Key Highlights:

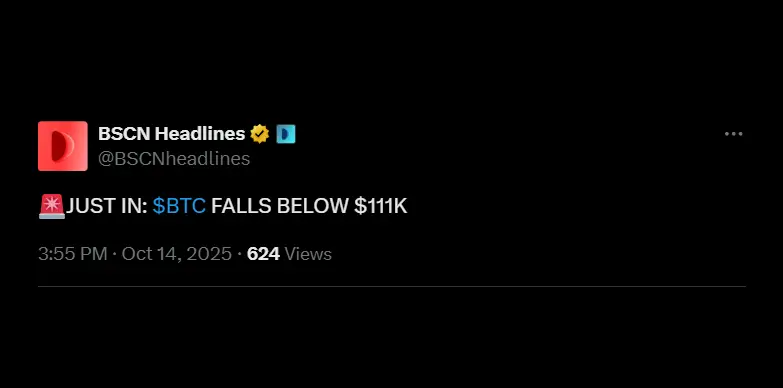

- Bitcoin (BTC) dropped below the $111,000 mark today, October 14, 2025.

- Crypto market capitalization also drops by 2.3%.

- Analysts indicate signals of a possible bullish reversal near $110,500.

Bitcoin’s price fell below $111,000 today, October 14, 2025, as the crypto market dipped down by 3.7% according to CoinGecko. This is in line with a large liquidation event where approximately $100 million worth of crypto positions were liquidated, which has increased the market volatility and uncertainty.

At press time, the price of the token stands at $111,386.92 with a dip of 2.8% in the last 24 hours as per CoinMarketCap.

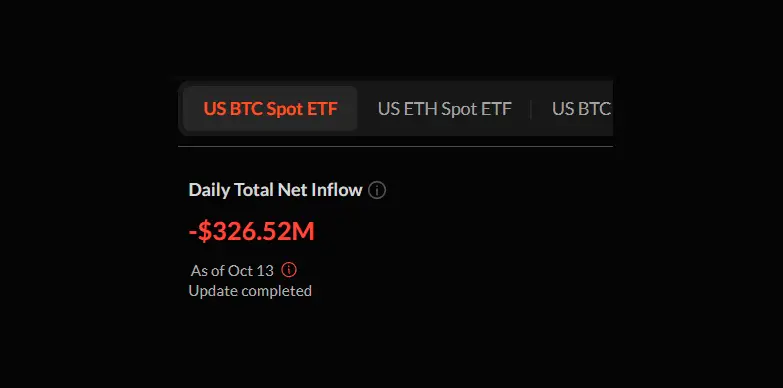

Bitcoin ETFs Experience Significant Outflows

From the latest Bitcoin’s ETF data, it can be seen that there had been a significant outflow on October 13, 2025. According to SoSoValue, approximately $326.5 million was liquidated as of October 13, 2025. Despite this outflow, BlackRock’s IBIT Bitcoin ETF was an exception with a net inflow of about $60.36 million. With this inflow, it is maintaining its position as the dominant Bitcoin ETF with total net assets around $93.11 billion and cumulative inflows reaching around $65.32 billion.

Meanwhile, other Bitcoin ETFs saw money flowing out. Grayscale’s GBTC had the biggest single-day outflow, which was around $145 million. This value brings their total withdrawals to more than $24 billion. Fidelity’s FBTC lost $93.28 million, and Bitwise’s BIBT saw $115.64 million being pulled out.

In all, Bitcoin spot ETFs now hold about $157.18 billion, which makes up around 6.81% of BTC’s total market value.

This net outflow on October 13 follows a week where Bitcoin spot ETFs had accumulated $2.71 billion in net inflows from October 6 to October 10. These numbers indicate a cautious but still engaged investor sentiment amid recent market volatility.

Overall Crypto Market Dips

The overall crypto market is down by almost 4% today, and it is mainly due to the liquidation of leveraged positions, which were somewhere around $100 million today in recent hours. All of this has come right after the record-breaking sell-off the week before, which has wiped off more than $19 billion in leveraged positions. Experts caution that these liquidations, along with lower market liquidity, could bring in even more price swings moving forward.

At press time, the market capitalization of the crypto entire crypto market stands at $3.7 trillion, which is down by 2.3% as per CoinMarketCap.

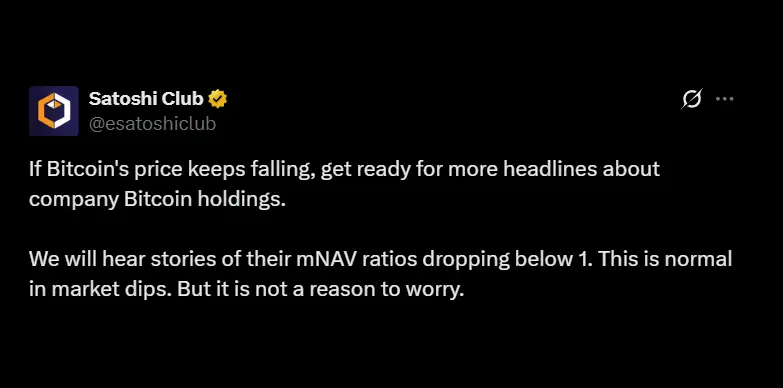

More mNAV Ratios to Fall

Market analysts say that if BTC price keeps falling, more attention will shift to company holdings, especially in cases where the asset management NAV (mNAV) ratio drops below 1. Now that BTC has dropped below the mark of $111,000, this is bound to happen.

This usually happens during market corrections, and it indicates short-term value change between crypto ETF holdings and the actual BTC price. It does not mean that there is a major problem. Today, it was reported by Bloomberg that Metaplanet, a Japanese company that holds BTC, saw its mNAV ratio drop below 1 for the first time, meaning that its enterprise value is lower than that of its Bitcoin holdings. This happened during the broader sell-off but did not cause a liquidity issue or structural risk.

Bitcoin Poised for Bullish Reversal on Key Support Break

For Bitcoin, according to a well-known influencer on X (The Wolf of All Streets) stated that, a recent overbought bearish divergence at the top of its price cycle has led to weaker buying momentum. Analyst points out that Bitcoin is currently under pressure, with its price below important moving averages.

On the 4-hour to daily charts, RSI also shows a negative divergence after being overbought. If Bitcoin closes below around $110,500 on these timeframes, though the level changes slightly depending on the chart, it would confirm oversold bullish divergence. This could signal a shift from the current downtrend to an upward move. It suggests that selling pressure may be slowing down, and buyers might slowly step in and start to take control again, which will become a technical turning point for BTC.

Also Read: Crypto ETPs Face Silence as Washington Shutdown Extends