- The Chainlink price correction witnessed renewed demand pressure at the $14 mark despite a major breakout from a head and shoulders pattern.

- LINK stabilizes as investors react to multiple collaborations revealed during SmartCon Day A2.

- Today, the Chainlink Reserve accumulated 78,252.51 LINK, bringing its total holding to 729,338.41 LINK.

LINK, the native cryptocurrency of the decentralized oracle network Chainlink, slipped over 2.4% during Thursday’s U.S. market hours to trade at $14.60. This downtick aligns with a broader market pullback after a temporary relief rally yesterday, which likely renewed the bearish momentum. Despite the mounting selling pressure, the social sentiment surrounding Chainlink hit a multi-year high as SmartCon’s second day revealed several key collaborations.

Chainlink Stabilizes as SmartCon 2025 Fuels Institutional Momentum

Following the Monday sell-off, the Chainlink price has been wavering below the $15.5 level, with no suitable follow-up for further correction. The daily chart accentuates long-tailed rejection candles, signaling intact demand pressure amid continued correction in the broader crypto market. The resilience comes as market participants digest the several collaborations revealed during SmartCon’s second day.

In addition, some major announcements from day two of SmartCon 2025 highlight institutional support for Chainlink’s infrastructure. Asset manager WisdomTree (with over $130 billion in assets under management) selected Chainlink to create a subscription and redemption system by placing fund net-asset-value data on-chain.

Last week, the leading liquid-staking platform Lido (with over $28 billion in TVL) announced its migration to Chainlink’s cross-chain interoperability protocol (CCIP) for its wstETH token on all chains. Chainlink and Apex Global announced an integration for Chainlink’s solution for Apex Global’s institutional-grade stablecoin standards solution in the emerging field of regulatory infrastructure, developing a solution specifically for embedded supervision projects such as the Bermuda Monetary Authority.

In another development in Japan, SBI Group’s digital-asset arm—SBI Digital Markets (¥10+ trillion in AUM)—announced that it will use Chainlink as the infrastructure partner for its forthcoming tokenized-asset platform.

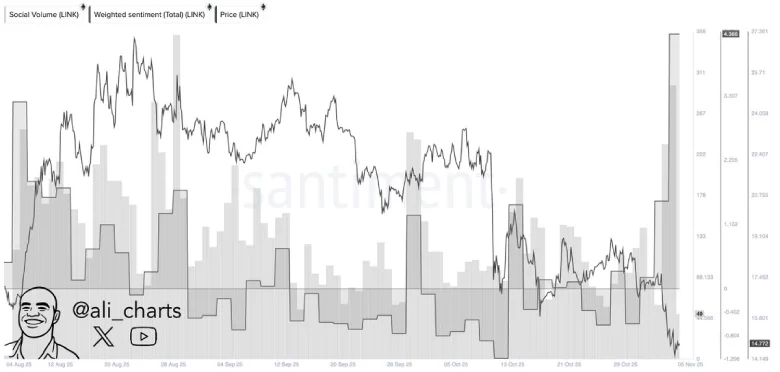

Amid these collaborations, social sentiment around Chainlink peaked to its most positive level in three years, even though the price declined. Market analyst Ali Martinez suggests this bullish divergence has often coincided with local bottoms in Chainlink price.

Chainlink Price Hints at Fake Breakdown From Major Support

Over the past two weeks, the Chainlink price has shown a notable correction from $1.19 to $14.58, its current trading price, registering a loss of 23.5%. Amid this downswing, the coin price gives a decisive breakout from the $15.50 neckline support of a head-and-shoulders reversal pattern.

This chart setup is characterized by waves, i.e., the left shoulder, the head, and the right shoulder. While the breakdown was expected to intensify selling pressure and drive a prolonged downturn towards $12, the LINK price shows strong resilience above $14.

The daily candles in recent days show long tail rejection at the $14 mark, accentuating the intact demand pressure for a price rebound.

If the coin price breaks above $15.54, the previous breakdown will be marked as a fake breakdown or bear trap. If materialized, the coin price could gain additional momentum and drive a renewed recovery toward $20 resistance.

The momentum indicator RSI (Relative Strength Index) at 35% reflects a price value close to the oversold region, which historically triggered a price reversal.