The pioneer cryptocurrency Bitcoin hit a new high of $123,236 on Monday, July 14th. However, the price fell sharply during the U.S. market hours to currently waver around $120,000. This rejection is likely a post-rally pullback for buyers to recuperate the bullish momentum. Despite the short-term volatility, the long-term trend remains strong as Bitcoin accumulators continue to stack more BTC every day.

Bitcoin Accumulator Holding Hit a New All-Time High

The Bitcoin market has once again captured the spotlight as its price continues soaring to new highs since last week. The recent upswing in momentum is triggered by growing investor optimism ahead of the anticipated pro-crypto policy developments coming this week.

Starting from Monday, the U.S. House of Representatives will be debating a series of crypto-related bills, including the Crypto Bill Genius Act, the Clarity Act, and the Anti-CBDC Surveillance State Act.

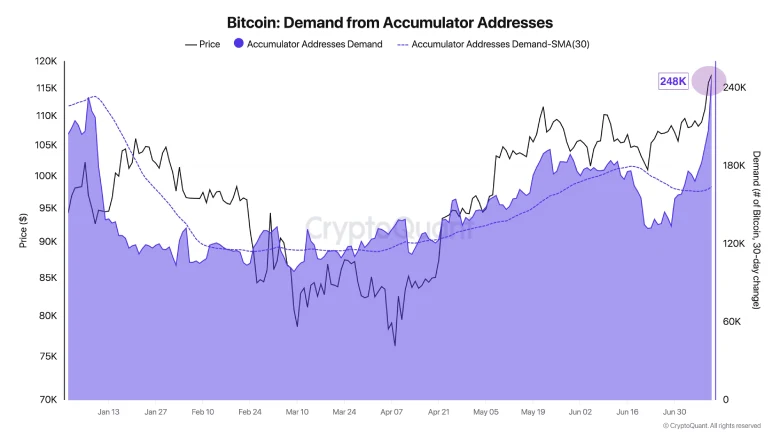

Amid the regulatory development, the on-chain data reveals significant demand from Bitcoin accumulators—wallets that strictly accumulate BTC and have no history of selling.

According to a recent analysis shared by X (formerly known as Twitter) user Darkfost, these dedicated wallets have collectively added approximately 248,000 BTC to their holdings, currently worth $30 billion. This marks a substantial spike compared to the monthly average of 164,000 BTC, indicating a strong accumulation trend.

Despite the new high in BTC, these investors are not concerned with profit booking or potential pullback, which indicates strong conviction for the asset’s long-term trend.

Key Support and Resistance as BTC Hits New High

Since last week, the Bitcoin price has shown a high momentum rally from the $107,471 mark to a recent high of $126,236, accounting for 15.67% growth. The bullish upswing, backed by increasing trading volumes, indicates a sustained recovery with increasing buyers’ conviction. However, the daily candle showcased a long-wick rejection from the aforementioned high to the current trading price of $119,800.

This selling pressure could be the profit booking from the short-term investors, triggering a short-term pullback. According to the traditional pivot level, the potential reversal could seek support at $117,690, followed by the next significant support of the $112,380 level.

However, this pullback could allow buyers to recoup the bullish momentum and prolonged price recovery. On the upside, the BTC price could face potential resistance at $125,000, followed by $132,000.