- The Cardano price shows a fresh recovery within the formation of a descending triangle pattern.

- Large Cardano holders have significantly increased their positions following the asset’s decline under the $0.50 mark last week.

- The $0.6 level stands as immediate resistance against ADA buyers to drive a stable price recovery.

ADA, the native cryptocurrency of the Cardano ecosystem, shows a 2.3% jump on Monday to trade at $0.59. This upswing likely followed a broader market upswing as buyers attempted to strengthen this relief rally to a stable recovery. While the Cardano price action is yet to confirm this transition, the on-chain data support the bullish narrative as major stakeholders in ADA have shown renewed accumulation amid the recent price dip.

ADA Rebounds 21% as Whales Accumulate 348M ADA

Over the past week, the Cardano price has shown a notable recovery from $0.489 to the current trading value of $0.6, registering a 21% surge. Meanwhile, the asset market cap jumps to $21.53 billion.

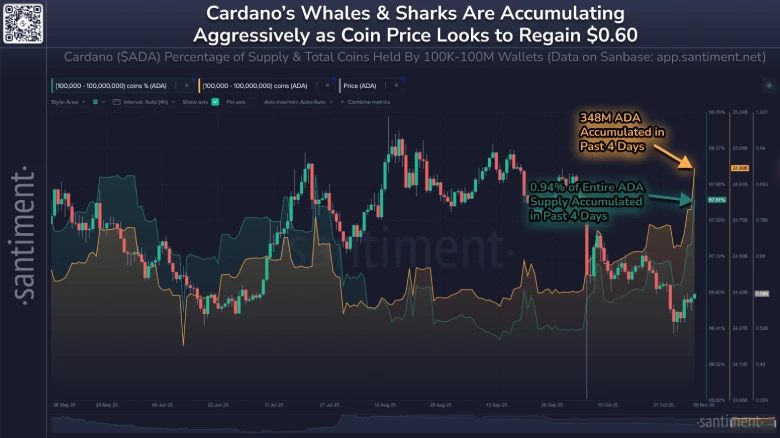

While the recovery trend followed the broader market upswing, the ADA coin gained additional momentum from renewed accumulation by large investors after the recent dip to the $0.5 mark. According to Santiment data, the crypto wallet holding between 100,000 and 100 million ADA tokens has expanded its holdings by roughly 348 million ADA in the last four days.

The accumulation represents nearly 0.94% of the total circulating supply of this token. The buying activity from these mid-to-large investors coincided with Cardano’s attempt to reclaim the $0.6 mark.

Since early October, the accumulation pace from the mid-to-large-tier investors has started to strengthen. While overall network activity has remained steady, the rapid buildup among larger holders highlights a noticeable concentration of ADA supply during a period of market uncertainty and moderate price recovery.

However, the derivatives data show little change in market conviction. According to Coinglass, the open interest tied to Cardano futures continues to waver around the $682 million level. This stagnation reflects restrained speculative activity and limited new leverage entering the market, implying that broader sentiment around ADA’s short-term price trajectory remains uncertain for now.

Historically, a surge in OI data has signaled renewed speculative force in the market to drive a bullish recovery.

Cardano Price Shows Major Reversal with Triangle Pattern

With today’s price jump, the Cardano price outlook challenges the $0.6 psychological resistance. This level stands as the candle high of the November 4th sell-off in the crypto market, while also holding the 20-day exponential moving average near it.

A potential breakout from this barrier will accelerate the bullish momentum and drive a 20% surge before challenging the $0.73 resistance. A broader analysis of this daily chart shows this reversal as a renewed bull cycle within the formation of a descending triangle pattern.

Theoretically, the chart setup is characterized by a firm horizontal support downsloping trendline, which gradually bolsters the bearish momentum in price for a decisive breakdown. If materialized, the Cardano price would enter a prolonged correction.

The coin price is currently positioned below the key exponential moving averages (20, 50, 100, and 200), indicating broader bearish sentiment, and the trader’s path to least resistance is downward.

Also Read: Bitcoin Price Hits $106K as Whale Buying Strengthens Market Structure