- The Bitcoin price extends its downtrend below $70,000 mark amid cascading liquidation, ETF outflow, and weak buying pressure from institutional investors.

- In the last 24-hours, the crypto market witnessed a forced liquidation of 326,642 traders with nearly $1.5 billion wiped out across the derivative market.

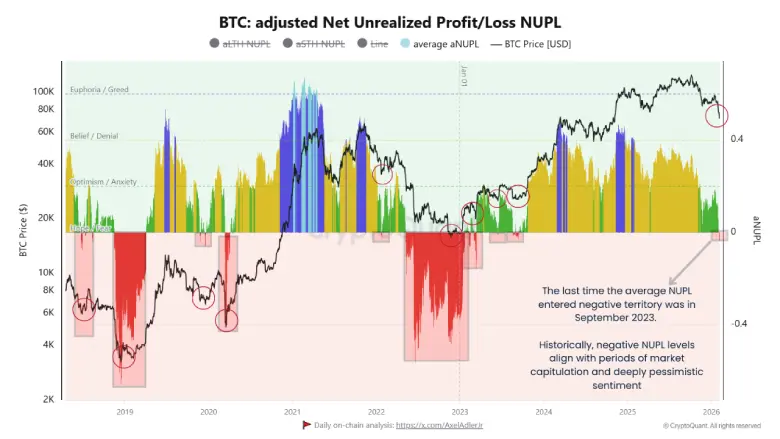

- Current negative aNUPL suggests most BTC holders are sitting on unrealized losses.

The bloodbath on the crypto market continues as Bitcoin price slips another 8% on Thursday to reach November 2024 low of $66,459. The sell-off today can be attributed to recent comment from Treasury Secretary Scott Bessent when he stated that the U.S. government would not step in to support the cryptocurrency market. As the selling pressure remains accelerated BTC faces risk of prolonged correction but on-chain data shows a historical bottom sign emerges.

What aNUPL Says About BTC’s Next Move

Over the past four months, the Bitcoin price has plunged from its all-time high of $126,272 to $67,000 current trading value registering a loss of 47.5%. Simultaneously, the asset market cap tumbled to $1.33 Trillion.

Analysis of the adjusted Net Unrealized Profit/Loss (aNUPL) metric through multiple market cycles reveals a recurring dynamic. Historically, Bitcoin has spent little time deeply negative in this indicator. Periods of negative readings in 2018-2019, 2020 and 2022-2023 each ran into long periods of price recovery. Chart annotations from those eras identify lows where widespread apprehension ruled the roost, but were in line with intervals that then turned out advantageous for position building by participants looking at longer time frames.

The current negative aNUPL position is based on the fact that the majority of Bitcoin addresses have positions showing unrealized losses. This condition has often resulted in weak hands capitulating and smart money using those liquidity to build their position. The indicator separates sentiment into periods like optimism/anxiety, belief/denial, hope/fear with the current environment lying in a zone of significant pessimism.

The transition from high enthusiasm in late 2024 to this state was fast, suggesting a compressed emotional readjustment process which could potentially lead to a faster resolution of the downturn phase.

On-chain data combined with patterns of previous cycles is indicative of the possibility of a major trough in the current market structure.

Key Support Levels To Watch As Bitcoin Price Extends Correction Trend.

The technical outlook of Bitcoin pricen

suggests that the market selling pressure accelerated with completion of a traditional bearish pattern called inverted flag pattern. On January 20th, the price gave a decisive breakdown from the flag’s bottom trendline at $89,800, with sellers still chasing its predetermined targets.

Today, the BTC is down 9.4% to current trade at $66,210. The sharp downtrend triggered cascading liquidation in the derivative market with long positioned traders losing over $577.8 million in value.

With sustained selling, the ongoing correction could plunge another 9.8% to hit $59,800, followed by an extended dive to the flag target at $52,811.

That said, BTC daily RSI at 17% is now more oversold than at any point during the 2022 bear market. Historically, this value has conceded with a slowdown in aggressive selling pressure and opportunity for a relief rally.

Thus, BTC’s price is poised for a few temporary upswing before it reaches the lower targets.

On the daily timeframe, Bitcoin price correction is also approaching a long-coming ascending support trendline near the $55,000 level, which has historically acted as a crucial defense zone for buyers. Since January 2023, this trendline has consistently served as a key accumulation area, helping BTC form durable market bottoms during major corrections.

Also Read: Leverage Flush Triggers Ethereum Price Dump — More Pain Ahead?