Key Highlights:

- Aster surged 400% in the last 24 hours after CZ endorsed the project.

- The APX token swap lets holders exchange their tokens for ASTER at a 1:1 ratio.

- Aster is being positioned as a direct competitor to Hyperliquid.

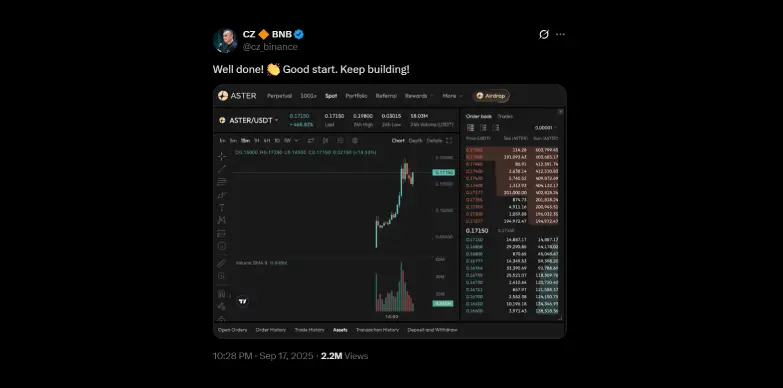

Aster surged more than 400% today, September 18, 2025. The price of the token shot up from $0.17 to $0.435 after Binance founder CZ endorsed the token on his social media account, the APX token swap, and growing platform adoption. The decentralized perpetual exchange is quickly positioning itself as a key rival to an established market leader, Hyperliquid, shaking up the competitive DeFi derivatives landscape.

At press time, the price of the token stands at $0.4706 with a surge of 457.7% in the last 24 hours as per CoinMarketCap.

Binance-Endorsed Momentum

The project rallied after CZ publicly tested the platform and hinted at Binance integration on X (formerly known as Twitter).

This led many of the community members to believe a Binance listing might be on the horizon, similar to past cases like PancakeSwap (CAKE), which surged before its Binance launch. However, there has been no official announcement yet from the Binance team, and the token could face some ups and downs if the plans change.

APX Token Swap Spurs Demand

The APX token swap went live yesterday, September 17, 2025, which allowed users to swap their APX tokens for ASTER at a 1:1 ratio. This swap was enabled on Binance Alpha and other supported platforms. ASTER tokens will be available for withdrawal from September 19, 2025. As the investors need $APX to get $ASTER, the demand for $APX has increased, and hence, this has helped push the price up. After the announcement, a huge number of users joined the Aster DEX, boosting trading and liquidity.

However, concerns have been raised that once the swap is completed on September 19, some early investors may quickly sell their new tokens so they can lock in their profits. If this happens, it could put pressure on the price and test its stability.

Strong Platform Growth

Aster now holds $356 million in total value locked and handles about $33 billion in monthly trading, and all this data makes it the second-largest perpetual DEX after Hyperliquid. The platform also has special features such as up to 1001x leverage and a Hidden Orders tool that adds privacy have gained attention of big institutional traders.

Aster also controls 45% of all DEX trading on BNB Chain, which indicates that its growth is coming from real usage and not just hype.

Rivalry with Hyperliquid

Aster is positioning itself as a serious contender to Hyperliquid, which is leading the market with about $2.7 billion TVL and a $15.7 billion market cap. Hyperliquid’s advantage comes from its own fast, custom-built blockchain that can process 200,000 orders per second with near-instant confirmation, giving it performance similar to centralized exchanges.

As of now, the project is running on BNB Chain, but it is planning to launch its own network, which will be called Aster Chain, and it will be built with zkRoll tech for higher speed and lower costs. Along with new products such as equity perpetuals (trading on assets like Tesla and Apple) and privacy-focused tools, the project will be using its ties to the Binance ecosystem to close these gaps.

However, Hyperliquid’s deep liquidity, strong community, and first-mover advantage will act as tough hurdles for the new projects. For Aster, the upcoming token swap and airdrop will be important events to see if it can turn today’s hype into lasting growth and loyal users.

Market Sentiment

People on social media are excited about Aster, but some are still careful. CZ’s support boosted the interest, but Aster still needs to prove that it can actually handle real trading and make users come back.

The “Aster Genesis” program, running with the token swap and airdrop, is giving out about 9% of the token supply through airdrops, with the claim period running from September 17 to October 17, 2025. The real test for the project will be if the project can keep daily trading above $100 million once token locks and withdrawal limits are lifted.

Also Read: Can Fed Rate Cut Push XRP Price Past $3.6 Resistance?