Since last weekend, the crypto market has been struggling to maintain its bullish momentum as the pioneer digital asset witnesses supply pressure at $110,000. The broader market selling particularly affects the meme cryptocurrencies like Dogecoin due to their inherent volatility. With an intraday loss of 2.6%, the DOGE price shows a sharp downtick with a potential breakdown from a bearish pattern looming. Is it $0.15 to the next station?

Dogecoin Price Faces $0.15 Fall Amid Inverted Flag Pattern

Over the last two weeks, the Dogecoin price has shown a steady recovery, rising from $0.142 to a high of $0.177, accounting for a 24% increase. The panic selling triggered by geopolitical tensions in the Middle East was a primary reason behind this. While the formation of higher-high and lower-high trends in price may indicate a steady recovery, the declining trend in trading volume suggests a lack of conviction among buyers.

A detailed analysis of the four charts shows this upswing as the formation of bearish flag patterns. This chart pattern shows a declining pole followed by a temporary relief rally resonating within two ascending timelines. Historically, the method has enabled sellers to recoup bearish momentum, providing a breakdown from the support trendline as a signal for a continued downtrend.

The post-breakout fall could plunge the DOGE price 5.6% to retest $0.56 support, followed by an extended drop to $0.15.

On the contrary, the current recovery could prolong until the two rising trendlines are intact.

On-Chain Data Marks Key Resistance Area

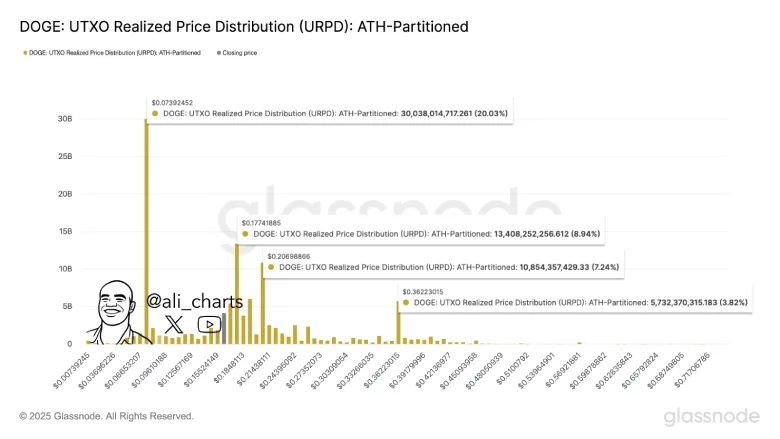

A look at Dogecoin’s UTXO realized price distribution data shows significant overhead supply pressure at $0.18, $0.21, and $0.36. The market analyst, Ali Martinez, highlighted this free resistance for DOGE traders, as this level presents the area where a large volume of DOGE was last moved, signaling a potential zone of selling pressure as traders seek to break the one or take profit.

While the highest volume sits around $0.073, such that most holders are in profit, immediate resistance around $0.178 and $0.207 could hinder the recovery potential of this asset.

Also Read: HTX Lists Trump-Linked USD1 Stablecoin on Tron Network