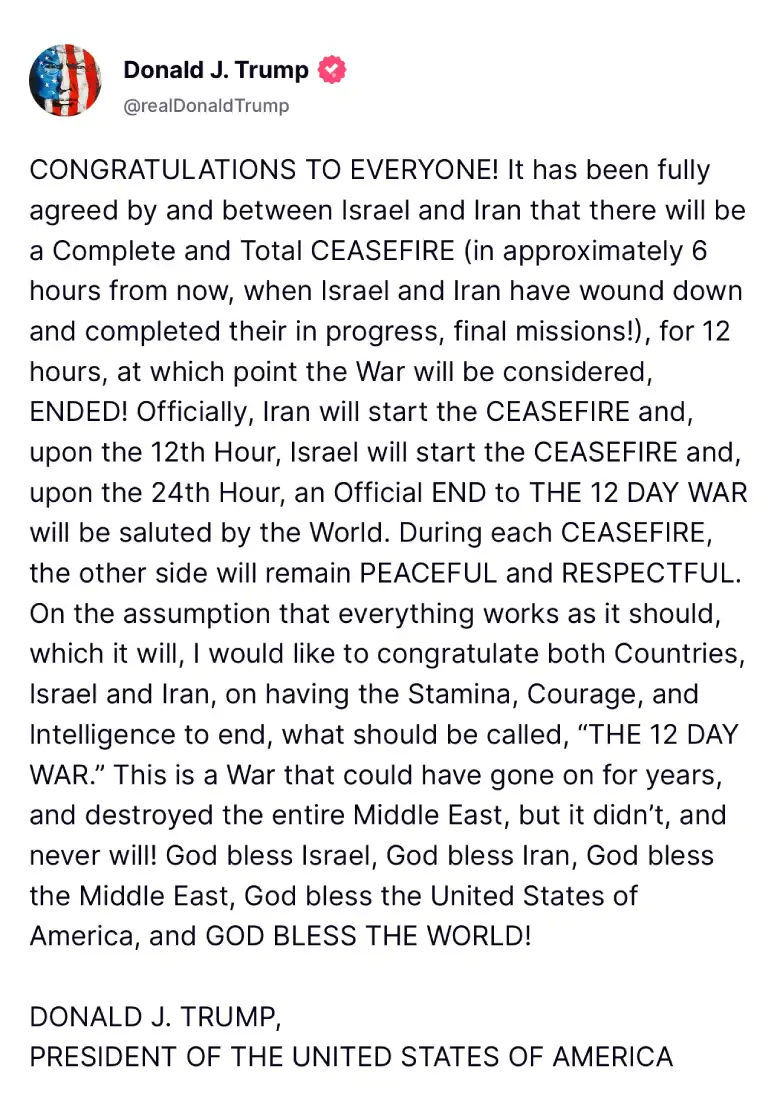

On June 23, Bitcoin (BTC) surged above $105,000 with a 4.79% hike in 24 hours, right after Iran and Israel agreed to a ceasefire within 6 hours. US President Donald Trump has shared this update on Truth Social.

(Source: Donald Trump on Truth Social)

Is Bitcoin Preparing for a Major Breakout?

BTC staged a dramatic rebound, skyrocketing back after briefly crashing below $100,000 earlier that same day. It was a wild swing that left traders scrambling. According to CoinMarketCap, Bitcoin is trading at around $105,952 at the time of writing.

According to crypto experts, Bitcoin is facing a key resistance zone between $110,000 and $112,000. They warned of potential downside risks, highlighting a “double top” pattern on weekly charts, which might reflect a possible pullback.

Over $12 billion in short liquidations suggest bearish pressure remains.

BTC’s price movements are following a familiar pattern that often leads to big surges. After recent dips and steady rebounds, experts believe that another major breakout could be coming soon, which could possibly send it to $175,000.

Crypto analyst Egrag Crypto mentioned a five-step cycle that BTC has been following since 2023:

- A drop below key support levels

- Two strong bounce-back phases

- Another small correction

- A powerful upward surge

According to Egrag, BTC appears to be in the bounce phase, which sets the stage for a possible climb toward $175,000. Egrag also mentioned a “CME gap” at $91,950, which is a support level Bitcoin might revisit before its next breakout.

Once that gap fills, the analyst expects a sharp rise toward $140,000-$160,000, which could pave the way for $175,000.

Another analyst, Gert van Lagen, remarked that BTC recently cleared out a major liquidity pool around $100,000. It will wipe out many stop-loss orders and leveraged positions.

According to the analyst, the next target for Bitcoin is an all-time high (ATH) as liquidity shifts higher. Since many short sellers are clustered near this level, a sudden price rise could force them to buy back, accelerating the rally even further. This “short squeeze” effect could push Bitcoin to new record highs.

All in all, if BTC holds above $100,000, it can cross the $175,000 mark with growing mainstream adoption and institutional demand of Bitcoin exchange-traded funds (ETFs).

But if it drops below, a retest of $91,000 may happen before the next big rally. Either way, crypto analysts are expecting a strong bullish momentum.

Iran’s previous threat to block the Strait of Hormuz created turbulence in the financial market due to its importance as a vital oil trade route. It boosted Bitcoin as a hedge against potential oil shocks.

Now, with a ceasefire easing tensions, stability returns, which might reduce short-term volatility.

Also Read: Ripple Co-Founder Breaks 14-Year Silence With Cryptic Post On X