- Bitcoin price breakdown from flag pattern hints risk for prolonged correction in near term

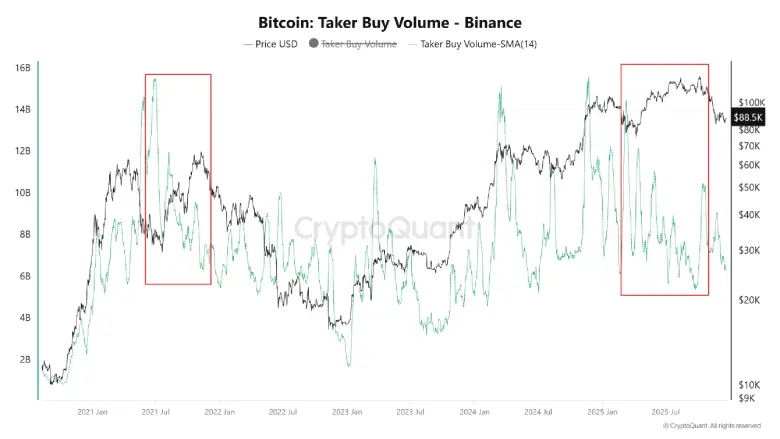

- Binance futures reveal a steady drop in aggressive buy orders since August.

- BTC’s fear and greed index at 24% indicate a broader market selling expenses,

On-Chain Activity Slides as Bitcoin Enters Possible Distribution Phase

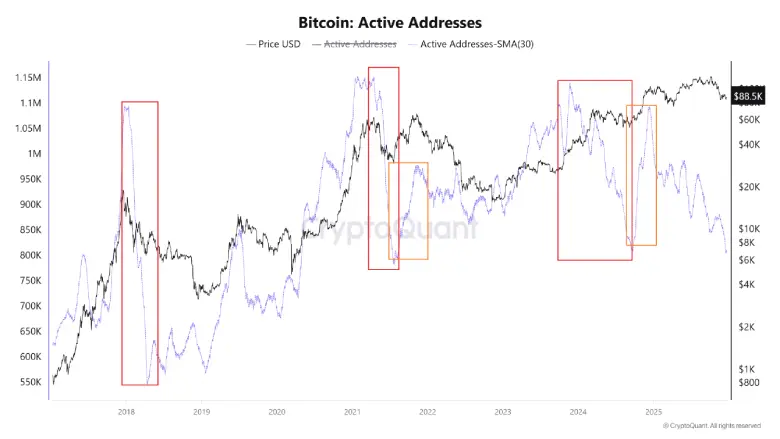

In a recent shared analysis, CryptoQuant’s analyst Mignolet highlighted declining buying momentum in BTC’s derivatives and on-chain market. Purchase strength, reflected in both the flow of trading in exchanges and the underlying blockchain records, has noticeably decreased over the last few months.

Particularly telling is the behavior in the futures arena of Binance. Even as asset values drove up, the volume of aggressive buy orders was contracting progressively – a mismatch that is strikingly similar to the run-up to the 2021 peak. That divergence, first flagged after August, is still not resolved and continues to grow larger.

On-chain participation is not so different. The number of addresses that are active has consequently shrunk considerably and is approaching 800 000 with a negative 30-day trend. Such metrics often also indicate interactions that occur over the counter and in broader networks and suggest declining overall involvement and loss of market energy.

Analysts had expected a possible movement momentum in a previously marked “orange zone” price range. Rather than assuming that pivot would happen, subsequent price action moved in a way that was indicative of the late stages of the previous cycle. This extension is now being considered by some as a final distribution period, in which any remaining supply will be distributed to new holders in the face of declining conviction.

Recovery of sustained demand is likely to take a long time. Questions remain as to how long the traditional four-year swing in digital assets will hold up, but for the moment, such long-term cycle debates have limited practical utility.

Bitcoin Price Gains Bearish Momentum in Bear Cycle Channel Pattern

Yesterday, the Bitcoin price showed a sharp reversal from a long rejection candle. This second pullback within two weeks, accentuates the intense overhead supply, along with potential risk of prolonged downturn.

The 1% intraday loss today offers a suitable follow-up to the potential downward move ahead. In the daily chart, the Bitcoin price had recently breached below the bottom trendline of an traditional bearish continuation pattern called inverted flag.

The chart setup is characterized by a long down-sloping trendline denoting the dominant trend in price, followed by such temporary pullback to regain bearish momentum.

A declining trend in key exponential moving averages (20, 50, 100 and 200) accentuate the path to least resistance is down. If the pattern holds true, the BTC price is poised for another 8.3% loss and retest the $80,008 floor.

On the contrary, if the coin price manages to reclaim the breached trendline and gain suitable for high.

Also Read: XRP Price Stalls Near $1.90 as Bearish Sentiment Spikes Across Social Media