Key Highlights:

- ASTER plunges 18% after experiencing a 400% rally as CZ’s endorsed the token.

- Machi Big Brother closed his ASTER short position with a profit of $80,000.

- ASTER faces selling pressure from airdrop unlocks.

Aster (ASTER) has seen a sharp pullback in the last 24 hours, where the price of the token has dropped by 18%. Its predecessor, APX, has also declined in the same manner. The reversal has come right after a great surge earlier this week after Binance founder Changpeng “CZ” Zhao appreciated and praised the project on his social media handle X (formerly known as Twitter), and this drove the ASTER’s price up by more than 400% in a single day.

From on-chain data, it seems like the rally has come to an end and analysts are clearly pointing toward profit-taking, air-drop driven selling, and technical breakdowns behind the sharp correction. This drop also indicates the uncertainty over whether ASTER can quickly build itself as a real rival to Hyperliquid.

At press time, the price of the token stands at $1.46 with a dip of 16.43% in the last 24 hours as per CoinMarketCap.

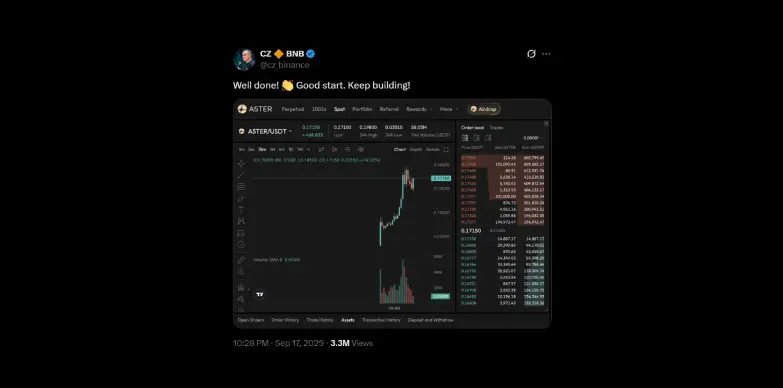

CZ’s Endorsement and Speculative Wave

Market sentiment around the ASTER token shifted quickly when CZ publicly supported the migration from APX to ASTER and supported the project recently. This backing from the founder of Binance drove the token up by 400% in a single day. This indicates that the public post by CZ managed to bring in retail traders and speculators to the project.

The momentum carried on and then there was the launch of ASTER/USDT perpetual contracts on Binance Futures that offered up to 50x leverage. Aster climbed further in the following week (1628% surge during a course of 7 days). All of this pushed trading activity higher, the volumes and risk-taking also reached unusual high levels. But as usually happens with fast crypto rallies, the price of the token quickly fell as traders took profits and leveraged positions came under pressure.

Profit-Taking and Liquidations

The main reason ASTER’s price dropped is that many traders started taking profits. Retail investors, early APX holders, and those using leverage all sold after the big price jump. With ASTER/USDT perpetual contracts available on Binance and OrangeX allowing up to 50x and 25x leverage respectively, the price shot down quickly.

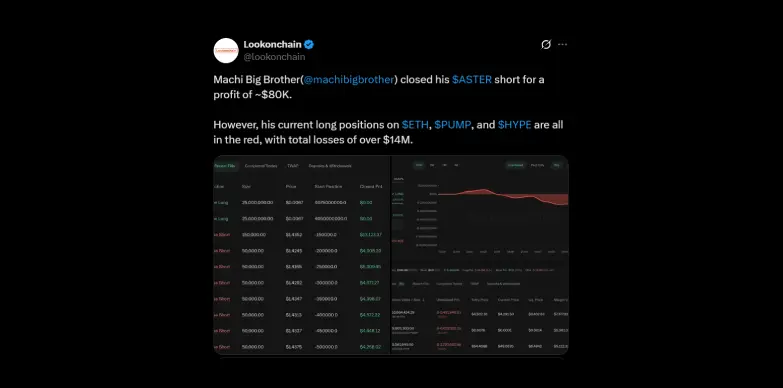

Even well-known traders started adjusting their positions amid the price swings. As per Lookon Chain data, Machi Big Brother, a prominent crypto influencer, closed his 3x leveraged short on ASTER and made a significant profit.

The influencer opened a 3x leveraged short on 105,000 ASTER tokens. He then entered the trade at around $2.10 and exited near $1.85, so there is a difference of $0.25 per token. Before leverage, this gave him a profit of about $26,250, and with 3x leverage applied, his profit was then around $78,750, which is close to reported $80,000. This incident show that even major players were taking profits and exiting their positions as the token price dropped.

Airdrop Pressure and Unlock

The recent 704 million ASTER airdrop, about 8.8% of total supply, added to the sell-off. Claims started on September 17, but withdrawals only open on October 1, creating temporary volatility as large holders prepare to move tokens to the exchanges. With only 36,000 holders and 1.65 billion ASTER circulating out of 8 billion total, these future token unlocks will cause big price swings and add future selling pressure.

APX, the project’s earlier token, is also experiencing a drop along with ASTER. Both of these tokens were promoted as challengers to Hyperliquid, but the sharp drop now indicates that the hype outpaced the fundamentals. Market watchers are now seeing the “CZ endorsement + Hyperliquid competitor” story as speculative, exposing retail traders to big swings.

All eyes are now set on October 1, when airdrop withdrawal starts, selling at that point could also push price of the token even lower.

Also Read: Aster Soars 400% on CZ Backing and APX Token Swap Buzz