On Wednesday, June 18th, the BNB price plunged 1.44% to trade at $641. The bearish momentum can be attributed to the broader market downtrend, as escalating military tension in the Middle East is fueling FUD (fear, uncertainty, and doubt) among investors. While price action suggests a continued downtrend, the Binance exchange maintains its dominance in spot market trading, underscoring the fundamental support for growth behind this asset.

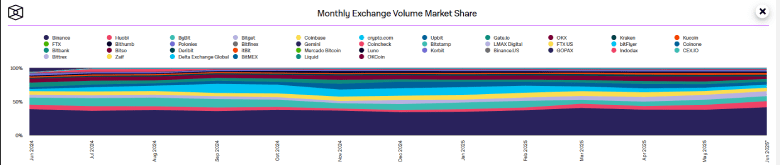

Binance Leads Crypto Spot Markets with Dominant BTC and ETH Share

Over the past week, the BNB price has declined from $674 to $641.20, representing a 5% decrease. The selling pressure accelerated with the geopolitical tension as the United States and Russia are rumored to join the Israel-Iran war.

While the broader market sentiment supports sellers, Binance’s spot market share has bounced to 41.14% in June 2025, its highest level since last year. According to TheBlock data, the exchange now commands 45.6% of BTC spot trading, edging closer to its all-time high of 47.7% recorded in June 2024.

In addition, Binance has maintained a 50% share of ETH spot trading volume since March 2025, underscoring its dominance when trading the two largest digital assets by market cap.

Binance’s market grip can be attributed to unmatched liquidity, competitive spreads, and aggressive fee incentives. As trading volume on Binance increases, so does the BNB burn mechanism and its uses for fee discounts.

Thus, this altcoin could experience renewed demand pressure, leading to a higher surge.

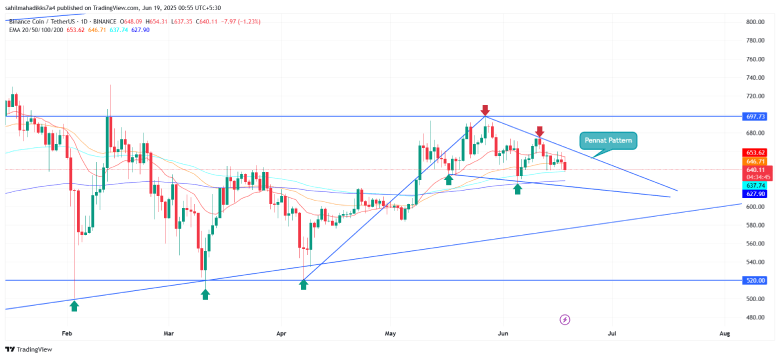

BNB Price Set to Rebound Amid Pennant Formation

Binance coin analysis of daily charts shows the current price correction is resonating within two converging trends. The chart setup consists of a long pole demonstrating the dominating uptrend followed by a temporary pullback within converging trend lines to regain bullish momentum.

If the Iran-Israel war continues to impact market sentiment, the BNB price could slide another 3% to test the pattern’s support at $6.20. However, the broader trend in Binance coin could maintain its bullish trend if the price holds above the 200-day exponential moving average at $620.

If the pattern holds true, the coin price is likely to show a bullish rebound to the overhead trendline for breakout, signaling the end of the current correction. The post-breakout rally could push the price to $700 mark, followed by an extended rally to $760 and $800.

Also Read: Will Bitcoin Drop Below $100K Amid U.S.-Middle East Conflict?