LINK, the native cryptocurrency of the decentralized Oracle Network Chainlink, recorded a notable 2% surge during Friday’s U.S. market hours. Despite the broader market correction, the Link’s daily candle shows a long-rejection candle at $17.30, indicating the presence of high demand. Recent on-chain data indicate that the ongoing recovery is supported by increasing whale accumulation, which bolsters the asset’s potential rebound.

Chainlink Accumulation Signals More Upside Ahead

Over the past two weeks, the Chainlink price has showcased a parabolic rally, rising from $12.73 to a recent high of $20.28, representing nearly a 60% growth. The regulatory development in the United States, particularly the passage of three crypto bills, was the primary catalyst behind the surge in the crypto market.

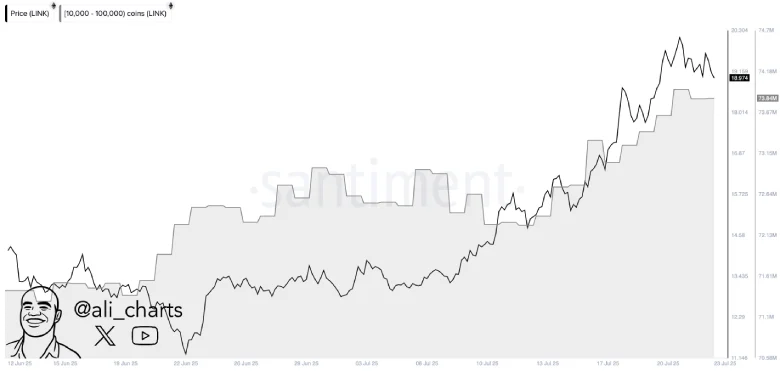

However, the recent on-chain data highlights that the LINK price recovery has witnessed sufficient support from the whale accumulation trend—a historical indicator of a sharp price rally.

According to a recent insight from market analyst Ali Martinez, crypto whales have accumulated over 1.6 million Chainlink tokens in the past two weeks. The accumulated chart shows no signs of a notable pullback in this metric, despite the recent market correction, indicating that high-net-worth investors remain confident in the potential recovery of this asset.

If the trend persists, this altcoin could quickly recoup its exhausted bullish momentum for the next leg up.

Head & Shoulders Pattern Hints Major Breakdown, But There’s a Catch

Over the past five days, the Chainlink price has experienced a notable pullback, dropping from $20.28 to its current trading price of $18.24, resulting in a 10% loss. An analysis of the four-hour timeframe chart reveals this correction as a potential formation of a classic reversal pattern known as a head and shoulders.

The chart setup is commonly spotted at the major market top and is characterized by three peaks, i.e., the middle head surrounded by two short shoulders.

If the pattern holds true, the coin price could plunge by over 6% and challenge the neckline support of $17.50. A bearish breakdown below this support would intensify the selling pressure and drive an extended correction towards $15.7.

However, the broader bullish trend and the active accumulation from whale investors hint at a higher potential for the LINK price rebound. If the coin price manages to breach the immediate resistance of $18.7, the bearish thesis would be invalidated.