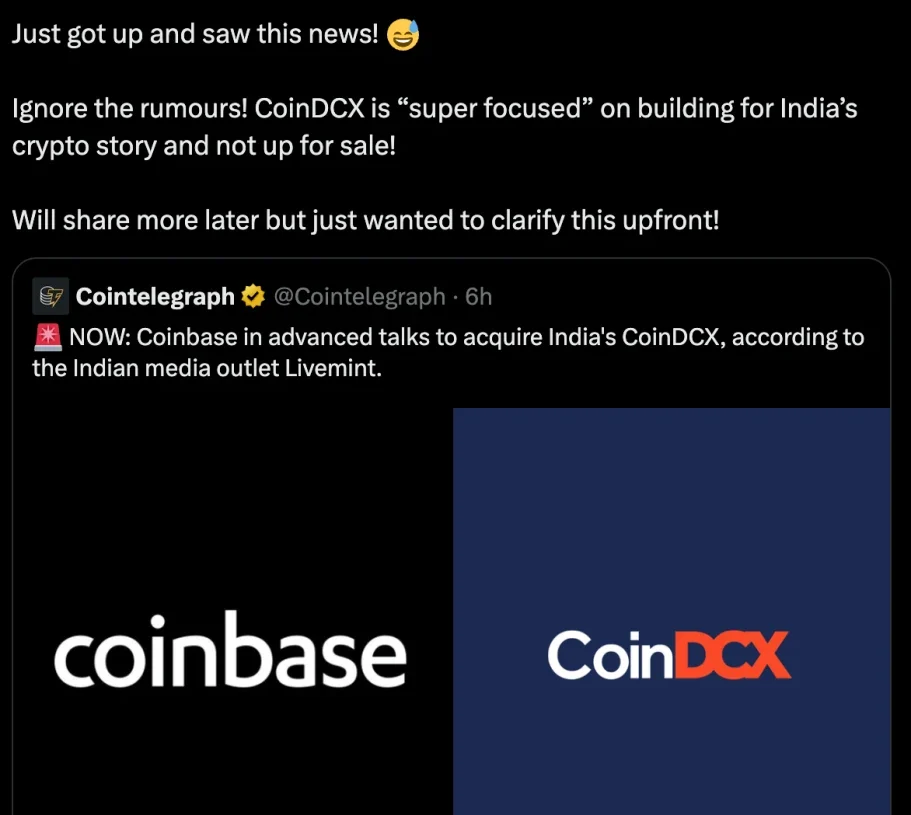

CoinDCX CEO Sumit Gupta has publicly denied reports suggesting Coinbase is in advanced discussions to acquire the Indian cryptocurrency exchange.

The denial came via social media after Livemint published claims about potential acquisition talks valuing CoinDCX below $1 billion.

The company is still “super focused” on developing India’s cryptocurrency infrastructure, according to Gupta, and it has no plans to pursue sale talks.

This view was mirrored by co-founder Neeraj Khandelwal, who emphasized CoinDCX’s dedication to helping the Indian cryptocurrency community.

Acquisition Reports Detail Strategic Positioning

The Livemint report suggested Coinbase views CoinDCX as a strategic investment opportunity following the exchange’s recovery from a recent security incident.

Sources claimed the potential deal would value CoinDCX well below its previous $2.2 billion peak valuation from three years ago.

The report also mentioned Coinbase’s existing stakes in both CoinDCX and rival exchange CoinSwitch, with speculation about potential portfolio company consolidation. However, CoinSwitch co-founder Ashish Singhal confirmed no active merger discussions are currently underway.

Security Breach Context Influences Market Speculation

CoinDCX recently disclosed a $44 million theft involving hackers who compromised an internal liquidity account on July 19.

The exchange reported no customer funds were affected, though the incident raised questions about disclosure timing and security protocols.

The company announced the breach approximately 17 hours after it occurred, contrasting with immediate disclosure practices followed by exchanges like Binance and Bybit. CoinDCX defended the delay as necessary for thorough investigation before public communication.

A recovery bounty program offers up to 25% of recovered funds, potentially reaching $11 million for successful asset retrieval. Forensic analysis suggests attackers compromised backend servers or internal credentials rather than exploiting blockchain vulnerabilities.

John O’Loghlen, Coinbase’s Asia-Pacific managing director, previously described India as one of the world’s most exciting market opportunities. The country’s growing crypto adoption and regulatory developments create attractive conditions for international exchanges.