Key Highlights

- Bitcoin has soared above $89,000; however, it quickly slipped below this crucial support level.

- This surge comes amid the U.S revealed a major slowdown in inflation, where the consumer price index for November 2025 rose 2.7% compared to the same month last year.

- The Bank of England has also announced a rate cut by 25 bps, while Japan is going to release a statement on its monetary policy, and

On December 18, the leading cryptocurrency, Bitcoin (BTC), witnessed a spike on a daily chart, surging over $89,000 with approximately 1% surge.

However, Bitcoin failed to sustain this upward momentum and quickly fell below this crucial mark. At the time of writing, the cryptocurrency is trading at around $88,713 with an impressive market capitalization of $1.77 trillion, according to CoinMarketCap.

Bitcoin Reacts to November Inflation Data

The cryptocurrency market has reacted quickly after the latest data on consumer prices in the United States. The latest data revealed a major slowdown in inflation, which is likely to provide a boost to the cryptocurrency market.

🚨BREAKING: U.S. CPI came in below expectations at 2.7% vs 3.1% expected.

This shows inflation is cooling down.

FED now has more room for rate cuts and monetary easing.

This is really bullish for markets. pic.twitter.com/ZWrzqwNBaA

— Bull Theory (@BullTheoryio) December 18, 2025

The consumer price index for November 2025 rose 2.7% compared to the same month last year. This figure was surprisingly lower than economists’ forecast and shows a drop from the 3.0% rate recorded in September.

The even more closely monitored ‘Core CPI’, which excludes volatile food and energy prices, increased by just 2.6%. This is the lowest reading since March 2021.

This data was released after the U.S. government shutdown. The U.S. government experienced a 43-day shutdown earlier this year, which forced the cancellation of the October inflation report entirely.

Because of this kind of delay, statisticians could not provide the typical month-over-month comparison for November. Analysts warned that the data collection process may have been delayed. It mainly covered holiday discounts and made the slowdown appear more dramatic than the trend.

Generally, lower inflation data reduces the pressure on the Federal Reserve to keep interest rates high.

This data has also raised expectations that the central bank could start cutting rates in 2026.

Back-to-Back Bullish News for Crypto Market

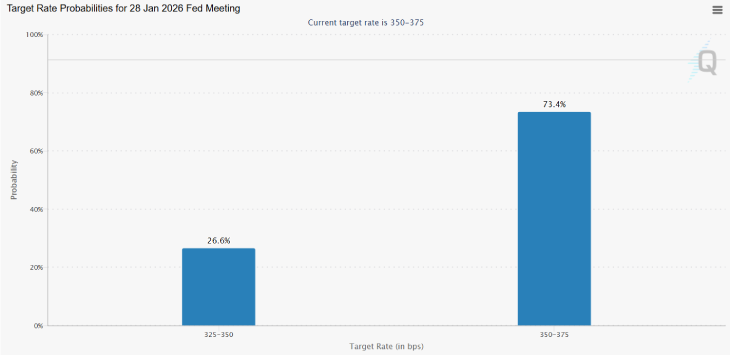

(Source: CME Group)

According to the CME Group indicator, the odds for a Fed rate cut in the January FOMC meeting soared to 26.6%. Citigroup has shared its expectation of a 25 bps Fed rate cut in September 2026, with additional cuts in January and March.

US inflation data is just the beginning of the day as more major events are scheduled for Thursday, which could influence traditional as well as cryptocurrency markets. For example, the Federal Reserve is going to share details on its balance sheet. Apart from this, Japan is going to release a monetary policy statement and share details on the rate hike.

The Bank of England cut its policy rate by 25 basis points to 3.75% as of December 18, in line with expectations, from a previous level of 4.00%. The decision met market forecasts, following the bank’s earlier pause in its quarterly rate-cut cycle that had been in place since…

— Wu Blockchain (@WuBlockchain) December 18, 2025

The Bank of England has also announced rate cuts of 25 bps. At the time, the European Central Bank raised its economic growth forecast for the next 2 years.

But Liquidation Risk Is Still Alive

The spike in Bitcoin was seen amid concerns about major liquidation in the cryptocurrency market. According to Coinglass, around 154,450 traders were liquidated with the total liquidations of $516.60 million in 24 hours. This major liquidation shows the continuation of turmoil in the cryptocurrency market.

Ahead of year-end, many traders are expecting a rally in the cryptocurrency’s price, calling it a Christmas rally.

According to the technical analyst on X, “Bitcoin Dominance and Others Dominance are moving in a familiar structure. We saw the same setup in 2021 and again in 2023. The trend is still intact. What happens next depends on how this zone plays out.”