DeFi insurance has become essential infrastructure for securing billions of dollars locked in decentralized protocols. In 2025 alone, the crypto market suffered $3.4 billion in losses, which is the highest figure since 2022. Yet, only approximately 0.5% of DeFi’s total value locked (TVL) of $119 billion was covered by insurance protocols.

DeFi insurance offers on-chain protection against specific technical failures. Instead of relying on traditional insurers, coverage comes from pooled capital managed by smart contracts, DAOs, or automated oracle systems. Claims are resolved either through governance votes, predefined data triggers, or a mix of both.

Stablecoin depegs, bridge failures, and oracle incidents have become common policy options as DeFi strategies grow more complex.

This guide explains how DeFi insurance works, compares leading protocols by TVL and coverage capacity, and walks through how claims actually get paid. Understanding these mechanics before entering a position helps set realistic expectations.

Why DeFi Needs Insurance in 2026

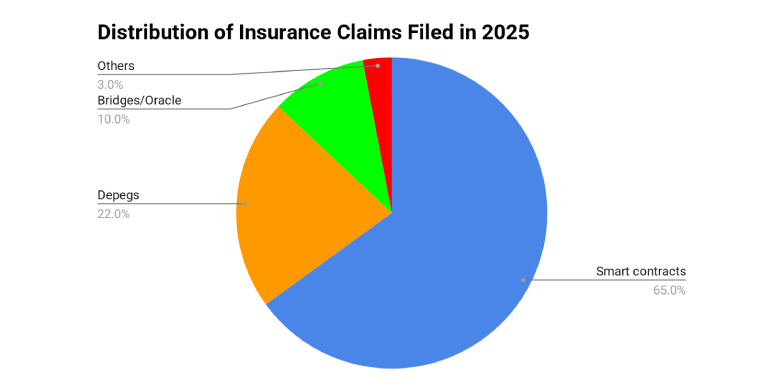

Data from Coinlaw shows that smart contract failures accounted for about 65% of insurance-related claims. These losses are often traced back to logic errors, upgrade issues, or incomplete audits. Multiple high-profile hacks usually follow routine updates rather than new deployments.

Stablecoin depegs account for roughly 22% of claims. Liquidity providers face sudden losses when pegs fail across cross-chain pools. InsurAce reported that depeg-related payouts made were about 35% year over year.

Bridge and oracle failures made up close to 10% of claims. Cross-chain systems continued to attract attackers due to their complexity. Governance-voted protocols such as Nexus Mutual resolved most bridge-related claims after extended review, with approval rates exceeding 90% in documented cases.

Governance attacks formed a smaller share, within 3% of all claims, but reports show this category growing by about 15% annually, a gap that parametric covers are starting to fill. As voting power concentrates, governance outcomes increasingly affect protocol safety. Comparing protocols helps align coverage with actual exposure.

How DeFi Insurance Works (Models Explained)

Discretionary cover relies on governance voting. Nexus Mutual follows this structure. Token holders stake capital, review claim evidence, and vote on outcomes. This approach supports wide coverage, including ambiguous events, but payout timelines usually take several weeks.

The next model is Parametric cover, which removes subjective assessment. Protocols such as Unslashed and Neptune Mutual define specific on-chain conditions. When oracles confirm those conditions, smart contracts release payouts automatically. Coverage is typically limited to only clearly definable events that oracles can verify.

Hybrid and pool-based models combine voting, automation, and layered capital. InsurAce and Etherisc use tiered pools to spread risk. Some events trigger instant payouts, while others require some review.

TVL vs Coverage Capacity

TVL shows locked capital, not what you’ll actually get paid when filing a claim. Coverage depends on underwriting limits and reinsurance deals. A protocol with $200M TVL might offer $500M+ in coverage through leverage, so don’t confuse these two numbers when evaluating protection.

Top 5 DeFi Insurance Protocols Compared

Unslashed leads with $700M+ in coverage capacity, running a two-sided liquidity model where capital providers earn yield on the risks they underwrite. Nexus Mutual holds $425M TVL on Ethereum (76% share) with the strongest brand recognition among institutional users, and their recent Symbiotic integration adds reinsurance expected to boost capacity by 40%.

| Protocol | TVL/Coverage (Dec 2025) | Supported Chains | Avg Claim Payout | Premium Cost (Annual) | Key 2025 Update |

| Nexus Mutual | $425M | Ethereum, Polygon | 7-90 days (vote) | 2-5% | Symbiotic reinsurance |

| Unslashed Finance | $700M+ | Ethereum | Instant (parametric) | 1.5-3% | Tokenized liquidity pools |

| InsurAce | $150M | ETH, BNB Chain, Arbitrum | 2-4 days | 1-4% | Depeg coverage expansion |

| Etherisc | $80M | 10+ chains | 1-7 days (custom) | 2-6% (custom) | DAO policies |

| Relm | $200M | Crypto assets | 5-10 days | 3-7% | Hybrid CeFi/DeFi |

Nexus Mutual has paid out $18M+ in claims since 2019, giving them the biggest payout record in DeFi insurance. They keep conservative ratios between coverage and capital, usually staying under 3:1 to reduce insolvency risk, even though it has scaling limits.

InsurAce runs $150M TVL across Ethereum, BNB Chain, and Arbitrum, with their depeg-focused pools growing premium volume 35% year-over-year. That growth makes sense when you consider how many stablecoin peg failures happened in 2025, finally convincing people to protect against risks they used to ignore.

Etherisc handles $80M TVL with custom policies designed for DAOs and unusual protocol risks that don’t fit standard templates. They’ve facilitated over $13M in decentralized flight delay insurance globally, proving parametric insurance works beyond just DeFi exploits.

Relm operates with $200M TVL using a hybrid CeFi/DeFi model that bridges traditional and decentralized insurance. Their 3-7% premiums and 5-10 day payout window positions them between pure parametric speed and discretionary thoroughness.

Read more: Polygon is shaping the future of DeFi

DeFi Insurance Market Trends

DeFi insurance TVL increased by about 58% year over year, reaching close to $1.7 billion across protocols. Parametric products grew 47% year-over-year as oracles became more reliable and institutions started demanding deterministic payouts. Still smaller than discretionary models overall, but the gap is closing as more protocols value instant payments over community voting processes that can drag on for months.

Protocols processed an estimated $250 million in claims cumulatively. About 28% reached approval, with over 80% of new product growth coming from instant-payout models.

Reinsurance is becoming standard infrastructure and gaining traction as a capital strategy. The Nexus-Symbiotic partnership now backs over $100 million in capital pools, introducing composable underwriting where restakers earn staking yields while simultaneously underwriting DeFi risks.

Capital allocation also shifted toward emerging chains. Around 58% of underwriting targeted ecosystems such as Solana, where application growth outpaced Ethereum during parts of the year.

Which DeFi Insurance Protocol Is Best for You?

What you’re actually doing in DeFi determines which protocol makes sense for your risk profile.

Farming on Ethereum makes Nexus Mutual your default choice. You get broad smart contract coverage with premiums running 2-5% annually, backed by the most experienced claims assessors in the space and $18 million in historical payouts proving they actually honor claims.

Running multi-chain LP positions with stablecoin exposure points you toward InsurAce. Their 1-4% premiums cover Ethereum, BNB Chain, and Arbitrum, with expanded coverage for depegs.

For fast payouts, unslashed delivers instant parametric payouts for 1.5-3% premiums, though you give up some coverage scope since only oracle-verified events qualify.

Etherisc writes custom policies at 2-6% premiums for DAO treasuries, working with your team to structure coverage for unusual situations that standard products can’t handle.

Step-by-Step Guide: Buy & Claim DeFi Insurance

- Connect wallet (e.g., Nexus app): Open MetaMask and navigate to the Nexus Mutual dashboard. Click “Connect Wallet” and approve the connection request in your MetaMask popup to access the insurance platform.

- Select cover ($10K ETH, stake NXM/USDC premium): Browse available protocols and configure your coverage, let’s say $10,000 worth of ETH coverage on Aave. Review the premium calculation, then stake the required NXM or USDC tokens to activate your policy. Confirm the transaction in MetaMask.

- Oracles trigger on exploit. Submit claim/vote: When oracles detect a covered exploit, navigate to “My Covers” and click “File Claim.” Provide transaction evidence from Etherscan showing your exposure during the incident.

- Payout via governance (track Etherscan): Once the governance vote approves your claim, the payout processes automatically to your wallet. Track the transaction status on Etherscan using your wallet address.

Pro Tip: Start with a $100 test cover to practice the full buy-and-claim process before purchasing larger coverage amounts.

What DeFi Insurance Does NOT Cover

Rug pulls and admin abuse aren’t covered because the moral hazard breaks the entire system. If teams could profit from insurance payouts by rigging their own protocol, nobody would underwrite anything, and the market would collapse.

User errors and phishing are entirely out of coverage as well. If you fell for a phishing site or sent funds to the wrong address, no DeFi insurance protocol will bail you out.

Market volatility isn’t a covered event since price movements are part of the standard market risk. Some parametric products might cover specific price crash scenarios, but most exclude normal market movements entirely.

Governance manipulation losses are nearly impossible to prove and don’t count as exploits. Governance outcomes are governance outcomes, even when you disagree with them.

DeFi Insurance Market Outlook (2026)

DeFi insurance is moving toward simpler payouts and tighter risk controls in 2026. Parametric insurance keeps gaining ground as oracle systems improve and on-chain data becomes easier to verify.

Reinsurance also becomes more common across leading protocols. By layering restaked capital and secondary pools behind primary insurance funds, providers increase coverage capacity without keeping large amounts of capital idle.

Regulatory clarity is advancing through frameworks such as the EU’s MiCA, offering clearer rules around disclosures and risk classification, which may make DeFi insurance easier for funds and DAOs to use. At the same time, AI-powered oracle tools refine risk scoring and help insurers validate claims with greater accuracy.

FAQs

What is DeFi insurance and how does it work?

DeFi insurance provides on-chain coverage for specific situations like Smart contract exploits, stablecoin depegging, and bridge failures. Policies run on smart contracts, get funded from pooled capital, and are governed by DAOs or automated triggers depending on the model.

What are the top risks covered by DeFi insurance in 2025?

Risks involving Smart contracts made up about 65% of total claims in 2025, followed by stablecoin depeg at 22%, bridge and oracle failures at 10%, and governance-related events, among others, at 3%.

Which DeFi insurance protocol has the highest TVL in December 2025?

Unslashed Finance led by coverage capacity at over $700 million. Nexus Mutual reported $197.88M in actual TVL on Ethereum, making them the leader by traditional metrics.

Is DeFi insurance safe and worth the cost?

It’s safer than not having insurance, but it’s not risk-free. Insurance protocols themselves fail through oracle manipulation or insolvency if claims exceed the reserves. It’s worth the cost when your exposure is large, and the protocol has a history of actually paying out.