Bitcoin price shows a short uptick of 0.83% on Friday as BTC’s weekly expiry resets. The pullback came after an aggressive downfall this week amid U.S. macroeconomic uncertainty and cascading liquidation. While this short relief rally has bolstered altcoins to seek suitable support, if the BTC sellers recapture the bearish momentum in this pullback, the price correction could extend to lower levels.

- The Bitcoin price broke decisively below the support trendline of a five-month channel pattern.

- Total BTC options OI dropped from ~515K BTC to ~355K BTC after contracts rolled off.

- Puts carry higher premiums than calls across maturities, with short-dated contracts showing the strongest tilt.

Bitcoin Options Reset After Massive Deribit Expiry

The Bitcoin options market underwent a sharp reset this week, with tens of billions of contracts expiring on Deribit, the largest cryptocurrency derivatives platform. The expiry moved the settlement to approximately 109,000, just short of the 110,000 mark, where the maximum loss was concentrated. The massive positions have been cleared, and traders have a clear area where new bets can be placed.

Open interest in Bitcoin options decreased drastically, dropping by approximately 515,000 BTC to 355,000 BTC following the roll-off. The decline is one of the sharpest resets in recent months. Market participants will reposition swiftly, which will assist in displaying how sentiment is restructured and whether appetite is biased towards protection or new risk-taking.

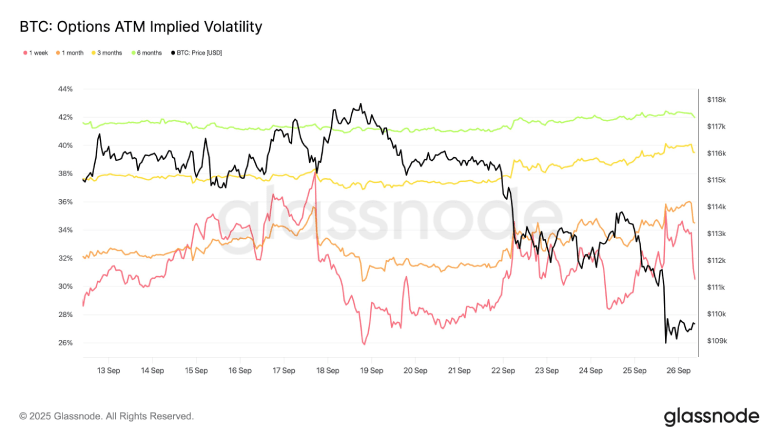

The recent price movements have shaken implied volatility on near-dated contracts, although premiums further out on the curve have remained unchanged. That means that despite the short-term turbulence subsiding, longer-run insurance and optionality are needed, and later expiries would be higher.

Skew readings support the defensive tone through the maturities. Puts are currently priced higher compared to calls, particularly at the front part of the curve. Downside cover is most preferred in contracts that have a maturity in the next few weeks, and maturities that are much further out appear more moderate.

The positioning indicates that the hedging flows are the activity of primary interest, and the calls are cheaply priced in comparison to the same puts. Meanwhile, 2026 expiries activity indicates that traders are not giving up the concept of major directional action in the future, although instant attention remains on the protection of risks.

The reset will make the derivatives structure of Bitcoin cleaner, and the next stage will depend on the ability of open interest to restructure and new demand to appear.

Bitcoin Price Gives Major Breakdown From Channel Support

Over the past week, the Bitcoin price has witnessed a sharp correction from $117,968 to the current trading price of $109,021, projecting a 7.58% loss. Just yesterday, this downswing gave a decisive breakdown from the support trendline of a rising channel pattern on the daily chart.

Since late April 2025, the Bitcoin price has been resonating within the pattern’s dynamic support and resistance trendlines to drive a sustainable uptrend. However, the recent breakdown signals a change in this momentum.

With today’s price jump, the BTC price tried to retest the breached trendline at an intraday high of $110,372. That said, the price reversed immediately and formed a long-wick rejection candle, indicating intact overhead supply.

With sustained selling, the coin price could reach the nearby support of $107,000 and charge towards the next significant support of $98,240.

However, the bearish thesis would be invalidated if the coin price rebounds and re-enters the channel range.