LINK, the native cryptocurrency of the decentralized oracle network Chainlink, bounced 2.08% during Wednesday’s U.S. market hours to trade at $14.25. The surge in buying followed a broader market uptick as the pioneer cryptocurrency, Bitcoin, bounced to a new high of $112,040. However, the LINK price shows potential for a higher rally amid the completion of a traditional reversal.

Chainlink Breaks Resistance, Signals Bullish Reversal

Over the past two weeks, the Chainlink price has demonstrated a strong recovery, rising from $10.94 to its current trading value of $14.30, representing a 30% surge. An analysis of the daily chart revealed that this recovery developed into a bullish reversal pattern known as the inverted head-and-shoulders pattern.

The chart setup displays three troughs: the middle head, which is enveloped by two shallow dips. On July 8th, the LINK price offered a bullish breakout from $13.8 neckline resistance and a downsloping trendline of a falling channel pattern.

Since mid-December 2024, the two trendlines of the parallel channel have served as dynamic resistance and support, driving a sustained correction trend. Thus, the recent breakout signals a major change in Chainlink’s dynamics. The coin price bounced above the 20-day and 50-day exponential moving averages, accentuating the shift in market sentiment.

If the breakout is sustained, the LINK price could rise 10% to challenge the $15.6, followed by an extended leap to $17.4.

On-Chain Metrics Major Support and Resistance

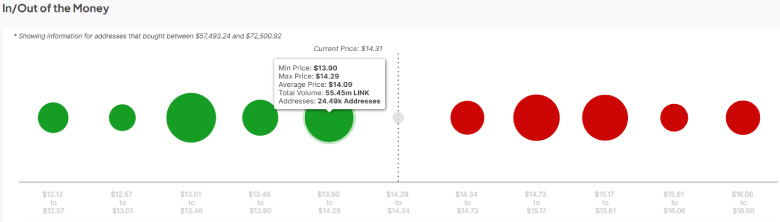

According to the Sentora analytics, the Chainlink price holds a strong support region of $13.8-$14. The Global In/Out of the Money data indicate that over 24,490 addresses hold $55.45 million at an average price of $14.25. The next strong support lies around $13.25 and covers 61.55M LINK tokens from 25.02k addresses.

Similarly, the $14.93 stands as a strong resistance against potential recovery as it holds a 50.82 LINK supply from 21.44k addresses. A price surge to this level could see a surge in selling pressure as traders may choose to exit at breakeven.