Key Highlights:

- $BSOL gains strong momentum within the first three days of trading.

- The investor base includes asset managers, institutional firms, and individual buyers.

- Fidelity Digital Assets, Canary Capital, and VanEck are also following the same path as Bitwise.

The Bitwise Solana Staking ETF ($BSOL) is quickly gaining momentum as it enters its third day of trading, becoming the largest ETF dedicated to Solana. Since the launch, $BSOL has attracted investors from big institutions, financial advisors, and everyday investors, as highlighted by Hunter Horsley, CEO of Bitwise, today on the social media platform X (formerly known as Twitter). The ETF offers an easier and a regulated way for people to invest in the Solana ecosystem, without holding or needing to buy the Solana tokens directly.

Strong Market Debut and Trading Activity

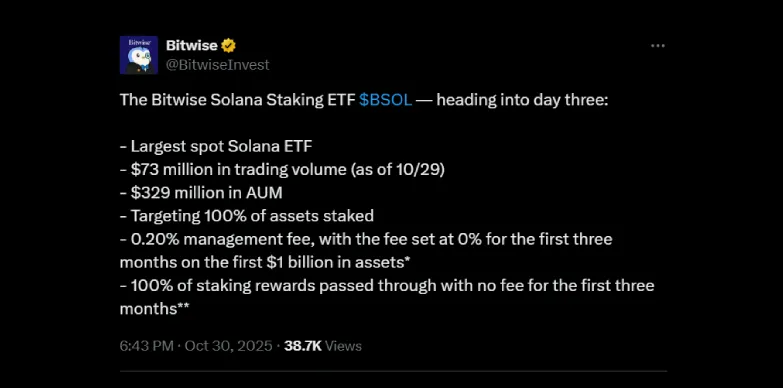

As of October 29, 2025, $BSOL has generated a strong $73 million in daily trading volume. This number indicates that there is a high investor activity and strong liquidity for the newly launched ETF. It also indicates that the market is actively buying and selling the fund, and that the interest in Solana continues to grow as a major blockchain for smart contracts and decentralized apps.

In addition to this volume, $BSOL’s assets under management (AUM) have also quickly climbed to around $329 million. This sharp increase also shows that the investors are confident in Solana’s long-term growth and value. Because the fund also includes staking rewards, it lets investors earn extra returns while gaining direct exposure to Solana.

Unique Positioning: Staking and Fee Incentives

One of the highlighting features of $BSOL is its target of staking 100% of its assets. By doing so, the ETF effectively participates in Solana’s network security and consensus mechanism, while generating staking rewards for its investors. This model is in line with investor interest in the network’s health and performance, offering a compelling value proposition compared to traditional spot ETFs.

The fund is also offering a competitive management fee of 0.20%, which is waived at 0% for the first three months on the initial $1 billion of assets under management. The fee waiver indicates that the company (Bitwise) is committed to attracting sizable investments and providing early-stage incentives.

Moreover, Bitwise is also promising to pass through 100% of staking rewards to investors without deducting any fees during this introductory three-month period. This move will further enhance the net yield for shareholders.

Significant Inflows Confirmed by Hunter Horsley

Hunter Horsley, CEO of Bitwise, shared new data which indicated that $BSOL has received about $46 million in inflows in just one day, and because of these large inflows, the ETF has bought a large amount of SOL tokens. The total assets under management are now holding almost $330 million.

He also highlighted that the people who are investing in this ETF are not bound to just one group; instead, the investors are seen to be from different categories. The investors include wealth managers, large institutional investors, and individual buyers.

Fidelity and Other Follow Bitwise with Updated Solana ETF Filings

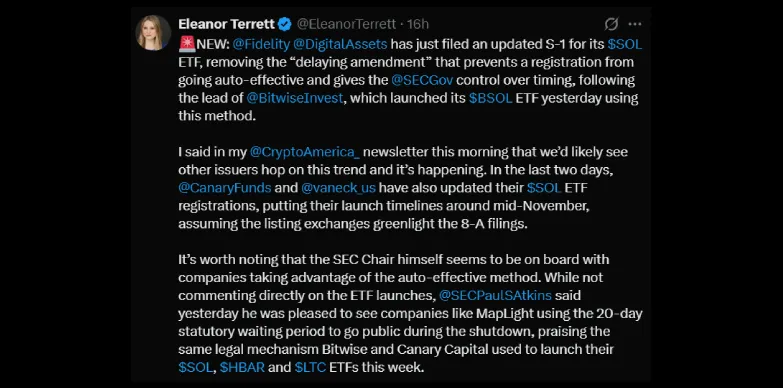

According to Eleanor Terrett, a well-known journalist in the crypto space, Fidelity Digital Assets has also filed an amended SEC S-1 registration for its upcoming Solana ETF. With this filing, the asset manager removes the delay clause, and the registration automatically becomes effective 20 calendar days after filing, unless the SEC intervenes within that period. This process is known as the “auto-effective” filing. This same strategy was used by Bitwise to launch its $BSOL ETF.

Other firms like Canary Funds and VanEck have also updated their Solana ETF filings and are currently aiming for mid-November launches, pending exchange approval.

Also Read: Solana’s Kamino Hits $15M BTC Deposits; Here’s All