- Canary Capital filed an S-1 registering with the U.S. SEC to launch the Mog ETF

- An approval could mark a milestone for meme-asset adoption in traditional finance.

- Since mid-july 2025, the MOG price has been reason within the formation of a falling wedge pattern

Mog (MOG), the Ethereum-based meme coin, jumped over 10% on Wednesday U.S. market hours to trade at $0.000000385. Defying the prolonged correction of the broader crypto market, the buying pressure in the MOG price can be attributed to the community’s excitement as Canary Capital filed an S-1 registration with the SEC for an MOG ETF. Will the news-driven sustain?

Canary Capital Seeks SEC Approval for MOG ETF

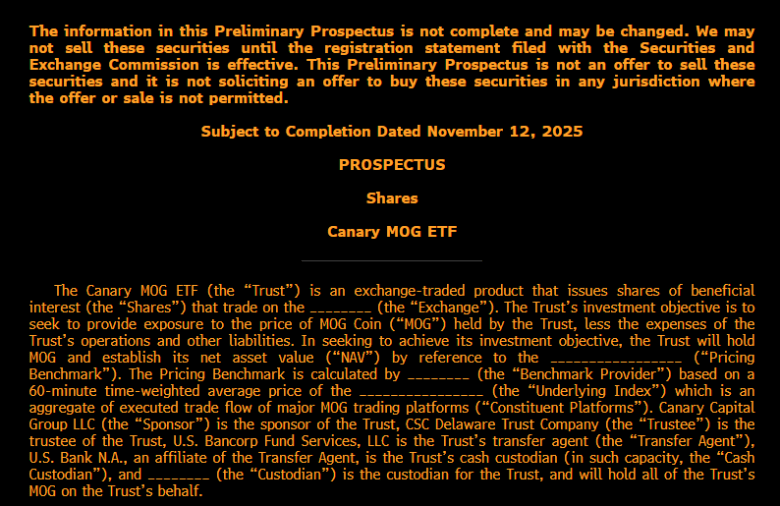

On Wednesday, the asset manager Canary Capital submitted a regulatory filing to the US Securities and Exchange Commission (SEC) for the launch of the Canary MOG ETF. The exchange-traded fund would be the first of its kind to track the price of Mog coin, an Ethereum-based memecoin.

The S-1 registration outlines the ETF as a passively managed fund designed to provide investors a direct exposure to the MOG’s spot price without the hassle of holding actual cryptocurrency. The ETF can hold up to 5% of assets in Ether (ETH) to cover gas fees for on-chain transactions, such as token transfers and custody operations, Reuters reported.

According to the filing, the Trust proposed to hold MOG directly, net of operational expenses, and to determine its net asset value (NAV) based on a pricing benchmark based on a 60-minute time-weighted average price of MOG aggregated across multiple major trading venues.

Following its launch in July 2023, Mog started as a lighthearted cat-themed meme project inspired by internet slang like “mogging”—a term to dominate look or vibe. Unlike the traditional utility tokens, the Mog relies on social media hype, community support, and its passion for memes and viral content. Amid its playful nature, MOG has climbed to the rank of #240, with a current market cap of $151.5 million, according to Coinmarketcap.

As the U.S. government prepares to end its prolonged shutdown, the SEC is expected to resume its review process for several pending crypto ETF applications. Thus, a potential launch could become a defining moment for the meme-asset market, opening the door for investors to gain exposure to MOG through regulated vehicles.

The ETF could attract significant inflows from institutional investors while boosting liquidity and increasing market visibility for this memecoin.

Also Read: Polymarket Re-Enters in US with its Beta Mode: Report

MOG Price Faces Intense Selling Pressure

Despite the growing speculation on the Mog ETF, the memecoin failed to drive a notable change in price trajectory. By press time, the Mog price trades at $0.000000385 and shows an intraday gain of 9%.

However, a deeper analysis of the daily chart shows a long-wick rejection attached to today’s candle, indicating the pressure of overhead supply. If the bearish momentum persists, the coin price could show another bearish reversal from the resistance trendline of the channel pattern.

Since Mid-july 2025, the Mog coin has witnessed a steady decline in its price while resonating within two parallel walking trendlines of a channel pattern. The potential reversal could push the asset another 53% to test the bottom trendline at $0.000000186.

On the contrary, a bullish breakout from the channel pattern could signal a key change in market dynamics for positioning the asset for a strong recovery.

Also Read: Bitwise Chainlink ETF Moves Closer to Market Debut Amid DTCC Listing