Key Highlights:

- Bitcoin fell by about 2% in the last 24-hours today, December 23, 2025.

- Hashrate dropped by 4% which has added a bearish sentiment.

- Key supports at $85,000-$90,000 are being tested, derivatives volatility is also rising.

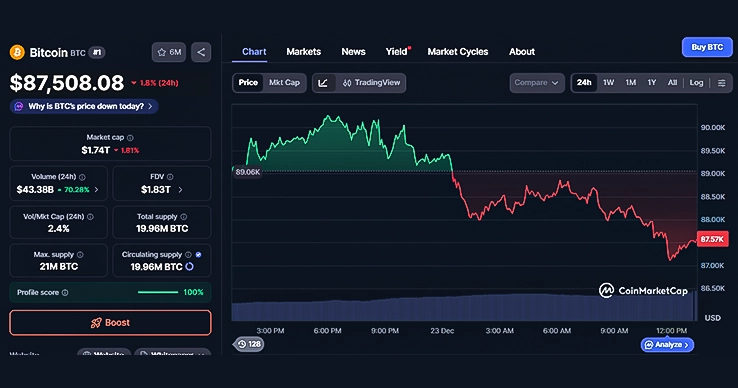

Bitcoin has fallen about 2% today and is hovering around the $87,500 mark in the last 24 hours as per CoinMarketCap. However, gold on the other hand, continues to surge, roughly by 71% this year.

This fall comes as investors are shifting their money to safer assets due to miner pressure, lower US institutional demand and weak technical signals. Key support at $85,000 is currently being tested, with US GDP and inflation data likely to influence the next move.

At press time, the price of the token stands at $87,508.08 with a dip of 1.8% in the last 24-hours as per CoinMarketCap.

Miner Capitulation Fuels Sell-Offs

Bitcoin’s mining power or hashrate has dropped by 4% in December 2025. This fall is one of the biggest falls since April 2024, which has caused miners to shut down about 1.3 GW of capacity as per VanEck.

According to the report by VanEck, mining profits fell sharply, with breakeven electricity costs down by 36% from last year to $0.077/kWh, which led to distressed selling and negative sentiment.

However, if you look at the history, Bitcoin has managed to gain around 72% in 90 days after similar drops, but near-term pressure may continue until prices rise above $90,000 to restore miner profitability.

Institutional Demand Cools in US

US institutional demand for Bitcoin has also slowed down. The Coinbase Premium has also turned negative, with a reduced buying from the big players.

Spot Bitcoin ETF inflows have also slowed down. Grayscale and BlackRock have lost a significant amount since December 1, however, MicroStrategy has raised $748 million without buying more BTC. Meanwhile, Asian traders have also seized the opportunity and bought the dips between $87,000 and $90,000, helping prevent a sharper decline.

Additionally, according to SoSoValue, last week’s inflow for Bitcoin spot ETF was -$497.05 million and yesterday’s inflow recorded was -$142.19 million.

Technical Breakdown Deepens Bear Case

Bitcoin’s price has weakened and it has dropped below various important technical levels. It broke the 7-day moving average at $87,573, the 30-day moving average at $89,494, and the 23.6% Fibonacci retracement from recent highs at $92,067, signals short-term weakness.

The RSI, which measures momentum, is currently neutral at 45.4, which indicates that neither there is strong buying nor there is any selling pressure, but the MACD indicator shows a bearish crossover at -1,455, which points towards continued downward momentum.

According to analysts, key levels to watch are immediate support at around $90,499 (38.2% Fibonacci level) while longer-term support is currently sitting near the 200-day moving average at $102,497.

For Bitcoin to shift back to bullish territory, it would need a daily close above $89,231 (50% Fibonacci retracement), which would challenge the current bearish trend.

Macro Rotation Favors Gold Over Crypto

Gold has also surged to its all-time high of $4,450 today, December 23, 2025. This surge is an indication that gold, also known as the traditional safe haven, has pulled money away from riskier assets such as Bitcoin and it has created a clear performance gap in 2025.

JUST IN: Gold reaches new all-time high of $4,450 pic.twitter.com/RbEDKTXFvw

— Watcher.Guru (@WatcherGuru) December 22, 2025

Peter Schiff also tweeted about this situation and said that gold’s sharp daily gains, like $100 in a day, are unusual and signal growing economic trouble. As gold continues its bull run, even bigger moves, like $200 days are likely, indicating rising investor fear and potential instability in the US economy.

It’s not often that gold rises over $100 in a single day. But $100-day rallies are going to become commonplace as this bull market matures. Soon, gold will notch its first $200-day move. Do not overlook the significance of this warning and what it portends for the U.S. economy.

— Peter Schiff (@PeterSchiff) December 22, 2025

Investors are also pulled towards gold’s stability amid economic uncertainty, while Bitcoin struggles to remain stable given the miner pressure and shifting institutional demand.

At the same time, derivatives open interest rose 9.8% in the last 24 hours, which hints at a potential volatility. Moreover, today’s US GDP and inflation (PCE) data could also affect the market direction.

Also Read: Bitcoin STH Realized Price Shows Historic “Pain Zone” – Bottom Incoming?