In a move that highlights the growing institutional interest in Ethereum despite the bearish market trend, Tom Lee’s Bitmine has made a massive investment in ETH. BitMine Immersion, the largest public holder of Ethereum, has once again made headlines with a whopping purchase of 44,036 ETH, valued at approximately $168 million. This strategic move underscores the company’s unwavering commitment to its ETH treasury strategy, even as the market grapples with volatility and uncertainty.

The timing of this purchase is particularly noteworthy as it comes amid the ongoing ETH price downturn and the increasing selloff among treasury companies. Yet, Bitmine’s bold move suggests that the company view the dip as a buying opportunity, rather than a cause for concern. This buy-the-dip strategy is a testament to the company’s conviction in Ethereum’s ability to rebound and thrive in the long run.

Bitmine Acquires $168M in ETH

In a recent X post, analyst Ash Crypto shed light on the recent development within the Ethereum ecosystem. Bitmine, the largest ETH treasury company, has further bolstered its Ether holdings with the latest purchase of 44,036 ETH, worth $168 million. With this buy, Bimine’s total holdings have reached 3,236,014 ETH, worth $12.4 billion.

This acquisition comes on the heels of Bitmine’s recent purchase of 27,316 ETH worth $113 million. Notably, the company sets its sights on amassing 5% of Ethereum’s total supply, signalling strong confidence in the long-term potential. To hit this aim, the company has been actively accumulating ETH even amid market crashes.

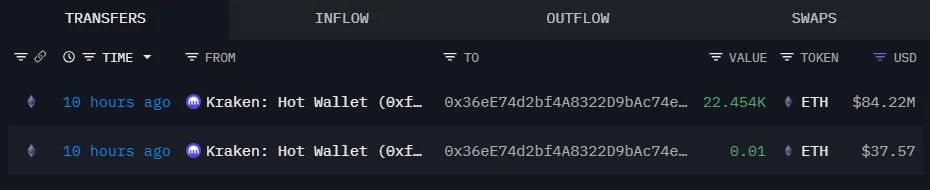

Significantly, Bitmine has a strong backing from prominent investors like Cathie Wood’s Ark Invest, Bill Miller III, Digital Currency Group, Founders Fund, Galaxy Digital, Kraken, and Pantera Capital. Tom Lee has expressed optimism about Ethereum’s prospects, highlighting its “neutral chain” status as a potential catalyst for institutional adoption and regulatory approval.

ETH Price Continues to Fall

Following the 1011 crypto market crash that accompanied a huge wave of liquidations, the Ether price has been struggling to maintain its positive momentum. After climbing to a new all-time high of $4,700 in early October, ETH declined to below $4k in response to the October 11 debacle.

Despite minor fluctuations, the cryptocurrency has traded in the red zone since then. As of press time, the altcoin is trading at $3,867, marking notable dips of 0.21% in a day, 2.27% in a week, and 10% in a month. The trading volume is also down by about 5%, reaching $38.8 billion over the past 24 hours. This highlights the plummeting confidence of traders and investors in the second-largest cryptocurrency by market cap.

Ethereum Treasury Companies Under Pressure

Interestingly, Bitmine’s latest Ether purchase comes in contrast to the growing ETH selloff among Ethereum treasury companies. Recently, analyst Ted took to X to highlight ETH companies’ sell-off trend, which appears to be a “massive red signal.”

Currently, especially due to the escalating negative trend in the market, Ethereum treasury companies are facing selling pressure, with some increasingly offloading their holdings.

For instance, ETHZilla, an Ethereum-focused treasury company, has sold about $40 million in Ether to fund share repurchases. The company aims to close the discount between its share price and net asset value (NAV). Since October 24, ETHZilla has repurchased 600,000 shares worth $12 billion, with plans to continue under its $250 million authorisation. In addition, the Ethereum Foundation recently announced plans to sell 1,000 ETH, valued at around $4.5 million, when the altcoin surged past $4,500.

In conclusion, Bitmine’s continuous Ether accumulation despite the market dip and growing selling pressure underscores the company’s commitment to its treasury strategy and the confidence in the altcoin’s potential. The move could also serve as a strong catalyst for the token’s possible bullish future.