- The Bitcoin price struggling to extend correction below the $90,000 mark indicates potential bear trap pattern that could renew recovery momentum.

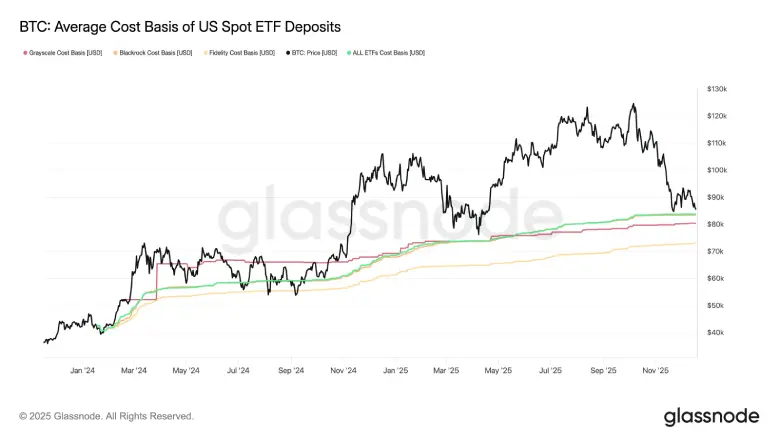

- The BTC price witnessed renewed buying pressure at the average cost basis of US spot ETF around $84,000 mark.

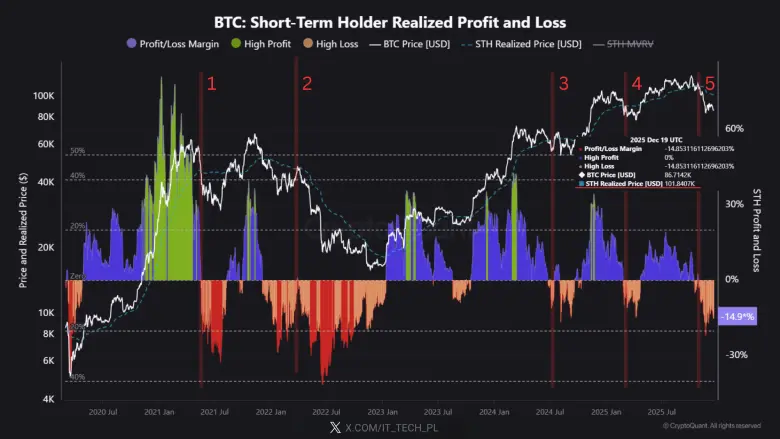

- On-chain shows that short-term Bitcoin holders are facing average unrealized losses of about 14.9%.

The pioneer cryptocurrency Bitcoin jumps 3.2% during Friday’s U.S. market hours to trade at $88,192. The buying pressure marks as an initial market optimism amid accommodative BOJ signals, while reports highlight concern of reduced liquidity for risky assets like cryptocurrency. However, a deeper analyst on ETF data shows Bitcoin price rebounded from the average cost basis of US spot exchange traded funds, signaling a potential bottom signal.

BTC Vulnerable as Short-Term Holders Near Capitulation Zone

Over the past two months, the Bitcoin price has witnessed a massive correction from $126,272 to $87,291, registering a 30% loss. In the last two months, the value of Bitcoin has experienced a severe crash, from a peak of $126,272 down to $87,291. This shift is a 30 percent reduction overall. During this time, the cryptocurrency has converged back near the average purchase price held by investors in U.S. spot exchange-traded funds.

Insights from market analyst ChrisBeamish_ show that a sizable amount of these ETF participants are now around the same level as they started with, basically offsetting gains and losses. This particular price area has significant implications as it may attract new buying interest to stabilize things, but also may cause more selling if people begin rethinking their exposure to volatility.

Further information is provided by analyst IT_tech, who notes that people holding Bitcoin for shorter periods are experiencing unrealized losses of 14.9 percent on average. With a current trading level around $86,700 this compares to an entry point of around $101,800 for those groups.

Such conditions create one difficult slice of the market: these shorter-term owners have bought in at high prices and are in the negative. Any rises close to $101,000 could see sales from those wanting to get out without losing any more money. Should the downturn run to 20 percent or 30 percent deficits, it could be a trigger to massive urgent disposals.

Past patterns have shown areas such as this often mark the beginning of rash exits or the setting of a support level. Dropping down under $85,000 tends to compound the difficulties involved.

Bear Traps Set Bitcoin Price For Bullish Rebound

On Monday, December 15th, the Bitcoin price gave a bearish breakdown from the support trendline of a traditional bearish continuation pattern called inverted flag. The chart setup is characterized by a prevailing downtrend displayed by the descending trendline, followed by a temporary upswing to recuperate the selling momentum.

The momentum indicator RSI down to 35% further accentuated the bearish market sentiments and potential for an extended correction. However, the coin price shifted sideways after the breakdown, signaling a lack of follow-up from the sellers.

This consolidation offers buyers an opportunity to counter-attack and re-gain control over the asset’s price movement. If the coin price manages to reclaim the beached flag support at $90,000, the coin price could restore bullish momentum for higher recovery.

On the contrary, if the Bitcoin price continues to face overhead supply at $90,000, the coin price could pledge another 8.5% to seek support at $80,700.