The pioneer cryptocurrency Bitcoin fell 1.22% during Wednesday’s U.S. trading session to reach $108,941. Following a 5-day bullish run, this slight downtick suggests an opportunity for buyers to regain the bullish momentum. According to the latest on-chain data, Binance whales are also holding their assets amid the broad market recovery, indicating a potential for a higher trend. Is BTC price ready for a new high?

Binance Whales Signal Confidence for Bitcoin Rally

Over the last six days, the Bitcoin price showed a notable bounce from $100,402 to a high of $110,568, accounting for a 10.12% gain. Despite the intraday sell-off, the coin is inches away from challenging its $112,000 all-time high, raising market speculation on a potential breakout or reversal.

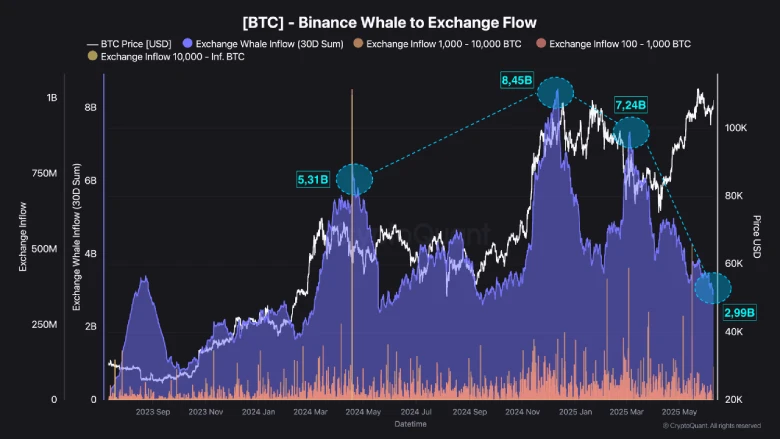

A recent analysis from CryptoQuant highlights that Binance whales offer a strong vote of confidence in Bitcoin for its potential to drive a higher rally. Historically, when the Bitcoin price teases a breakout from its all-time high (ATH) resistance, large holders often book their profits, which results in a significant spike in exchange inflow.

However, the current scenario deviates from the usual pattern, as the exchange inflow from Binance whales shows a notable decline. In the early 2024 bull run, the monthly inflow to Binance surged to $5.3 billion, followed by $8.45 billion and $7.24 billion—figures that precede a short-to-medium-term correction in the BTC price.

Currently, the monthly inflow hovers around $3 billion and rides a declining trend. This notable reduction implies that the large investors are choosing to HOLD (hold on for dear life) their assets in anticipation of a higher rally.

This behavior from whales has often triggered a broader market bullish sentiment and pushed the price with accelerated momentum.

Healthy Correction Sets BTC for New High

In the daily chart, the Bitcoin price showcased its bullish reversal from the 23.6% Fibonacci retracement level and the 50-day exponential moving average. Theoretically, a correction to these levels is often considered healthy for buyers to regain their exhausted bullish momentum.

The rising price backed by above-average trading volume further accentuates the buyers’ conviction for a higher level. With today’s 1.2% drop, the BTC could revert to a 20-day EMA slope at $106,500, displaying its sustainability at a higher price.

If the support holds, the coin buyers could breach the $112,000 resistance and turn it into a potential support level. According to the traditional pivot level, the BTC price could witness resistance of $113,174, followed by $121,844.

On the contrary, potential buyers must watch for signs of supply pressure at $112,000 to invalidate the thesis and potentially reverse the trend.

Also Read: Connecticut Goes Anti Crypto; Bans State Crypto Investments