Key Highlights:

- Around $22 billion in Bitcoin and Ethereum options expire today, sparking high volatility.

- Bitcoin slipped below $110,000 testing critical support between $107,000 and $112,000.

- Ethereum slipped below $4,000, risking a deeper correction unless it breaks above $4,841 resistance.

Around $22 billion in Bitcoin and Ethereum options contracts are set to expire today, September 26, 2025, which will mark a critical and potentially volatile day for cryptocurrency markets. This event is being considered to be one of the year’s largest options expires, which is aligning with key U.S. inflation data. The combination of these two events is something that could affect the market trends and price swings heavily.

The expiration includes around $17 billion in Bitcoin options and more than $5 billion in Ethereum options, with contracts expiring at 8:00 AM UTC as reported by Deribit on their X post. Options are a type of financial contract, that give holders the right, but not the duty, to buy or sell an asset at a set price before the expiry. The expiry pushes traders to adjust or close positions which causes bigger price swings with the underlying asset.

This large expiry makes up a big part of the crypto derivatives market and is being closely watched by traders and investors worldwide.

Bitcoin Faces Crucial Test Amid Massive Options Expiry

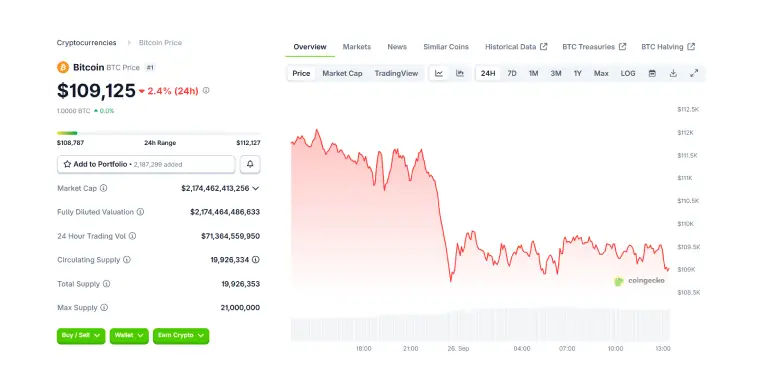

Bitcoin is currently testing at a critical support level, dipping below the $110,000 mark to a six-week low near $109,500. This decline is aligning with the expiry of $22 billion in Bitcoin and Ethereum options contracts today.

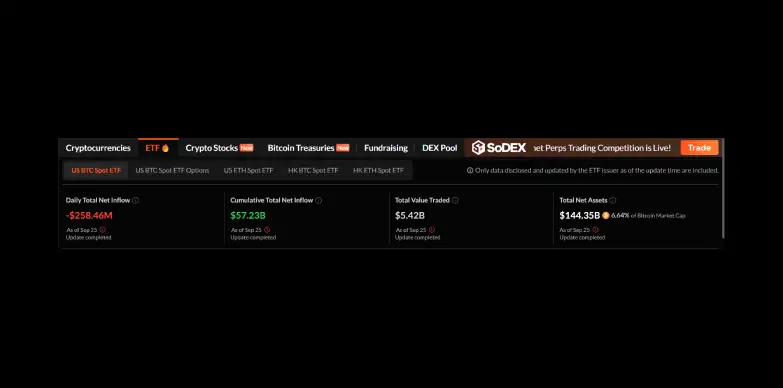

Moreover, according to SosoValue data of September 25, 2025, a net outflow of $258.46 million from U.S. Bitcoin Spot ETF was reported which was opposite of the previous day’s $241 million inflow. The outflows were led by Fidelity’s FBTC at $115 million, Bitwise with BITB $80.5 million, Ark and 21Shares ARKB $63 billion and Grayscales GBTC $42.9 million. BlackRock’s IBIT on the other hand, was the only ETF that saw an inflow, gaining $79.7 million.

According to Michael van de Poppe, the support currently lies between $107,000 and $110,000. If Bitcoin closes in this range, put options will dominate, giving bears $1 billion edge. Staying above $112,000 could favour bulls, with about $600 million lead in call options. Falling below $108,000 may trigger automated sell-offs as market makers hedge, pushing prices further down in extreme cases.

At press time, the price of the token stands at $109,125 with a dip of 2.4% in the last 24 hours as per CoinGecko.

Ethereum Faces Pressure as Options Expiry Nears

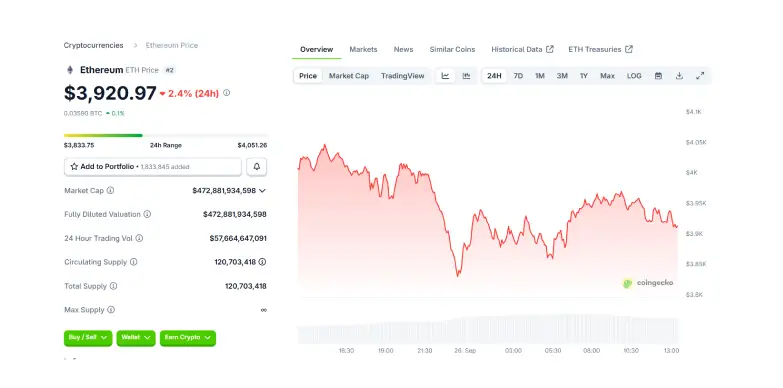

Ethereum is also under pressure as it dropped below the $4,000 mark yesterday, and is trading around $3,963. About $5 billion in Ethereum options are expiring alongside Bitcoin.

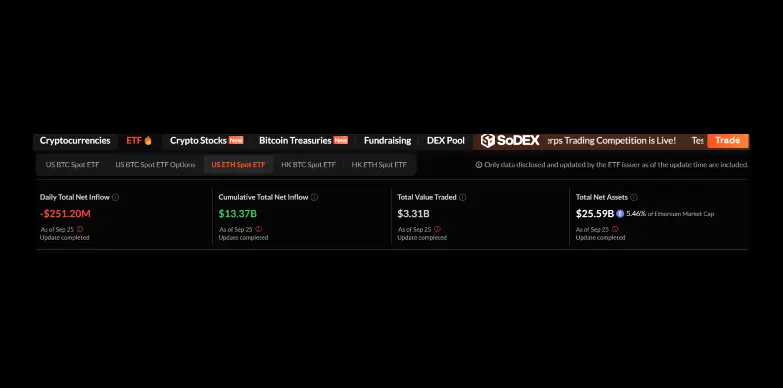

According to SoSoValue data, Ethereum spot ETFs have experienced a net outflow of $251 million on September 25, 2025. This data marks the fourth consecutive day of outflows from ETH ETF. This indicates investor caution or profit taking which is probably influenced by broader market volatility and the expiry of significant options contracts.

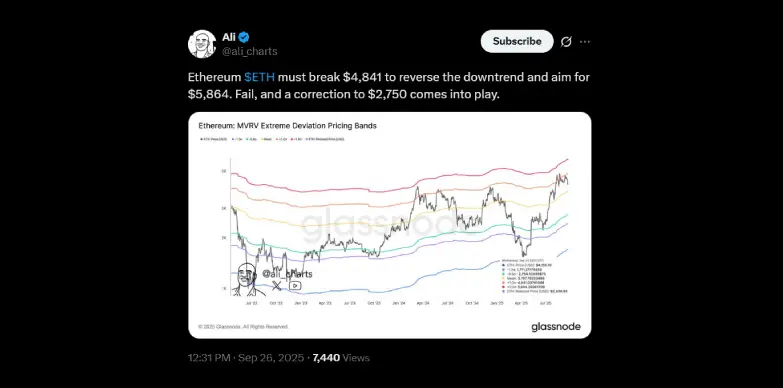

According to crypto analyst, ali_charts, depicted in his post on X that, Ethereum needs to break above $4,841 to end its current downtrend. If that does not happen, the prices could drop towards $2,750. These views are in-sync with bearish commentary from market figures like Peter Schiff, who noted Ethereum’s fall yesterday and suggested that Bitcoin might face similar pressure soon.

At press time, the price of the token stands at $3,920.97 with a dip of 2.4% in the last 24 hours as per CoinGecko.

Crypto Market Braces for Volatility Ahead of Massive Options Expiry

The entire crypto community is tensed ahead of the $22 billion Bitcoin and Ethereum options expiry. The Crypto Fear & Greed Index has dropped down to 28, which indicates a sense of fear, while the market has seen around $1.5 billion in leveraged in liquidations this week. Altcoins like Dogecoin and XRP have also dropped, dragging overall market capitalization lower.

The U.S. inflation can also affect the crypto prices, if the inflation is high, traders may buy Bitcoin and Ethereum, pushing the prices up but if it is low, buying may slow down and the prices may fall again. This factor when combined with the expiry data, has the potential to trigger high volatility, making today a critical test for the crypto market.

Also Read: Ethereum Price Breaks $4K Floor — Capitulation or Accumulation Phase?