- The Bitcoin price witnesses a mid-term sideways trend with an expanding channel pattern.

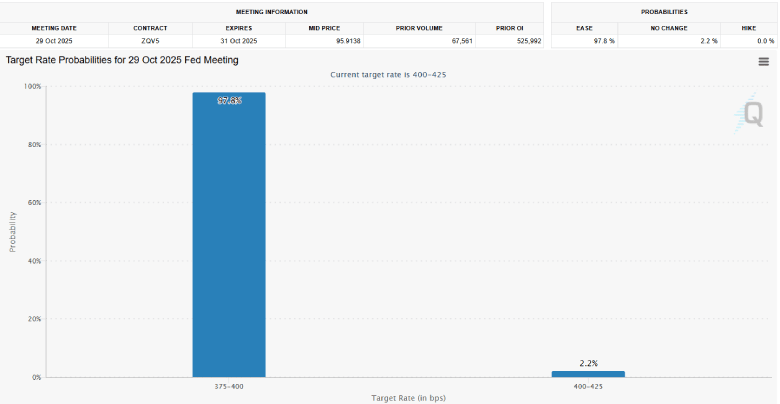

- Fed Watch Tool projects a roughly 97–98% probability that the FOMC will lower rates by 25 basis points at Wednesday’s announcement

- Bitcoin’s corporate adoption accelerates in Quarter 3rd, having purchased over 176,762 BTC.

The pioneer cryptocurrency, Bitcoin, plunged 1.436% during Tuesday’s U.S. Market hours to currently trade at the $112,474 mark. This downtick counters the broader optimism in the crypto market ahead of the anticipated 25 basis-point cut in interest rates by the Federal Reserve. The overhead supply at $116k stalls the Bitcoin price recovery, signaling a possibility of continued correction in the coming month.

Fed Expected to Cut Rates by 25 bps as Markets Price In 97% Odds

The Federal Reserve (Fed) started its two-day policy meeting today with an overwhelming consensus among markets that the Federal Open Market Committee (FOMC) will announce a 25 basis-point cut in interest rates tomorrow. Market-based instruments put the likelihood of a cut at more than 97%.

Prediction platform Polymarket highlights negligible odds for a larger 50 basis-point cut or no change at all.

The federal funds rate benchmark would fall to the range of 3.75%-4.00% if it’s put into effect, its lowest level since late 2022. The announcement follows a quandary for the Fed: inflation is still high (consumer prices are up nearly 3 percent y/y in September), but labor-market measures are beginning to show weakness.

Adding to the challenge, the prolonged U.S. government shutdown has significantly impacted the Key economic data releases that complicate the Fed’s outlook. Experts predict the future action to be focused on strengthening employment and financial developments, while the inflation target of 2% is still a long way off.

Many expect that the Fed could be signaling further easing as soon as the December meeting, but officials are unlikely to commit to a particular path anytime soon.

In a nutshell: The Fed is quite likely to respond to reduced growth and a softening labor market even if inflation remains higher than the target—demonstrating more concern for employment risk than price risk in the short term.

The anticipated rate reduction has brought optimism to the risk-sensitive markets. Investors expect cheaper liquidity to bring back an appetite for equities and digital assets, with Bitcoin having already begun to recover after its recent correction period.

Bitcoin Price Rides Consolidation within a Megaphone Pattern

In the last two weeks, the Bitcoin price witnessed a bullish rebound from a $103,530 low to a recent swing to the $116,381 mark, registering a 12.4% gain. The upswing can be attributed to advancements in U.S.-China trade talks and rising odds of a rate cut by the Federal Reserve.

A deeper analysis of the daily chart shows that this upstream assists in the formation of an expanding channel pattern, also known as a megaphone. Theoretically, the diverging nature of these trendlines and larger swings in asset prices reflect the increasing uncertainty in the market.

Currently, the BTC price faces overhead supply at the $116,000 mark, resulting in an intraday loss of 1.2%. If the anticipated rate cut fails to drive bullish momentum, the BTC price could continue its correction trend and re-challenge the support at $106,000.

On the contrary, if the coin price manages to flip the overhead resistance into potential support, the BTC price could surge nearly 10% and hit a new high around $127,000.

Also Read: WLFI Token Soars After $26.7 M Burn Amid Political Pressure