April 25th, 2025— Bitcoin price recorded a slight uptick of 1.3%, teasing a bullish breakout from the $95,000 level. This intraday recovery likely followed another day of strong inflows into BTC ETFs and active accumulation from large-scale investors. Is the current momentum sufficient to push for a new all-time high?

ETF Inflows and Whale Buying Fuel the BTC Rally

In a six-day rally, the Bitcoin price bounced from a low of $83,940 to its current trading value of $95,358, projecting a growth of 13.5%. The recovery momentum can be attributed to several reasons, including the ongoing trade talks of the United States with other countries, significant inflow into spot BTC ETFs, and renewed accumulation from whales.

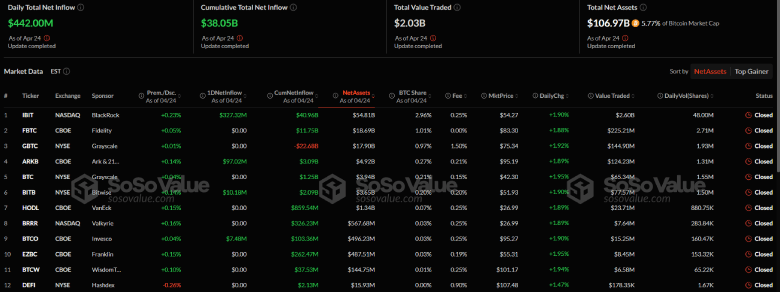

According to SoSovalue data, the Bitcoin ETF has witnessed a positive inflow for the past five days, staggering over $2.6 billion weekly. On April 24, BTC ETFs recorded a net inflow of $442 million, with BlackRock’s IBIT taking the lion’s share of $327.32 million.

Ark 21Shares’ ARKB posted a strong showing with a $97.02 million inflow, while Bitwise’s BITB and Invesco’s BTCO followed closely, attracting $10.18 million and $7.48 million, respectively.

Adding to the bullish note, whale wallet holdings between 10 to 10,000 BTC have added a massive 19,255 BTC to their holdings in just seven days.

The Santiment data shows this surge has pushed the total BTC held by these key stakeholders to an all-time high of 13.47 million BTC.

The substantial ETF inflow and aggressive accumulation from crypto whales reinforce the sustainability of the current price recovery for a breakout to a new high.

Bitcoin Price Reclaims Major Support for New All-Time High Rally

On Tuesday, April 22nd, the Bitcoin price decisively broke through the $91,315 resistance. This horizontal level was a major support during early 2025, and therefore, the previous breakdown was expected to accelerate the market selling pressure and prolong the recovery.

However, the coin price reclaiming this support amid the backing of ETF inflow and whale accumulation signals a weakness in sellers’ conviction. Moreover, the fast-moving 20-day exponential moving average is on the verge of surpassing the 100-day EMA slope, reinforcing the initial change in market sentiment.

Thus, the BTC price will likely surge another 5% to breach the $100,000 resistance, followed by a leap towards a new high above $109,500.

Also Read: NEAR Protocol Gains Momentum as Bitwise Registers First-Ever NEAR ETF