On Tuesday, June 18th, the Bitcoin price takes another dip of over 2% to reach $104,563. The renewed selling pressure can be attributed to escalating geopolitical tensions in the Middle East, amid growing speculation that the United States may become involved in the Israel-Iran conflict. Will this correction push BTC below the $100k floor, or will buyers have the opportunity to counterattack?

Iran-Israel Conflict Intensifies as U.S. Involvement Looms

On June 16th, Iran launched a large-scale military attack on central Israel, damaging the city of Tel Aviv, including the American embassy. While no civil injuries were reported, the embassy structure sustained visible damage.

According to new reports, the embassy building experienced broken windows, shattered glass, and structural cracks. It is the first time that a current conflict has directly affected a United States diplomatic facility.

While the U.S. officials have not confirmed their response to this incident, the Pentagon is closely monitoring the situation, and the area is under high alert. This attack has made global headlines and raised speculation on whether the U.S. will get involved in the Iran-Israel war.

This escalation has led to global market tension, as BTC also reflected with a 2.2% dump during Friday’s trading session.

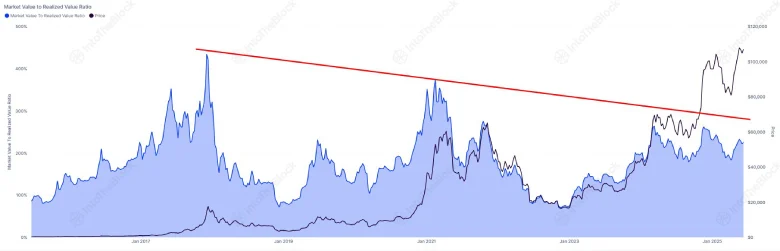

Bitcoin MVRV Ratio Suggests Room For Further Growth

Over the week, the Bitcoin price plummeted from $110,400 to $104,386, representing a 6% loss. Amid the increasing military action between Iran and Israel, the BTC price is likely to undergo a prolonged correction.

While the short-term trend favors sellers, the latest on-chain data indicate that BTC’s long-term growth remains unaffected. According to Sentora, Bitcoin’s current MVRV ratio is 2.25%, which is notably lower than the previous cycle peaks.

This indicates the market is not in an overhead zone and has sufficient room for growth.

If the United States shows signs of military retaliation against Iran, the BTC price would likely dump 3.66% to breach the $100,000 floor. The bearish breakdown could further accelerate selling pressure and push a fall to $93,400.

On the contrary, this anticipated downturn would still be under the 50% Fibonacci retracement ratio, signaling the buyers will have an opportunity to seek suitable support and drive a reversal.