Bitcoin price surged 2.21% on May 6, creating a bullish engulfing candle. This marked a significant recovery, undermining the pullback over the weekend, reinstating a bullish trend for the week.

The crypto market bounceback comes with China agreeing to negotiate trade deals with the US in Switzerland this weekend. This marks a key pivot in the ongoing tariff wars and leads to a spike in hopeful sentiments in the global and crypto markets.

Bitcoin is now trading at $96,875, creating a 24-hour high at $97,717. As bulls grow stronger, Bitcoin prepares for a massive rally towards the $100,000 mark.

Bitcoin Price Eyes $100k

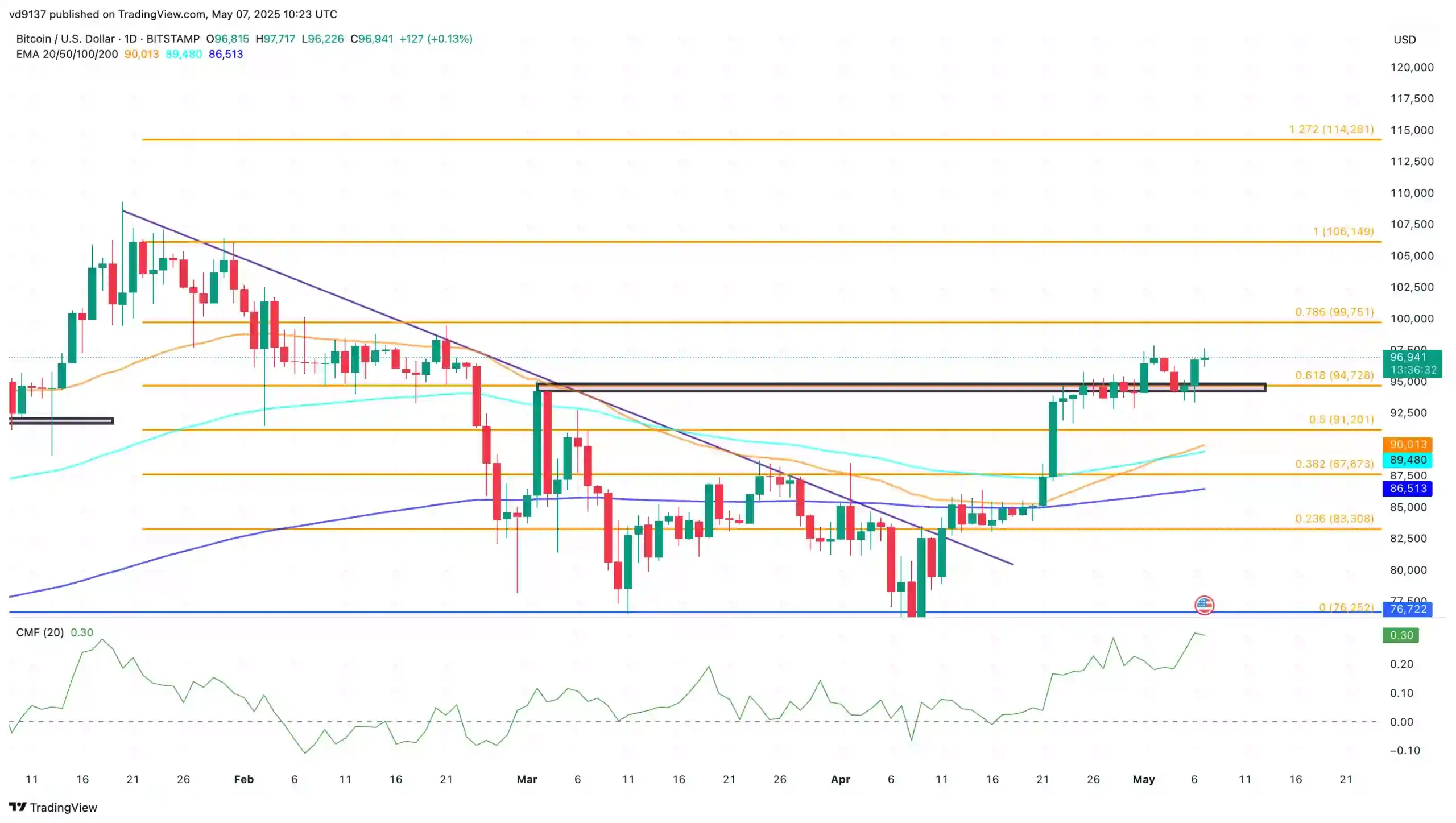

Bitcoin price trend showcases a bullish breakout of a long-standing resistance trend line. This has resulted in a high-momentum rally crossing the 61.80% Fibonacci level near the $95,000 levels.

As a retest, Bitcoin creates a Morning Star pattern near the supply-turned-demand zone near $95,000. The recently formed bullish engulfing candle completes a V-shaped reversal and hints at an exchange recovery towards the next resistance.

Based on the Fibonacci levels, the next key resistance lies at the 78.60% level near the $100,000 mark. With the cemented bullish dominance near the $95,000 level, the recovery rally in Bitcoin is likely to reclaim the psychological level. This marks an upside potential of nearly 3%.

Supporting the bullish, the technical indicators support the chances of an extended bull run. The 50 and 100 EMA lines have given a positive crossover. Furthermore, the Chaikin Money Flow Index has reached the value of 0.30. This marks the previous peak at 0.29, formed during early 2025.

As the sentiments turn bullish, Bitcoin is likely to reach the previous swing high close to $106,000.

FOMC Threat Looms Over Crypto Market

Despite the short-term sentimental spike in the crypto market with the US-China trade deal discussions, the looming FOMC meeting brings back the pessimism. As per the FedWatch tool, the Federal Open Market Committee meeting in just a few hours is likely to keep the rates stagnant at 425 to 450 basis points.

This will result in a short-term volatility spike, possibly leading to minor corrections before the prevailing trend continues.

On-Chain Data Supports Bitcoin’s Chances of Topping $100k

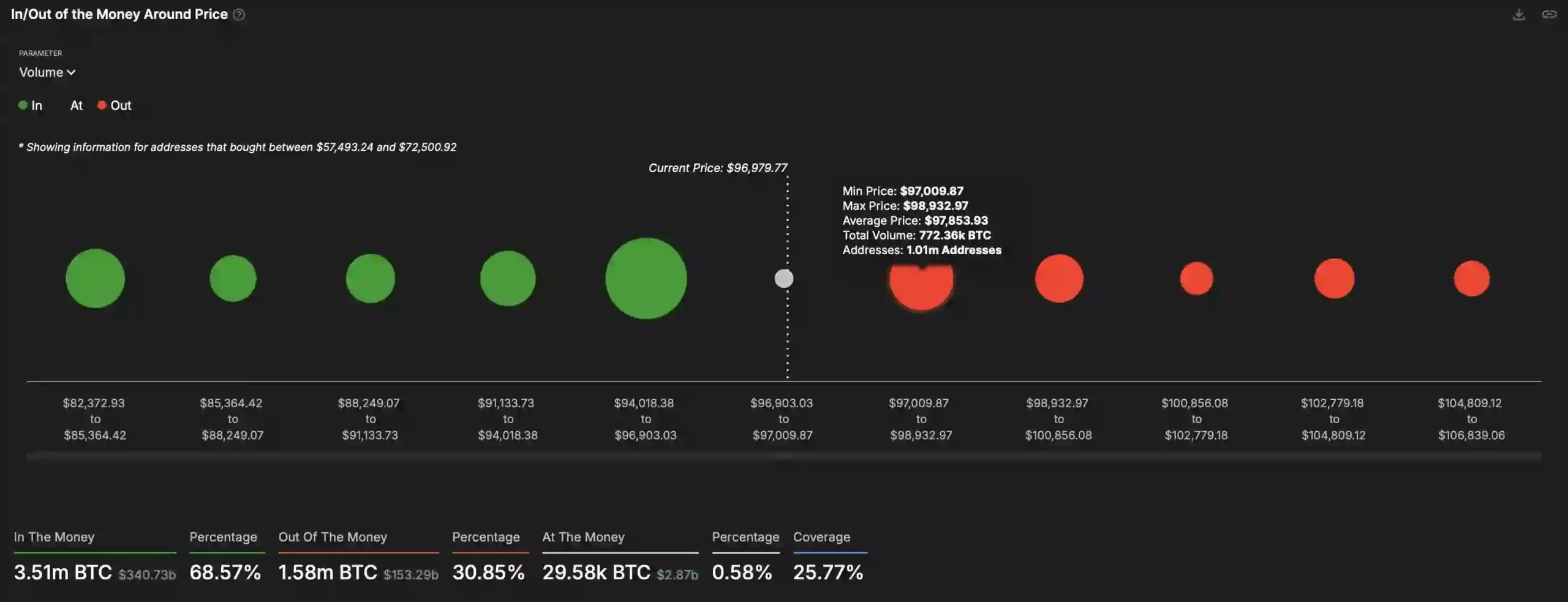

As per the In/Out of the Money Around Price (IOMAP) indicator by IntoTheBlock, Bitcoin is heading towards a critical resistance. More than a million investors have purchased Bitcoin between $97,000 to $98,932, with an average price of $97,853. This zone holds a supply of 772.36k BTC, projecting a massive overhead supply.

However, the nearest in-the-money zone extending between $94,018 and $96,903 holds 1.5 million BTC and 2.47 million addresses. As the immediate in-the-money zone appears significantly stronger, the bull run is likely to continue.

If the Bitcoin price manages to surpass this resistance, the next supply zone extends till the $100,000 mark. This supports the possibility of Bitcoin reclaiming the psychological level.