In the second week of June, the Bitcoin price experienced a bullish turnaround, regaining its position above $108,000. The buying pressure can be attributed to the initiation of trade talks between the United States and China, which has eased geopolitical tension, and continued BTC accumulation from whales and institutions. Amid the recent upswing, the coin price invalidated a bearish pattern, which many crypto analysts had highlighted as a signal for the downtrend to continue.

Corporate Bitcoin Accumulation Heats Up

Over the last four days, the Bitcoin price has bounced from $101,588 to $108,850, registering a 7.18% gain. While the upswing initiated as a relief rally for the recent correction, the sudden 2.6% intraday gain led to a shift in market sentiment.

The buying pressure can be attributed to the initiated trade talks between the United States and China in London. The bullish momentum further accelerated as Bitcoin witnessed an active accumulation trend from institutions and whales.

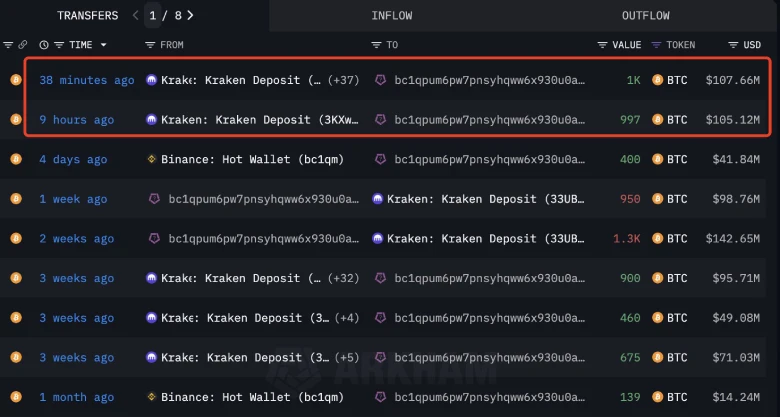

According to blockchain tracker Lookonchain, a whale identified as bc1qpu withdrew 1,997 BTC (worth approximately $212.78M) from the Kraken exchange in the past 10 hours.

In addition, the Bitcoin mining and hosting company, BitMine Immersion Technologies, has recently announced its first plain buy of 100 Bitcoins as part of its new treasury. The purchase was funded from the company’s offering of equity shares.

“We are excited to make our first plain market purchase of Bitcoin and expect to make more Bitcoin purchases moving forward,” said Jonathan Bates, CEO of BitMine.

Furthermore, the KULR technology group has intensified its Bitcoin accumulation by acquiring 118.6 Bitcoin for approximately $13 million.

Meanwhile, MicroStrategy further continues to cement its position as the largest corporate Bitcoin holder with another purchase of 1,045 BTC last week, worth approximately $110.2 M. The acquisition was recorded at an average price of $105,426.

This accumulation trend strengthens BTC’s sustainability above $100,000 and bolsters price recovery.

BTC’s Bearish Thesis Got Invalidated

Following the correction in the bitcoin price over the last two weeks, several crypto analysts highlighted the formation of a bearish head and shoulders pattern. This chart setup is commonly spotted at major market tops and typically delivers a prolonged correction trendline.

However, with today’s price jump, the BTC price breaks a key resistance of $106,500, signaling the invalidation of the aforementioned bearish thesis. If the daily candle closes above $106,500, the buyers could gain sufficient support to rechallenge the all-time high resistance of $112,000.

This bullish reversal in BTC recorded from the 50-day exponential moving average suggests that the previous pullback has benefited buyers in regaining bullish momentum.

On the contrary, if the coin price faces an overhead supply of $112,000, the sellers may push for another reversal.

Also Read: Trump’s Truth Social Files S-1 for Bitcoin ETF; Will BTC Surge Again?