- The Bitcoin price prolongs its downtrend within the formation of a bearish flag pattern.

- The 12-month price performance of Bitcoin has slipped into negative territory.

- BTC fear and greed index at 27% indicate fear among market participants.

The pioneer cryptocurrency Bitcoin recorded low volatility sideways trading during weekend hours as its price continued to waver around $90,000. The uncertainty can be linked to the recent dip in the US unemployment rate which has also lowered the investors expectation for a January rate cut and overhead supply limiting recovery opportunities. However, the recent market data shows a potential rare event in Bitcoin price that could drive a sustainable recovery this year.

BTC Faces 5% Inflection Point That Could Decide Its 2026 Trend

Over the past four days, the Bitcoin price has showcased low volatility trading around the $90,000 mark. The daily chart highlighted long wick rejection candles with narrow bodies, indicating the market-wide uncertainty.

While the prolonged consolidation could signal risk for further downtrend, the latest onchain data signals an opportunity to raise a recovery trend.

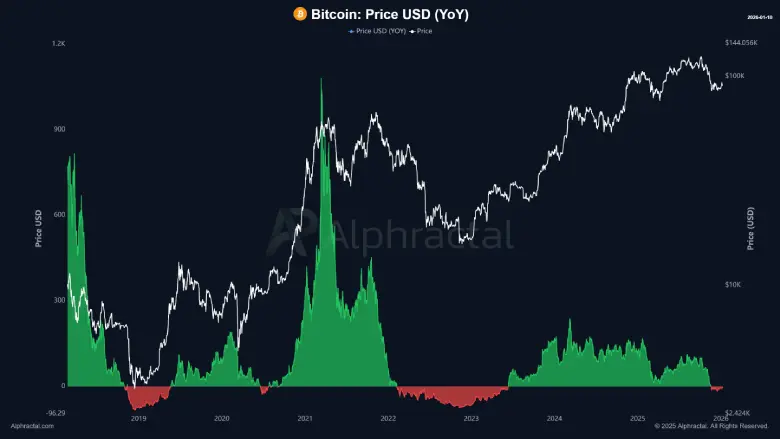

Bitcoin’s 12-month price performance indicator is currently in negative territory, which has generally indicated prolonged downtrends in the asset’s history. The only significant exception occurred in July 2020, when the metric dipped just into the red, before a strong upward surge took its place.

Today’s set-up looks strikingly similar to that moment in 2020, making the scenario very rare. Bitcoin would have to rise some 4.5% from its current value to see this annual change turned into a positive number, which would only be the second time in history that such a change has been measured.

Should the price fail to do this and really perform this modest gain of the indicator would persist in the negative readings, as viewed by patterns throughout previous periods of extended declines. As such, a move of around 5% is in a position to either continue the established historical precedent, or break with it altogether, potentially signaling a significant shift in market direction.

This measure, based on the comparison of the current price with the value at the exact same time last year, provides a rudimentary indicator of long-term momentum. Prolonged negativity has generally coincided with dominant selling forces and drawn out corrections. In contrast, the 2020 case was fought in a context of broad economic uncertainty, from which the short-lived deficit soon turned into a major rally that changed expectations.

Current similarities include the volatility characteristics and post-correction recovery characteristics. Various influences (e.g., changing investor psychology, policy developments, and general economic conditions) continue to shape these cycles. With this required uptick still relatively small, there is now increased significance of daily price action in terms of determining outcome.

Bitcoin Price Extends Correction Within Flag Pattern

Over the past six weeks, the Bitcoin price has traded in a narrow range confined within $95,000 and $84,300. The coin price bounced several times from the boundaries of this range indicating lack in initiation from buyers to sellers.

However, a deeper analysis of the daily chart shows the coin price is developing into an inverted flag pattern. The chart setup consists of prevailing downtrend, denoted by a downsloping trendline, followed by a temporary consolidation within two ascending trendline.

Currently, the Bitcoin price trades at $91,000 , gradually heading to the pattern’s bottom trendline. A potential breakdown below this floor would accelerate the selling pressure and extend BTC downtrend to $80,000.

On the contrary, if the bottom trendline holds, the coin price could attempt bullish recovery of price break overhead trendline.

Also Read: Ethereum On-Chain Metric Highlights Strong Holder Conviction at $2.7K–$2.8K