As the crypto market stands on its solid ground hours before the FOMC meeting, Cardano is creating a bullish pattern. Currently, the ADA token trades at a market price of $0.6798 with a price surge of 2.51% on May 6, hinting at a potential turnaround.

Cardano price eyes surpassing the $0.74 neckline for an extended recovery run. Will this pump the ADA price to a $1 price target? Let’s find out.

Cardano Price Analysis Eyes $0.90

Cardano’s price recently bounced off the 50% Fibonacci level at $0.6362. With a lower price reaction at $0.64, Cardano is struggling to surpass the 50-day EMA line.

However, the short-term price action reveals an inverted head-and-shoulders pattern under progress. At present, Cardano prepares the right shoulder with a neckline at least 38.20% Fibonacci level at $0.7437.

Due to the prevailing declining trend and consolidation, the 100 and 200 EMA lines are on the verge of giving a potential negative crossover. Additionally, the MACD and signal lines have given a negative crossover. Hence, the technical indicators warn of a potential bearish turnaround.

Nevertheless, the recent lower price reaction, creating a bullish engulfing candle, hints at a potential recovery. Considering the broader cryptocurrency market recovers, a potential breakout rally in Cardano will reach the 23.60% Fibonacci level at $0.90. This will significantly increase the possibility of Cardano reclaiming the $1 mark.

However, a potential breakdown under the 50% level will test the $0.5542.

Optimism Rises in ADA Derivatives

Despite the short-term risks highlighted by Cardano price analysis, the derivatives market is gradually turning optimistic. The long positions over the past four hours have surpassed the 50% mark, equalizing the playing field.

Currently, the long-to-short ratio stands at 1.028, as per the data by Coinglass. Furthermore, the funding rate has reached a new peak at 0.0078%, reflecting growing bullish sentiments.

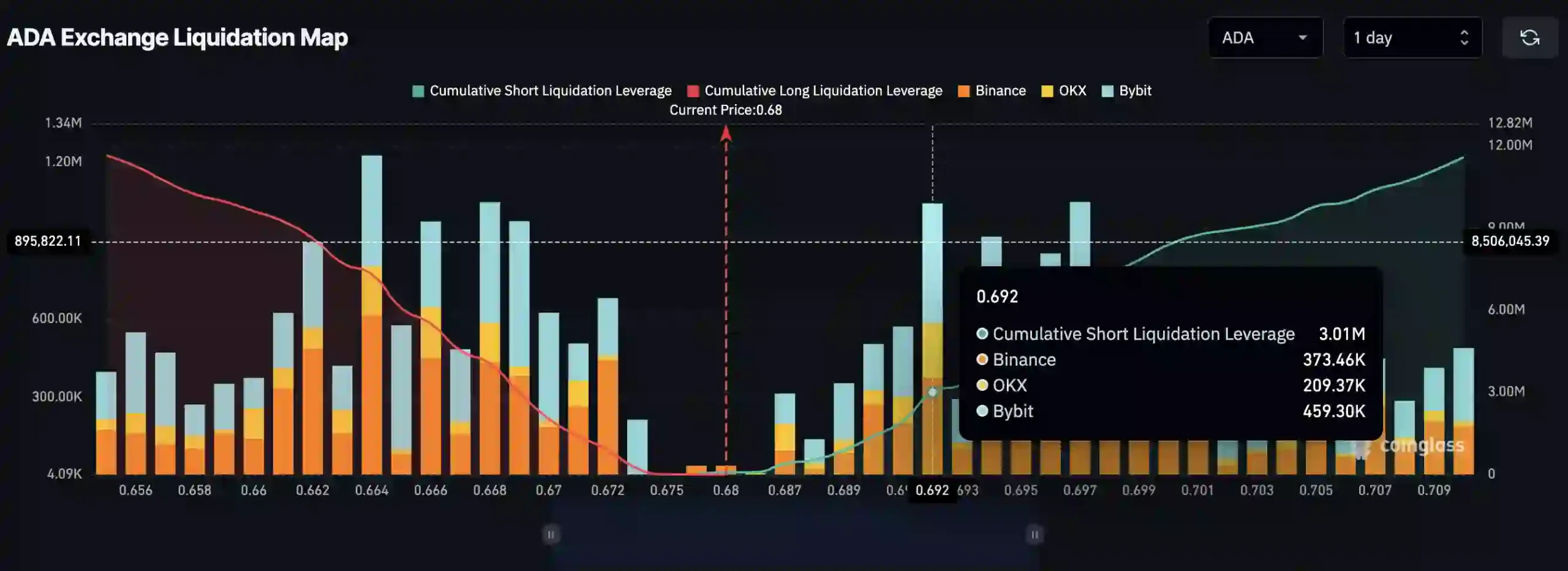

If the uptrend continues and surpasses $0.692, the ADA exchange liquidation map suggests a $3.01 million cumulative short liquidation. This will likely trigger a domino effect, fueling the bullish trend in Cardano prices.