- The current correction trend in Bitcoin price could extend another 4.5% before retesting the key support area of $60,000, followed by a deeper dive to $56,000.

- The current MVRV Adaptive Z-Score stands at -2.66, indicating that BTC is trading in a deep correction phase.

- Crypto fear and greed index dropped 5% today, surpassing the panic seen during the Terra/Luna collapse and COVID-19 crash.

The Bitcoin price is slowing yet steady heading to last week’s low of $60,000. Currently trading at $65,881, the coin price is down another 1.5% amid sharp decline in U.S. stocks. While the bearish momentum has slowed down, the direction remains persistent, pushing BTC into a deep capitulation zone. The on-chain data further suggest that the price is heading into a historical accumulation phase, signaling an opportunity for recovery in the near future.

BTC’s MVRV Z-Score Screams Capitulation

The first two weeks of February have been a roller coaster ride for the crypto market. Bitcoin, the pioneer cryptocurrency attempted a quick rebound from $60,000 to $71,000 last Friday, but struggled to sustain its ground and reverted to $65,881.

As the broader market weakness persists, the BTC price is again under pressure and gradually heading for $60,000 breakdown.

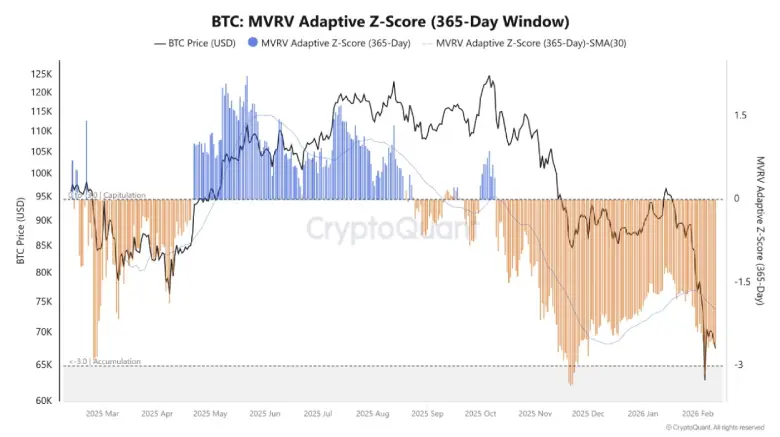

To navigate these volatile markets, On-chain analysis provided by CryptoQuant is concentrated on the MVRV Adaptive Z-Score with a 365-day window. This measure, which compensates for the volatility of each year and measures the difference between the market value and the actual value, currently registers at -2.66.

The reading places Bitcoin in the capitulation range, which historically is considered to be between 0.0 and -3.0 where corrections are more intense and test lower support levels. Values below -3.0 are usually accumulation zones where the sellers are exhausted.

The chart also incorporates a 30-day simple moving average of the Z-Score, which trends above the daily readings, suggesting persistent short-term selling dominance, despite intermittent relief rallies. The adaptive approach is focused on filtering out the noise of the structural shifts in the market cycle.

Analysts watch this indicator closely as the four-month decline plays out with the Z-Score nearing levels that have preceded historical bottoms in previous cycles. Market participants consider these signals along with conflicting forecasts from institutions and traders anticipating additional downside potential.

Bitcoin Price May Extend its Consolidation if this Support Holds

Over the past week, the Bitcoin price has traded within the range of $73,135 to $60,000, marked by the February 5th daily candle. With this consolidation, the coin price has recently reversed from the upper boundary to currently trade at $65,340.

However, the below average trading volume backing this price action indicates a weak conviction from sellers. The momentum indicator ADX reached a high of 54% also hints the sellers could soon hit exhaustion in the current correction trend.

If the selling pressure persists, the Bitcoin price is poised for another 4.5% drop and retest the $60,000. This support could cushion BTC buyers for another reversal and extend the sideways action within the aforementioned range.

However, if the Bitcoin price breaks below the $60,000 floor with daily candle, the buyers could seek its next stable support at $56,000.

Also Read: Ethereum Whales Lose Control of 75% Supply—Is a Bigger Drop Coming?