- An ongoing relief rally in Bitcoin price faces immediate resistance at $71,000.

- A long-coming support trendline drives the major uptrend in BTC, offering dynamic support for buyers.

- Any potential upswing in price could face dynamic resistance from key exponential moving averages (20, 50, 100 ,and 2000)

Bitcoin’s rebound from last week’s flash crash witnessed an immediate selling pressure at $71,000. As a result, the coin price plunged 1.6% today to currently trade at $68,945. Along with intact overhead supply, the on-chain data shows lack of fresh capital inflow to bolster Bitcoin price. Historically, such conditions often indicate an early bear market scenario, suggesting a risk of prolonged correction ahead?

BTC Faces Liquidity Drain as Investors Turn Net Sellers

Since last month, the Bitcoin price has witnessed a sharp correction from $97,386 to $59,390 low, before recently reverting to its current trading value of $68,934. This downswing pulled the market sentiment gauge— BTC fear and greed to 9%— a level last since the FTC-led 2022 downturn.

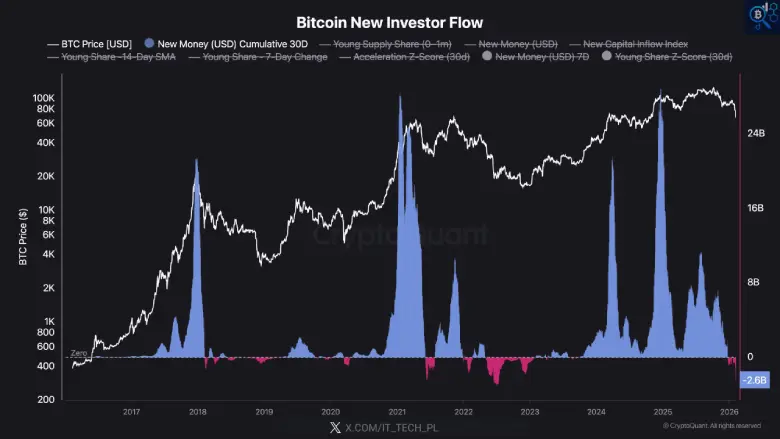

In addition, Bitcoin is under constant pressure from the lack of incoming capital, as new data shows a reversal in the behavior of investors. Over the trailing 30-day window, aggregate flows to Bitcoin-related assets have registered a net deficit of around $2.6 billion, meaning disposals by current holders are outstripping any additions from the newcomers.

This pattern is dramatically different from normal bullish environments where typically price weakness will trigger rapid flow of more funds into the market and faster recoveries. Instead, the continuing retreats have seen little response from potential participants with no apparent upsurge in buying interest during these periods of softness. Market activity now seems to be dominated by repositioning among those who are already there, rather than broad-based expansion through outside money.

Such dynamics have been observed in previous cases when more drawn-out declines have begun, with a reduction in overall liquidity and a contraction in the number of active traders. A temporary surge during these periods are often marked as a relief rally where sellers recoup their exhausted bearish momentum for continued correction.

Why Bitcoin Price Faces Risk of Prolonged Correction

Following a sudden sell-off on February 5th, the Bitcoin price witnessed a short pullback to $68,983, triggering a broader market relief rally. This uptick, however, backed by low trading volume indicates lack of conviction from buyers to sustain current price levels for higher recovery.

In addition, the daily chart analysis of BTC shows several short-bodied candles with long upper wicks at $71,500, suggesting an intact overhead supply. The momentum indicator ADX at 50% accentuates the current strong bearish momentum in price, but an extreme value reflecting sellers could exhaust that stall bearish trend.

Thus, the Bitcoin price is poised for prolonged correction but it needs sufficient consolidation to regain its bearish momentum. With sustained selling, the coin price could plummet another 16% to retest the bottom support trendline.

Since January 2022, this ascending trendline acts as a key accumulation zone for buyers to regain bullish momentum and drive a higher rally.