Key Highlights:

- Balancer protocol has been exploited today, November 3, 2025.

- BAL token dropped by 5% due to this exploit.

- Related projects like Berachain also take actions.

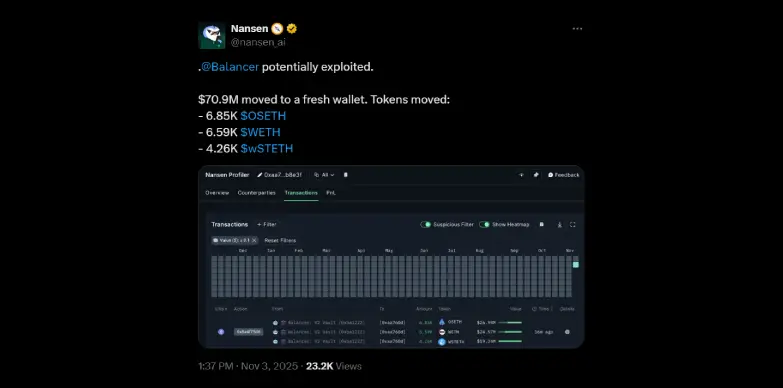

Balancer, a decentralized finance (DeFi) protocol, has been hit by a suspected exploit, with millions in assets transferred to an unknown wallet across multiple chains. Nansen, a blockchain analytics firm, reported this exploit on X (formerly known as Twitter) today, November 3, 2025.

Massive Outflow Detected

On-chain data compiled by Nansen indicate that a total of 6,850 osETH, 6,590 WETH, and 4,260 wstETH tokens were transferred from Balancer-linked pools to a fresh external wallet. However, as per the updated data, the total amount that has been drained has increased to $117.26 million and the attack is still ongoing.

All of these funds were drained in a short time-period, which is a common pattern in large-scale exploits. Blockchain explorers show these movements originating from smart contract addresses associated with Balancer liquidity pools, though the specific attack vector remains under investigation.

The wallet that received these tokens has conducted minimal activity and has been holding tokens as of now. The tokens have not yet been swapped or used in bridging operations. It seems like the attacker is trying to delay liquidations till the investigation slows down or is probably looking for a safe way to move the funds. Security teams and community researchers are now tracking the wallet in real-time to watch for any new transfers or laundering attempts.

No Official Statement Yet

As of reporting time, the Balancer team has not issued a public comment or on-chain message confirming the exploit or outlining mitigation steps. Typically, in such incident, DeFi protocol teams halt front-end operation, engage with security partners, and coordinate with exchanges to backlist suspicious addresses.

Balancer’s silence recalls similar early-stage responses observed in other 2025 DeFi exploits, where teams confirm security breaches only after completing preliminary contract audits and isolating impact zones. However, some DeFi observers believe that transparency in the early hours of an incident can prevent panic withdrawals and reduce reputational risk.

Market Reaction

As soon as the news broke out, the price of Balancer’s native token BAL dropped by 5%. At press time, the price of the token stands at $0.9533 with a dip of 3.28% in the last 24-hours as per CoinMarketCap. The market cap of the token stands at $64.63M which is also down by 3.25% in the last 24-hours.

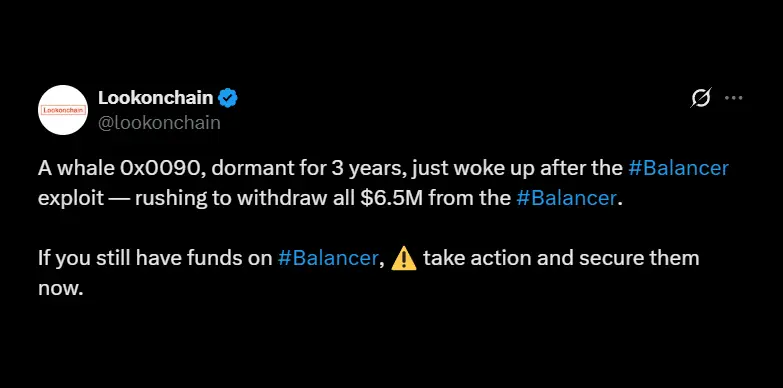

According to Lookonchain, a major Balancer whale, which was dormant for now, was seen to be reactivated after the exploit was announced. The whale withdrew approximately $6.5 million from Balancer’s protocol, indicating a rapid reaction to secure assets amid growing concerns post-exploit.

Balancer users that are holding funds on the protocol are being advised to take action immediately and withdraw or secure their assets.

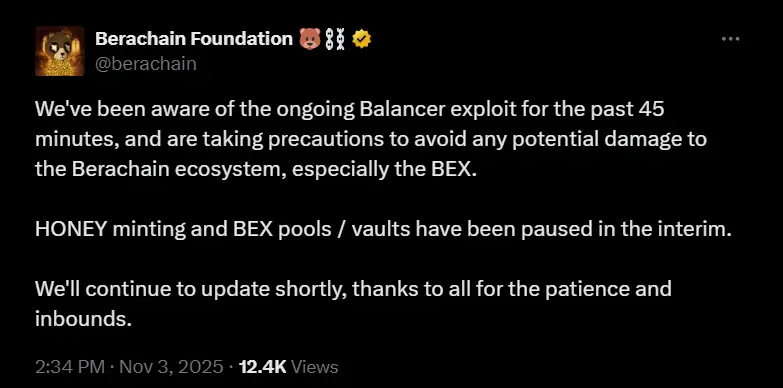

Berachain Activates Safety Pause

Berachain in an X post stated that it has paused HONEY minting and activity on BEX pools, vaults to prevent any potential spillover from the ongoing Balancer exploit. Since Balancer’s systems were compromised and attacker activity was still unfolding, there was a risk that connected liquidity or pool interactions could become a target. By freezing these functions immediately, Berachain is protecting its user funds and stopping new deposits from entering any vulnerable pathways.

This step was important because Berachain’s exchange system is based on Balancer’s technology (BEX is forked from Balancer’s V2) and hence this step and this announcement was important to reassure its users that the pause is a protective measure and not a malfunction.

Also Read: Surge in Ethereum Stablecoin Volume Amid Market Weakness