LINK, the native cryptocurrency of oracle network Chainlink, recorded a 2.12% fall during Tuesday’s trading to $12.38. The selling pressure followed a recent reversal from the 20-day EMA slope and the broader influence of the falling channel pattern.

As the escalating trade tension between the United States and China keeps financial markets on edge, the LINK price faces a risk of a $10 breakdown.

Chainlink Price Action Mirrors Falling Channel Formation

An analysis of Chainlink’s daily chart shows the current price correction resonating within a narrow range of two parallel trendlines, indicating a well-known channel pattern formation. Since February 2025, the altcoin has bounced at least twice from each trendline, suggesting the pattern’s strong influence over price movement.

With today’s downfall, the LINK price reversed from the dynamic resistance of the 20-day EMA slope and plunged to $12.26. Over the past two months, the coin price showed several failed attempts to breach the EMA resistance, which resulted in accelerated selling pressure and a prolonged downfall.

The coin price could plummet another 25% and test the pattern’s support trendline at $9.25.

On the contrary, if the global trade tension eased on Chainlink price, the buyers could breach the overhead trendline to project an early signal of recovery. The momentum indicator RSI forming a higher low formation accentuates the building bullish momentum at bottom support and higher potential for a bullish breakout.

The post-breakdown rally could push the asset 26% up to challenge the next significant resistance at $16.7.

LINK Price: Key Support and Resistance

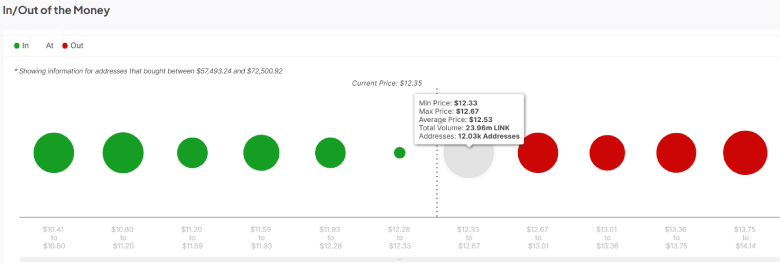

According to Intotheblock’s In/Out of the Money indicator, the recent drop in price pushed 23.96 million LINK out of the money, impacting 12.03K addresses. If the price begins to recover, the $12.53 zone—where this supply is concentrated—may act as a strong resistance, as holders could seek to exit at break-even.

Additional resistance levels lie at $12.86 and $13.00, where 13.75 million and 17.4 million LINK are held, respectively.

On the downside, the next key support level is around $11.00, where 14.6 million LINK is held by approximately 9.3 million addresses.

Also Read: Bitcoin Set to Exit 120-Day Correction as Whales Ramp Up Accumulation