Following Trump’s tariff announcements yesterday, the crypto market witnessed a major downturn in the first few days of April. The selling pressure plunged major assets like Bitcoin and Ethereum below key support, indicating the continuation of a prolonged downfall.

New U.S. tariffs have intensified market uncertainty, shaking investor confidence across major crypto sectors. However, the latest on-chain data shows firm confidence of SHIB long-term holders as they continue to hold the majority of the supply in the volatile market. But is there a risk of centralization?

- High concentration of supply with long-term holders raises concerns over price manipulation.

- The $0.00001 psychological support backed by a long-coming ascending trendline creates a high accumulation zone.

- A negative alignment between daily EMAs (20<50<100<200) indicates the broader market sentiment.

Long-Term Holders Demonstrate Confidence in SHIB

An analysis of Shiba Inu’s daily chart shows a V-top reversal from $0.0000156 to the current price of $0.000012, registering a 23% loss. This fresh lower high formation reverting below the 20- and 50-day EMA slope indicates intact overhead supply and risk of prolonged correction.

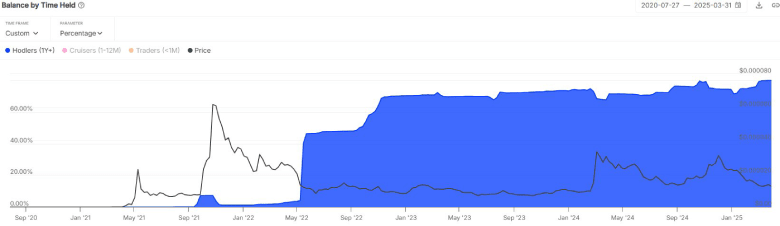

The Intotheblock analytics platform reveals noteworthy HODLer behavior in the SHIB community despite this growing bearish momentum. Long-term holders currently control more than 80% of the total supply, highlighting a significant level of optimism amid the current market correction.

The high percentage of long-term holders suggests that a large segment of the SHIB community believes in the project’s future development.

However, this concentration of supply in the hands of a small group raises the risk of centralization. If these investors were to make any movement, the SHIB value could change drastically, potentially kicking the retail investor with sudden liquidation.

Thus, while the current optimism is high, the Shiba Inu coin is an asset traders must follow with a strict stop-loss, or investors must have a diverse portfolio.

Dynamic Resistance Sets Shiba Price Price For Major Support Test

For the past four months, the Shiba Inu price showcased a steady downtrend under the influence of a downsloping trendline. This dynamic resistance drives the new lower high formation in SHIB’s daily change, maintaining the sell-the-bounce sentiment in the market.

Following the recent reversal, this dog-themed memecoin currently trades at $0.000012 and holds a market capitalization of $7.2 billion. If the selling pressure persists, the Shiba Inu price could plunge 12% to tease a breakdown below the multi-month support at $0.0000107, a key level highlighted in many SHIB prediction analyses.

A breakdown below this support will accelerate the bearish momentum and set the SHIB coin for a major downtrend.

However, the $0.00001 psychological level has acted as a major accumulation trend for crypto investors, and therefore, the buyers would get an opportunity to counterattack.