Key Highlights

- Bitcoin (BTC) has plunged below $99,000 after 3% drop in the daily chart, after facing massive liquidation

- This comes after BTC ETFs witnessed major outflows in recent weeks, after witnessing turmoil in the cryptocurrency

- Binance founder Changpeng “CZ” Zhao will face off against noted economist Peter Schiff

On November 13, Bitcoin (BTC) plummeted below $99,000, experiencing a 2.65% drop in a single day, sparking panic in the cryptocurrency community. This downward trend has also impacted its market capitalization, slipping below $2 trillion.

(Source: TradingView)

This heartbreaking drop comes after over $215 million worth of crypto investment was wiped out after seeing massive liquidation. At the time of writing this, BTC is trading at around $98,625.76 with a 24-hour trading volume $95.96 billion, according to CoinMarketCap.

Bitcoin ETFs See Major Outflows

Bitcoin’s institutional adoption has witnessed a major outflow in recent days. From October 28 to November 5, Bitcoin ETFs have witnessed major outflows consecutively, one of the longest streaks in the crypto ETFs’ history. On November 12, Bitcoin ETFs suffered a massive outflow, $558 million, according to Farside.

On November 13, a sharp sell-off damaged investors’ confidence after the Federal Reserve’s unwillingness to cut interest rates in December.

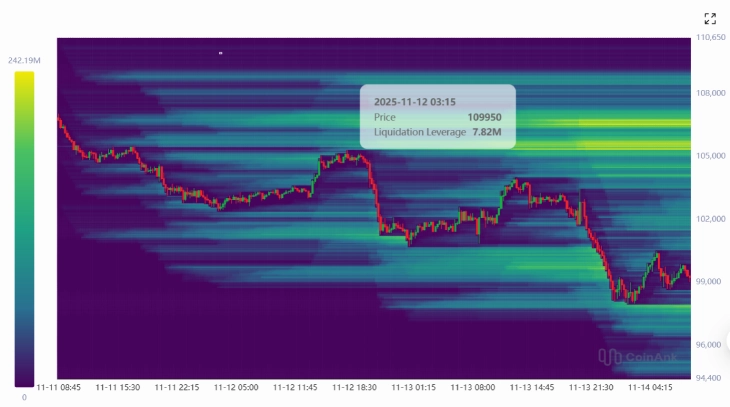

(Source: CoinAnk)

The crypto equity sector was hit particularly hard. Mining companies with major exposure to AI infrastructure and data centers led the declines.

With markets now estimating only a 50% chance of a modest rate cut next month, Howard believes Bitcoin will likely remain near its current levels for the rest of the year. He suggests that the 2025 peak for BTC may already be in. It forecasts a more gradual ascent over the coming year instead of new all-time highs in the immediate future.

Adding to the market’s headwinds is a notable drop in fiscal liquidity. The recent government shutdown, which lasted for much of October, forced a major shift in federal spending. Instead of running its typical deficit, the government actually achieved a major surplus.

Why Crypto Market is Falling: BTC, ETH, and Solana Face Major Drops

In a month, Bitcoin has fallen three times below $100,000 amid the U.S. economic turbulence and growing fear of another war in the world between the U.S. and Venezuela. Furthermore, the ongoing government shutdown drama has also created panic in investors.

BTC isn’t even really doing anything, hasn’t for a while and yet here we are, down 60%+ pic.twitter.com/TaLOaGIsFf

— DonAlt (@CryptoDonAlt) November 14, 2025

This downfall in Bitcoin has also triggered correlation in altcoins like ETH, SOL, and others.

For example, A popular crypto analyst has raised an alarm for Solana, who earlier predicted Bitcoin’s major downfall in 2021. The analyst named DonAlt stated that the smart contract platform could face a major drop. This statement is quite shocking, as recently, Solana ETFs have opened a floodgate for institutional investment.

DonAlt stated that Solana’s price chart is showing one of the most concerning patterns that he has observed on a long-term scale in recent months. This bearish prediction comes after SOL’s inability to break through a crucial resistance level around $208.

Some experts believe that the recovery of Bitcoin’s derivatives market after a massive crash on October 10 is expected to be a slow process.

Max Xu, the Director of Derivatives Operations at the crypto exchange ByBit, stated that it could take up to two full quarters for trading activity to return to its former levels.

He mentioned that a meaningful rebound depends on improvements in the global financial market. He stated that if anticipated rate cuts come to pass, it might improve investors’ sentiment.

Amid the market crash, a high-profile debate on the future of digital value is set for Binance Blockchain Week in Dubai this December. Binance founder Changpeng “CZ” Zhao will face off against noted economist and long-time Bitcoin critic, Peter Schiff.