On meltdown Monday, the crypto market witnessed a massive surge in volatility evidenced by the long-wick rejection in Bitcoin. The market uncertainty can be attributed to the global market downturn and ongoing tariff war. However, the latest on-chain data shows a chunk of the BTC circulating supply has turned into losses, signaling a potential pivot zone for this asset.

Highlights:

- The Bitcoin price is less than 5% away from exiting the current downtrend with a channel pattern breakout.

- On Monday, April 7th, the Bitcoin Fear and Greed Index plunged to 23%, signaling extreme fear among market investors.

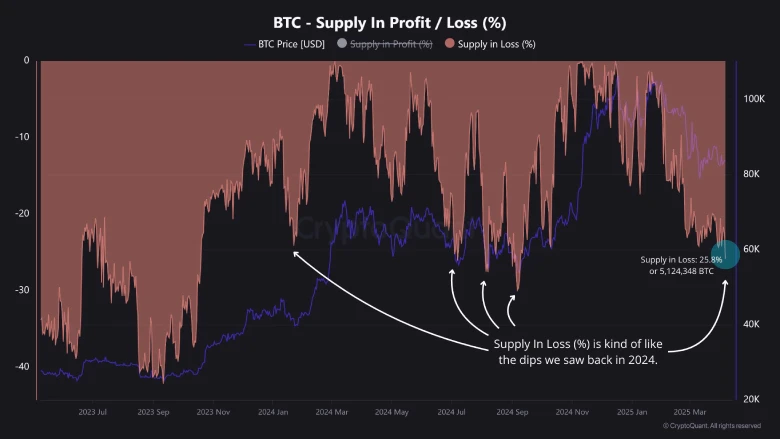

- On-chain data shows 5.12M BTC (25.8%) is now in unrealized loss, similar to drawdowns seen in 2024.

On-Chain Data Reveals Over 5.1M BTC in Loss—Echoes of 2024

On April 7th, the Bitcoin price experienced a significant intraday sell-off, which plunged the asset to a 5-month low of $74,345. The bearish momentum escalated as nations like China and the European Commission imposed retaliatory tariffs on a range of U.S. goods.

Amid this downturn, approximately 5,124,348 BTC, or 25.8% of the circulating supply, has entered a state of unrealized loss, According to CryptoQuant analysis, the BTC investor witnessed a similar instance in 2024, while a significant portion of the supply was underwater.

On January 22, around 24.1% of the supply—or 4.72 million BTC—was in the red. July 6 saw 22.4% (5.13M BTC), followed by a sharper rise on August 5 with 27.5% (5.43M BTC), and September 6 marked the peak, with 29.9% (5.90M BTC) of the supply in the loss.

Interestingly, these low levels have coincided with a market cooldown and accumulation phase rather than a bearish downturn. If history repeats, the Bitcoin price could seek support near the ongoing trading value before a bullish turnaround.

Bitcoin Price Eyes $100,000 Amid Channel Pattern Formation

Despite the intraday sell-off, the Bitcoin price showed notable resilience and bounced back to $79,800. The renewed buying pressure followed a slight relief rally in market sentiment as around 70 countries have reached out to President Trump to negotiate new trade deals.

If the bullish reversal gains momentum, the BTC price could gain 4.6% to challenge the resistance trendline falling wedge pattern. Since January 2025, the pattern’s two downtrend lines have guided the price with dynamic resistance as support, creating a crucial pivot floor for investors.

Thus, a potential breakout will signal a change in market dynamics and an accelerated market buying pressure for $100,000.

On the contrary, if sellers continue to defend the overhead trendline, the coin price will prolong the current downtrend.

Also Read: Strategy Didn’t Buy Any Bitcoin in the First Week of April Despite BTC Falling to $74,000