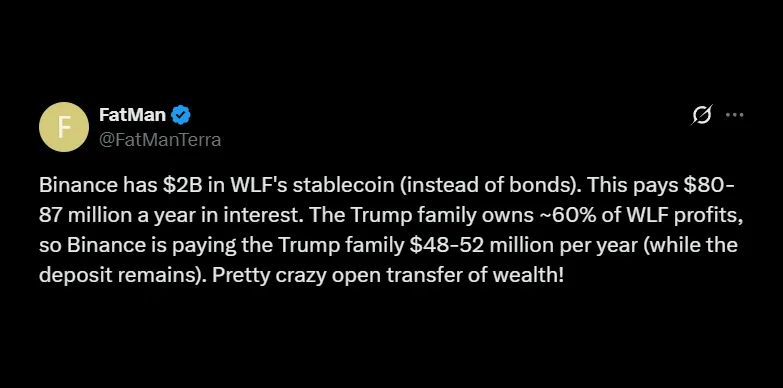

All of this drama started when FatMan posted a tweet, in which he made various claims. According to the post, Binance holds about $2 billion in WLFI-issued stablecoins. From this data, it can be calculated that this amount can easily generate $80 million to $87 million in interest income annually.

FatMan further claimed that since the Trump family is controlling 60% of the WLFI’s profits, Binance’s deposits could result in $48 million to $52 million in yearly payments that benefit the entire family.

“Pretty crazy open transfer of wealth,” FatMan wrote in his post. This post by him has fuelled speculation that one of the world’s largest and well-known cryptocurrency exchanges might just be indirectly enriching the family of the U.S. President through yield-generating stablecoin holdings.

CZ is again in the spotlight because President Donald Trump granted him with full pardon for his conviction related to failing to maintain effective anti-money laundering (AML) controls at Binance. Moreover, Senator Elizabeth Warren also commented on this matter in a recent post on X. Even she referenced the claims around Binance’s WLFI stablecoin holdings and highlighted concerns regarding potential conflicts of interest and political favouritism.

Teresa Goody Guillén Fires Back

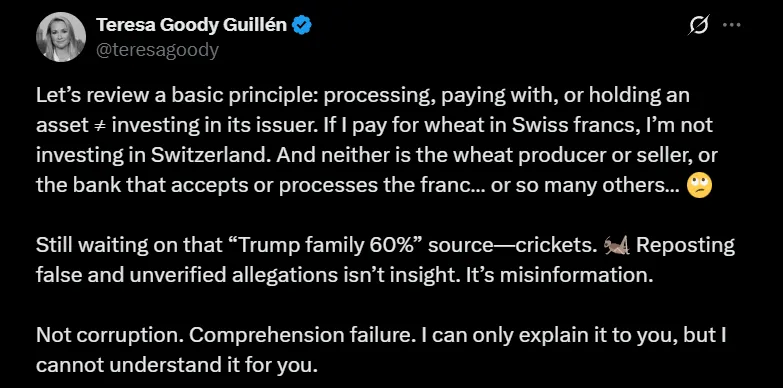

Teresa Goody Guillén, who is a well-known attorney and a former U.S. SEC litigation council, gave a strong reply to the crypto researcher. She directly replied to FatMan’s post and delivered a sharp and slightly mocking correction to what she described as a fundamental misunderstanding of asset handling versus investment behaviour.

In her post, Guillén pointed out that just because Binance holds or uses a stablecoin, it does not mean that the exchange is investing in or financially supporting the company behind it. She then moved on to compare it to using Swiss francs, joking that using a currency does not give money to Switzerland.

CZ Amplifies the Response

CZ later reshared Guillén’s post, which indicates that he supported the explanation and then added his own clarification to the post.

Through the post, CZ was implying that the claims about Binance enriching the Trump family through WLFI stablecoins were not accurate and were misleading. He said even said “we have already converted many of the stablecoins we received,” which means that Binance no longer holds most of the WLFI stablecoins, as they were already converted to some other assets.

With this, CZ was pointing out that FatMan’s claim made no sense, since the coins are sold, Binance practically cannot earn interest on them and send profits to WLFI or the Trump family.

Both Guillén and CZ emphasized that simply holding or processing stablecoins does not create a financial relationship with the issuer or its shareholders.

The Broader Context

WLFI, a newer USD-pegged stablecoin, has grown very quickly, but online claims linking it to politically connected investors remain unverified. FatMat suggested Binance’s holdings could benefit WLFI shareholders, but experts say stablecoin reserves, mostly safe assets like short-term Treasuries and cash, generate yield that stays with the issuer, not users like Binance.

CZ and Guillén posts were shared widely within the crypto industry. One of the users pointed out that Binance is usually the victim of rumours because of its size and visibility.

As of now, neither WLFI or any of its representatives has responded to its claims. Binance continues to stress that its stablecoin holdings are used only for liquidity, trading, and transactions, and that it is not meant for earning interest or making investments.

Also Read: Pi (PI) Climbs as KYC Completions Surge and Mainnet Migration Ramps Up