April 15th, 2025— The crypto market witnessed low volatility trading with intact overhead selling evidenced by BTC’s high wick rejection candle. While the panic surrounding Donald Trump’s reciprocal tariff has subsided, several countries have yet to attain a fair trade with the United States, reinforcing the broader correction trend in the market. However, the Bitcoin price action reveals an opportunity for a major breakout as a crypto whale shows renewed accumulation.

Whale Activity Indicates Growing Confidence in BTC’s Future

Following Donald Trump’s 90-day suspension of reciprocal tariffs, the Bitcoin price witnessed a relief rally above $80,000, and market sentiment rebounded from extreme fear. The renewed recovery is gradually gaining momentum as on-chain data show a growing sentiment of BTC accumulation in the market.

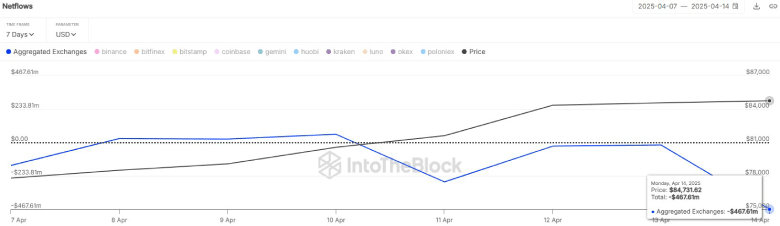

According to data from IntoTheBlock, over $467 million worth of BTC was withdrawn from exchanges just yesterday. This move indicates that large investors are shifting their holdings away from centralized platforms, which could be a precursor to upward price pressure.

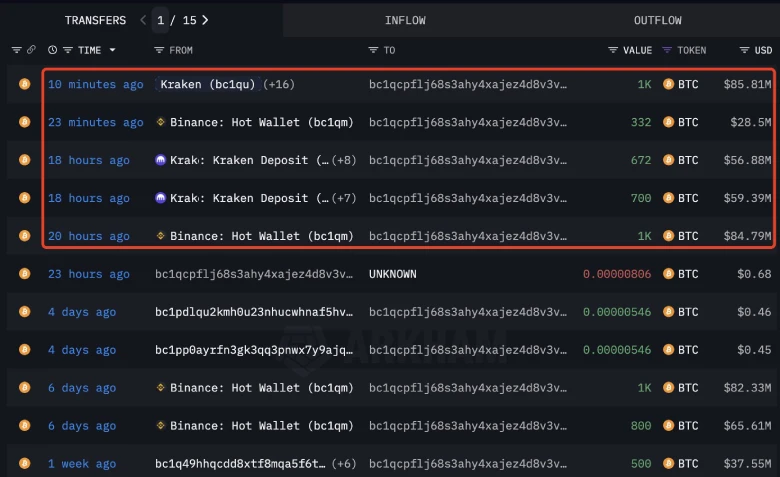

Simultaneously, Lookonchain tracked a massive withdrawal of 3,704 BTC, valued at approximately $315 million, from major exchanges Kraken and Binance. Such large volume buying indicates firm confidence by deep-pocketed investors in BTC’s future growth potential.

Bitcoin Price Stands at Make-or-Break Road

Since last week, the Bitcoin price has bounced from $74,568 to $84,584, registering a 13.4% growth. This upswing currently challenges the resistance trendline of a falling wedge pattern, which has been carrying BTC’s correction trend since early December 2024.

With today’s long-wick rejection candle at the resistance trendline, the coin price faces risk for another reversal. If history repeats, the sellers could drive a nearly 20% fall to retest the lower support trendline at $67,127.

On the contrary, if the broader market recovers from tariff-driven selling pressure, the Bitcoin price breaches the overhead resistance as a signal to end the 120-day downtrend. With sustained buying, the post-breakout rally could push the asset 18% to reclaim the $100,000 psychological level, followed by a leap to a new high.

Also Read: Ethena Shuts Down German Unit After Regulatory Blow