As the week kicked off on a positive note for the crypto market, the lingering pain from the previous week’s digital asset outflow still casts a shadow over investor sentiment. A perfect storm of US economic uncertainty and October volatility swept through the markets, leaving a trail of heavy outflow in its wake.

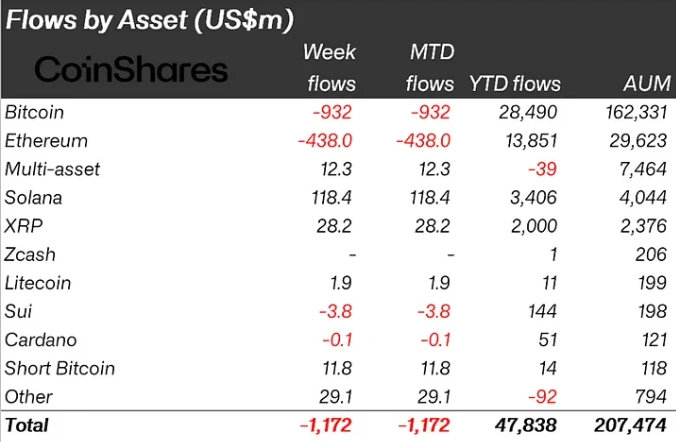

A staggering $1.17 billion was pulled from digital asset investment products, marking the second consecutive week of sharp declines. Bitcoin and Ethereum bore the brunt of the sell-off, with outflows exceeding $1300 million collectively.

Yet, a glimmer of hope emerged amidst this chaos as altcoins like Solana shone bright with a remarkable positive flow. Solana’s unexpected surge in inflows has left many wondering if the action is poised for a sustained price rally.

Crypto Investment Funds See $1.17B in Outflows

The latest CoinShares report revealed a significant outflow of $1.17 billion from digital asset investment products last week. This marks the second consecutive week of substantial losses.

This downturn reflects investor caution amid economic concerns and political turmoil, with Bitcoin and Ethereum experiencing notable outflows of $932 million and $438 million, respectively. However, short Bitcoin positions attracted $11.8 million in inflows, marking one of the highest levels since May 2022, as investors bet against the crypto’s price.

US Leads the Charge; Here’s Why

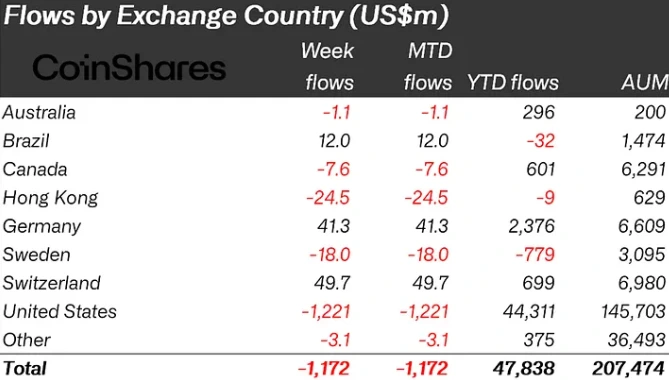

Significantly, the CoinShares report highlights a stark regional divide, with US investors driving the sell-off with $1.22 billion in outflows, while European markets, particularly Germany and Switzerland, remained resilient with inflows of $41.3 million and $49.7 million, respectively.

This contrast emphasises steady institutional appetite in Europe despite global uncertainty. Although midweek optimism briefly sparked hopes of a US government shutdown resolution, it was short-lived, and outflows resumed by week’s end as sentiment soured again.

One of the main reasons for this negative flow is the ongoing US government shutdown, which is now in its 41st day, exacerbating economic instability and uncertainty. This political crisis and the subsequent economic data blackout have significantly changed the investor sentiment.

Fed Chair Jerome Powell’s recent comments hinting at a more cautious approach to interest rates have heightened market tensions, which triggered this sell-off in risk assets. As a result, investor sentiment shifted from anticipating monetary easing to worrying about inflation and economic headwind.

This divergence between the US and European markets persists, with the US bearing the brunt of negative sentiment while Germany and Switzerland continue to attract investment.

Solana Defies the Trend

Interestingly, Solana bucked the overall negative trend with $118 million inflows last week, extending its nine-week streak to $2.1 billion. For 2025, Solana products have attracted a whopping $3.3 billion year-to-date, signalling growing institutional interest.

The recent launch of the US Solana ETFs, including Bitwise’s BSOL and Grayscale’s GSOL, has been a major catalyst, with four consecutive days of net inflows totalling $200 million. This follows a record-breaking week prior, where Solana saw $421 million in inflows, its second-highest rally.

While Bitcoin and Ethereum faced headwinds, altcoins like Solana and XRP attracted inflows, showcasing selective strength in the market. This divide highlights conflicting trends, with US policy uncertainty and cautious sentiment weighing on major cryptocurrencies.

Solana Price Soars 6%

In line with the overall positive trend in the crypto market today and aligning with Solana’s significant inflows, Solana is also experiencing a notable rise. As of press time, the altcoin is valued at $168.20, making a notable uptick of 6% in a day. Despite this daily hike, the token has seen a 4.16% and 8.2% plummet over the past week and month, respectively.

This daily uptick has sparked widespread optimism, with the recent surge expected to be a signal for a massive uptrend ahead. Investors are closely watching key levels, anticipating a potential breakout that could propel prices higher.