- The Bitcoin price breakdown from support trendline of inverted flag pattern signals the potential downswing to $80,000 support.

- Rising geopolitical tensions, including renewed U.S. tariff threats toward European nations, pressured global risk assets.

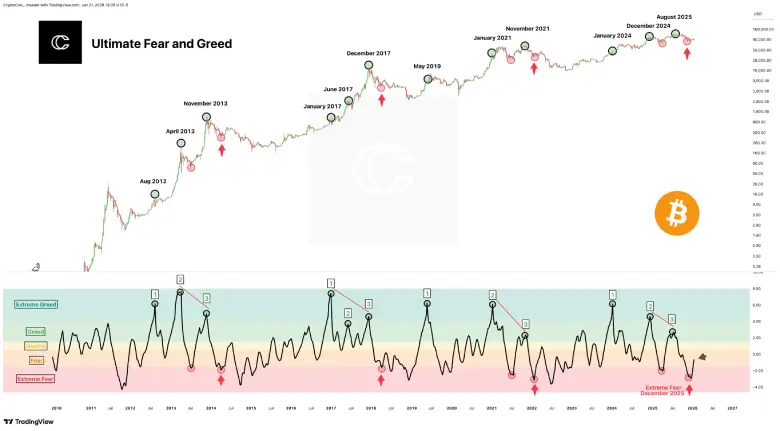

- BTC’s fear and greed 32% indicate a fear sentiment among market participants.

On Wednesday, January 21st, the Bitcoin price jumped 1.6% to trade at $89,756. This uptick likely came as a relief rally after the broader crypto market witnessed heavy correction since last week amid Japanese government bond yields hitting a high of 2.29% and U.S-EU trade tension. As a result, BTC’s fear and greed sentiment plunged to fear which many analysts believe is a precursor for bullish bounce. However, historically data indicate this may not be the case this time.

BTC Slides as Geopolitical Tensions and Risk-Off Sentiment Shake Markets

Over the past week, the Bitcoin price witnessed a bearish drawdown from $97,393 to $87,197, projecting a loss of nearly 11%. A primary catalyst for this pullback was geopolitical tension over Greenland as U.S. president Donald Trump threatened to raise tariffs on eight European nations.

The bearish momentum accelerated on Tuesday as the surge in Japanese government bond (JGB) yields has triggered a risk-off sentiment in the cryptocurrency market. As a result, the open interest associated with BTC futures contracts plunged from $66.17 billion to $60.44 billion. This drop signals forced liquidation of long positioned traders amid sharp price decline.

In addition, traders also exit their ongoing position to reduce leverage exposure amid uncertain market conduction, reducing speculative force in the market.

Furthermore, the sentiment gauge of the Bitcoin market has shifted to a fear zone, slightly improvement from extreme fear levels recorded at the end of 2025. These profound fear stages are not always a suitable entry point for investors, as history shows mixed results.

Over a long period of years, the indicator has been in the area of greed, but the most recent pivot indicates a significant change in the momentum. The process is reminiscent of cycles in the market, in that excessive speculation will always lead to substantial bearish market indications on the long term charts.

The current recession is in line with the initial trend in the bear phase and its development is estimated to be at 20% to 30% in comparison with previous cycles. The analysis of charts shows the major highs in history such as those of 2013, 2017, and 2021 when such highs of greed were followed by corrections.

The continuous changes in the fear-greed indicator are still following the price trends with the last figures showing that there is still volatility in the market with the changing economic conditions.

Bitcoin Price to Extend Correction Amid Inverted Flag Breakdown

On January 20th, the Bitcoin price gave a decisive bearish breakdown from the support trendline of a bearish continuation pattern called inverted flag. The chart setup is characterised by a sharp correction trend displayed through a downsloping trendline, followed by two ascending trendlines indicating temporary upswing to replenish bearish momentum.

As a result, the coin price often breaks the pattern’s bottom trendline to signal downtrend continuation. With today’s jump, the coin price retested the breached trendline as potential resistance to check BTC’s sustainability below $90,000.

The downsloping tick in daily exponential moving averages (20, 50, 100, and 200) accentuated the path to least resistance is down. Thus, with sustained selling pressure Bitcoin price $84,700, followed by a drop to $80,000.

On the contrary, if the ongoing retest reenters the flag range, the resulting failed breakdown would accelerate market buying pressure.

Also Read: Grayscale Files S-1 With SEC to Convert Near Trust Into ETF