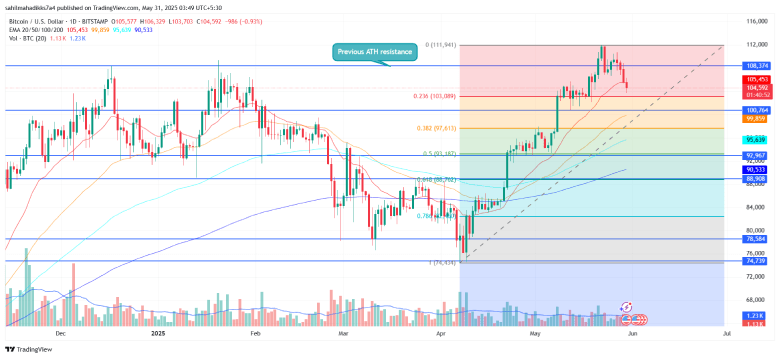

Bitcoin, the pioneer cryptocurrency, currently trades at $104,522 and continues to prolong its current correction trend. The downward trend, accompanied by sufficient volume action, signals a potential breakdown below the $100,000 psychological level if the momentum is sustained. However, the increasing global adoption of BTC backs its fundamental strength and potential for a bullish turnaround. Will the digital gold breach the $100k support level, or are buyers ready for a counterattack?

Trump Media’s $2.3 Billion Bitcoin Bet Boosts Institutional Confidence

Trump Media and Technology Group, the company behind Truth Social, has raised $2.44 billion through its major private placement, comprising $1.44 billion from stock sales and $1 billion in convertible bonds maturing in 2028.

The company plans to deploy $2.3 billion of net total to create a Bitcoin treasury, making it one of the largest BTC investments by a U.S. public company.

“Trump Media is focused on acquiring great assets, and this deal will give us the financial freedom to implement the rest of our strategies,” Trump Media Chief Executive Officer Devin Nunes said in the statement announcing the deal. The deal gives the company more than $3 billion in liquid assets and gives shareholders exposure to Bitcoin, Nunes said.

Crypto.com and Anchorage Digital will handle the custody of BTC assets, while Yorkville Securities and Clear Street will serve as placement agents.

In addition, the Brazilian public company Méliuz has filed to raise $26.45 million to purchase Bitcoin. The move highlights the growing institutional adoption of Bitcoin, bolstering its bullish sentiment despite the recent price correction.

Key Support Level is BTC Correction

Since last weekend, the Bitcoin price has fallen from a high of $112,000 to $104,647 (current trading value), registering a 6.4% loss. While the pullback seems reasonable, it projects buyers’ failure to sustain above the recent breakout of $108,375, amid headlines like the Bitcoin laundering case in the US.

The falling price has recently breached the dynamic support 20-day exponential moving average, signaling an initial shift in market sentiment. If the bearish momentum persists, the 23.6% Fibonacci retracement level at $103,250 stands as the immediate support for buyers.

In a prolonged correction, buyers can rely on the 36.8% and 50% Fibonacci (FIB) support levels at $97,450 and $92,650, respectively. Until the coin sustains these levels, the broader trend remains bullish, and buyers will counterattack to drive a higher price rally.

Amid the aforementioned Bitcoin adoption, the asset price is likely to hold this support and offer a dip opportunity for buyers.

Also Read: Crypto Holds Strong as Tech Stocks See Outflows: QCP Report