AVAX, the native cryptocurrency of Avalanche Network, records an insignificant loss of 0.09% during Tuesday’s U.S. trading session. The downtick is likely a brief breather for buyers to regain their bullish momentum after the sharp recovery in the last five days. According to the latest on-chain data, the Avalanche network’s daily transaction volume spiked 275% since last month, suggesting the potential move in price.

Avalanche Network Activity Growth Signals Potential for Market Shifts

Since February 2025, the Avalanche coin price has been consolidating within a narrow range between the $26.80 resistance and $14.60 support. The coin price bounced back twice from both levels, indicating no significant movement from either the bulls or the bears.

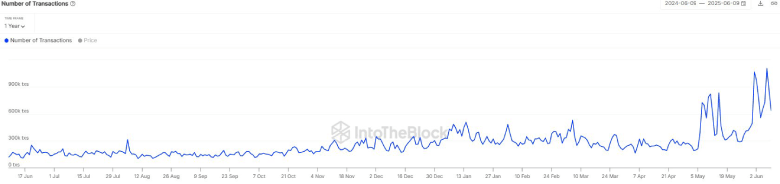

However, Avalanche network activity began to record a sudden surge, suggesting a potential move is underway. According to Sentora data, the number of daily transactions on the network has surged 275% since early May.

The blockchain now sees a daily transaction average of 759,000, indicating a surge in adoption and activity within the AVAX ecosystem. Typically, the transaction spike could hint at a broader trend of recovery or expansion in the blockchain’s user base.

A continued trend will support AVAX price recovery and drive for a bullish breakout.

Also Read: Crypto.com Unveils New Credit Card with Uncapped Crypto Rewards for US Users

AVAX Price Fake Breakdown Fuels Bullish Upswing

Over the last five days, the Avalanche price has bounced from a low of $18.43 to its current trading value of $21.83, representing a 19% gain. The upswing proved a fake breakdown from the $19 support and likely liquidated some hasty sellers.

In the daily chart, the reversal indicates the formation of a new higher low, suggesting that a buy-the-dip sentiment has emerged in the market. With the intraday downtick, the AVAX price is seeking support from the 50-day exponential moving average.

If it holds, the buyers could drive a 22.5% surge to challenge the overhead resistance at $ 26.80.

A bullish breakout from this resistance is crucial for buyers to enter a sustained bullish trend.

On the contrary, if coin prices show supply pressure at $26.8, the current consolidation could prolong till next month.

Also Read: Zeconomy Launches DCP on Ripple’s XRP Ledger: Tokenized $280M Asset